10 lpa in hand salary

CTC vs In Hand Salary is the tricky truth of Corporate Economics which is relevant to every individual who is the part of the corporate sector specifically in India. Cost to company CTC is a term for the total salary package of an employee, 10 lpa in hand salary. Tax is also deducted from the cash amount the employee receives directly. The term CTC is used by companies to more accurately reflect the incremental spend per employee the concept of Direct Cost from the perspective of an organisation.

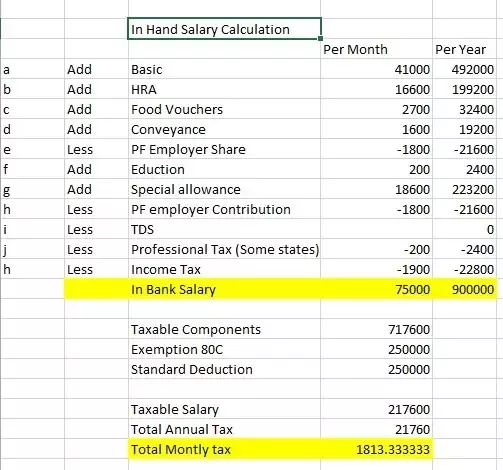

In every professional field, employees get paid at the end of the month by their employers. This payment is called the salary. The amount they receive is usually mentioned in their contract as well as the pay slip. The salary has many components that may vary among different employers. Below is a list of the most common breakdown of the salary structure.

10 lpa in hand salary

.

Companies pay the HRA to employees who stay in a rented property. Bonus Bonus is a component of the gross salary that the employers may pay as a performance encouragement.

.

Consult an Expert. Talk to a Lawyer. Talk to a Chartered Accountant. Talk to a Company Secretary. Business Setup. Business Registration. Private Limited Company. Limited Liability Partnership.

10 lpa in hand salary

Salary is compensation that companies pay to their employees for their services in the company. Your salary slip has two main sections. One section is income or earnings. And the second part is deductions. Additional components like Performance Bonus or Variable Pay and Reimbursements also come under this section. The second part, i. All these details can be intimidating and overwhelming for a salaried person to get an idea about their in-hand salary. And this is where the salary calculator can home handy. It will ask you for your CTC and a few basic details. And based on the inputs, it helps you calculate the in-hand or take-home salary.

Om nom stories season 11

Below is a list of the most common breakdown of the salary structure. Follow the three steps given below: Choose if you want to calculate monthly or yearly salary. Download now. In every professional field, employees get paid at the end of the month by their employers. Can I find the TDS on the salary calculator? Surcharge is a tax on tax. Obviously, the indirect cost like the cost of facility, the support teams like HR, IT, Management, etc would still be incurred and hence not included in CTC. You must provide the gross salary and total bonus. Some commonly searched salaries Please note that this is just for informational purposes only. Companies pay the HRA to employees who stay in a rented property. It is to understand that in hand income is a part of CTC and the pay you receive consists of package deal which includes multiple variants into it along with the In hand Salary which one receives after deductions. A rebate under section 87A is one of the income tax provisions that help taxpayers reduce their income tax liability. Category : career-counselling , gdpi , general-knowledge , placement-training-program. Moreover, your employer matches your contribution and invests the same amount in your EPF account.

In every professional field, employees get paid at the end of the month by their employers. This payment is called the salary.

If you use the tool, it will determine the amounts from the above calculations and show you the numbers within seconds. Can I find the TDS on the salary calculator? You cannot find the TDS on salary calculator separately. How much gratuity amount is deducted from salary? There is no formula to calculate this amount. CTC vs In Hand Salary is the tricky truth of Corporate Economics which is relevant to every individual who is the part of the corporate sector specifically in India. The entire bonus amount is fully taxable. So, the amount will be the same. This payment is called the salary. It depends on factors like the industry, employee designation, and much more. We show daily updated currency exchange rates and more facts about it. FAQs related to salary calculator 1. If the breakdown seems complicated, you are not alone. You should only know your gross salary and total bonus.

You have hit the mark. It is excellent thought. It is ready to support you.

You have hit the mark. In it something is also to me it seems it is good idea. I agree with you.