350 per day annual salary

This calculator will help you to quickly convert a wage stated in one periodic term hourly, weekly, etc. This can be helpful when comparing your present wage to a wage being offered by a prospective employer where each wage is stated in a different periodic term e.

After years spent working in permanent employment, many people decide to take the plunge and move into uncharted freelance territory. Whether you take on an ad hoc freelance project or a longer term, interim contract, in many cases this will mean working on a day rate basis for the first time. When it comes to getting paid for freelance work, the three most common and practical options are: setting up your own Limited Company, signing up to an umbrella company, or simply speaking to the business or agency about PAYE, via payroll. To make things slightly easier we have outlined each option below and included some useful links to introduce you to the processes involved:. Many businesses and employment agencies will require you to have set up your own Limited Company — sometimes referred to as a Personal Services Company — to get paid for your work. Registering your own Limited Company is a very straightforward process, but you will also need to apply for a business bank account and take advice from an accountant — preferably one specialising in Personal Service Companies. It is also important to note that you will need to protect your company with professional insurance.

350 per day annual salary

I've just started freelancing for a largeish organisation and been asked to consider joining them permanently. I have a meeting next week to discuss in more detail but would really appreciate any advice on what salary I should be asking for. Now of course this is the best case scenario and it would be easy to make less if i couldnt find work. There are many things to consider apart from cold hard cash but if anyone has any thoughts I would really appreciate it!! Will speak to my accountant as well but no doubt he'll want me to stay freelance as it gives him business so thought i'd post here too! Thanks in advance. Hi, If you were on 70k permanently previously, why are you only sking per day now? I assume you are a BA, PM? I know I should look to charge more but I didn't think I'd get in the door with some companies Tax wise I am still better off than before. Sorry - I have no idea what you mean by this!

PHI or any other personal insurance is paid out of your after-tax income, however the company may be able to pay for key man insurance as a taxable expense. All jobs New Search Events. Find a high-paying job today!

This computation is derived from multiplying your foundational salary by the total number of hours, weeks, and months you dedicate to work in a year, presuming a standard hour workweek. How much is your salary? Enter your salary in one of the fields to start the conversion. Your work hours per week Frequently Asked Questions. To calculate the yearly income based on working days, we typically exclude weekends and public holidays.

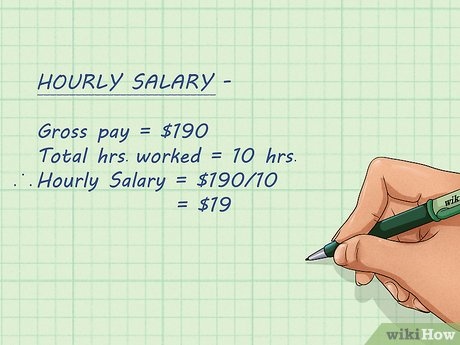

The salary calculator on this page is helping people convert their annual salary, hourly salary, and monthly salary. The Salary calculator assumes hourly and daily salary inputs as unadjusted values. All other pay inputs are holidays and vacation days adjusted values. The salary calculator uses 52 working weeks or weekdays per year in its calculations, ignoring holidays and paid vacation days. Calculate hourly to annual salary conversions confidently with this versatile and precise salary calculator. Salary is a fixed, predetermined amount of money paid to an employee for their work over a specific period, usually on a monthly or annual basis.

350 per day annual salary

Are you tired of trying to calculate your annual pay by hand? This yearly pay calculator is the perfect tool for simplifying your financial planning. Whether you're considering taking on extra work, negotiating a new job offer, or planning a big purchase, our hourly-to-annual salary calculator will give you the power to make informed financial decisions. Input your hourly rate and working hours per week, and the tool will generate your projected annual pay.

Torture amulet

Add post. Now have read your detail, I understand why you don't get such a mark up on your rate from contract to permie. Sharing posts outside of Mumsnet does not disclose your username. Companies House will provide you with everything you need to know about starting, running and closing a company. Read more here. To find the hourly rate from your daily income, we divide by the standard length of a workday, commonly eight hours for full-time employment. Frequently Asked Questions. Sorry - I have no idea what you mean by this! You have remembered to include the costs of your pension, holiday pay, sick pay, training, professional subscriptions, life assurance, expenses and non-earning periods? Piglet - fair point - its easy for us accountants to forget that just because our work is not physically tiring and most of us keep working part time till we drop, that our clients' line of work may not be the same. PHI or any other personal insurance is paid out of your after-tax income, however the company may be able to pay for key man insurance as a taxable expense. Hourly salary. But I would go back to contract dependant on the job.

This calculator will help you to quickly convert a wage stated in one periodic term hourly, weekly, etc.

The surge in the minimum income standard over the last year is attributed to the swift escalation in prices for a wide array of products and services. Bookmarks CV. These would bump up your overall compensation making the 70k more reasonable. Hi, I've worked both at contract and perm. Converting more salaries. Work Follow topic. OP posts: See all. They will also have to pay you holiday pay and sick pay So they will drop your freelance rate to an equivalent extent. Yearly salary. This calculator will help you to quickly convert a wage stated in one periodic term hourly, weekly, etc. Be very wary of trying to avoid NHI by going for big dividends.

I apologise, but, in my opinion, you are mistaken. I can prove it. Write to me in PM.