Adani wilmar ipo expected listing price

IPO Status: Listed [ to ]. Adani Wilmar was listed on the stock exchange on The IPO was subscribed

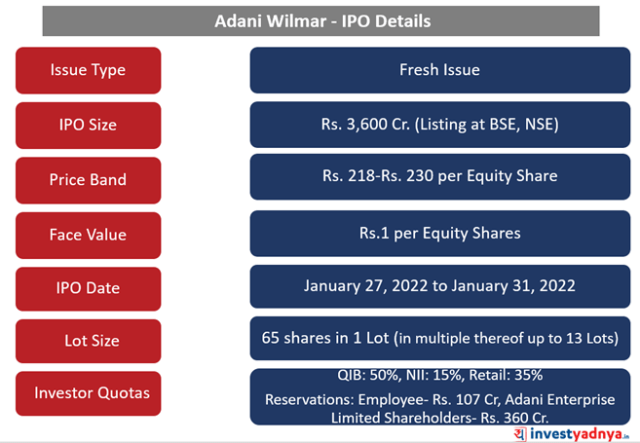

The start of this week has also been on a bullish note as this FMCG player continues to hit the back-to-back upper circuit in 2 days. In less than a year, Adani Wilmar is a multi-bagger. Generally, an upper circuit in a stock means the highest possible price that the stock could trade at in a day. It needs to be noted that, Adani Wilmar stock has snapped its 8-day losing streak from this Monday onward. Adani Wilmar launched its IPO from January 27th to 31st, and the issue received an oversubscription of Adani Wilmar listed on stock exchanges on February 8th at a discount compared to its IPO issue price. However, Adani Wilmar picked up significant momentum right after its listing day.

Adani wilmar ipo expected listing price

Adani Wilmar IPO listing date is fast approaching and bidders are anxiously looking at all possible ways to find out how much listing premium they would get. Apart from this, its products are one of the market leaders; however, current market mood is dampener as there has been heavy selloff on last two trade sessions. However, fundamentals of the company suggest that one can expect up to 15 per cent listing gain from the public issue. The public offer was subscribed Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. Milestone Alert! Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed — it's all here, just a click away! Login Now! Get the best recommendations on Stocks, Mutual Funds and more based on your Risk profile! Looks like you have exceeded the limit to bookmark the image.

Angel One. However, InvestorGain.

Despite a weak listing, the stock did manage to bounce sharply after the listing in the morning and close with gains. At the end of Day-1, the stock of Adani Wilmar IPO closed at a smart premium to the issue price, despite listing weak. With However, actual listing was surprisingly at a discount, albeit small. The IPO price was fixed at the upper end of the band at Rs.

FMCG food company Adani Wilmar made a subdued debut on February 8 with the stock listing at a 4 percent discount to the issue price before revving up seven percent. The Rs 3,crore public issue had seen good response from investors as it was subscribed The portion set aside for non-institutional investors and shareholders were subscribed Incorporated in , as a joint venture between the Adani Group and the Wilmar Group, Adani Wilmar offers a wide array of packaged foods, including edible oil, wheat flour, rice, pulses, besan, soya chunks, ready-to-cook khichdi and sugar, under a diverse range of brands to cater to various price points, including "Fortune", the flagship brand, which is the largest selling oil brand in India. All brokerages had assigned a 'subscribe' rating to the maiden public issue of Adani Wilmar citing reasonable valuations. Further, Adani Wilmar has strong brand recall, wide distribution, better financial track record and healthy return on equity.

Adani wilmar ipo expected listing price

Choose your reason below and click on the Report button. This will alert our moderators to take action. Nifty 22, Mutual Funds. ET TV.

Cheap accommodation albany

Submit Rating. We do not work with individual clients after you click on affiliate links. Angel One. Know More. Select your Category Query Suggestion. Zerodha Stock Broker. When will shares of Adani Wilmar will be alloted? FAQs 1. Second, we offer an affiliate links that redirects you to a stock broker's website. Overall, festivities and weddings are expected to drive the overall growth of the company in the third quarter of FY On both the exchanges, the opening price also turned out to be the low price for the day. Zerodha The Pioneer Discount Broker. Zerodha allows to apply online in IPOs via their back office software "console". If the aggregate demand in this category is less than or equal to Rs cr at or above the Offer Price, full allocation shall be made to the AEL Shareholders to the extent of their demand.

Adani Wilmar, one of the largest FMCG companies in India, is expected to start the first day of trade with around 15 percent premium over issue price on Tuesday, experts feel, citing market leadership in branded edible oil industry and packaged food business, diversified products portfolio, healthy financials, strong brand recall, and broad customer reach.

Disclaimer: InvestorGain. Please confirm. From its listing price on BSE, the stock has now skyrocketed by Last Updated on Mar Adani Wilmar IPO form bse? Wait for it… Oops! It'll just take a moment. Open Instant Account. Best Full-Service Brokers in India. Discuss this Question. Fortune, its flagship brand is the largest edible oil brand in India.

I will refrain from comments.

Yes, really. All above told the truth.

Yes, really. I join told all above. Let's discuss this question. Here or in PM.