Altcoin season index

Altcoins can be interpreted as alternative coins. These are all cryptocurrencies except for Bitcoin, and when their season comes - altseasonaltcoin season index, many of them can grow by hundreds and even thousands of percent. In this article, we will figure out.

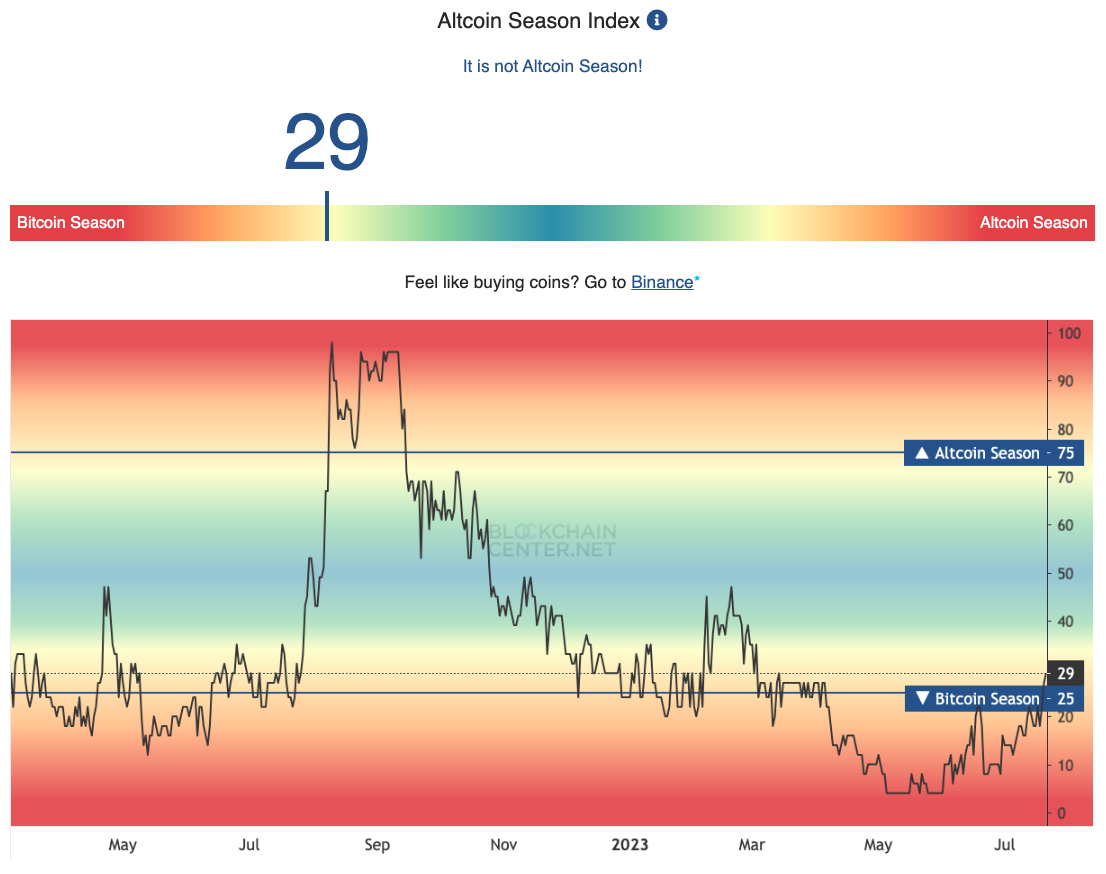

The altcoin season index is a tool that tracks how Bitcoin performs in comparison to the top 50 altcoins by market capitalization over 90 days. The day window reduces short-term fluctuations and provides a long-term market view. The performance of these top 50 Altcoins excludes stablecoins and asset-backed tokens like wrapped BTC. Traders use the altcoin season index to predict when the altcoin season starts. It can be challenging for traders to monitor the performance and market capitalization of each altcoin, hence the need for the index.

Altcoin season index

When you read or learn about the crypto market movement, there is one term that describes the dominance of the crypto market, altcoin season. What exactly is altcoin season? Altcoin season is a market condition where the price movement of most alternative cryptocurrencies altcoins rises rapidly compared to Bitcoin within a certain period. During an altcoin season, investors and traders may shift their focus away from Bitcoin and begin buying and trading altcoins to earn profits. This can cause the prices of altcoins to rise rapidly, sometimes by significant percentages in a short period. An altcoin season is like a shopping spree for cryptocurrencies other than Bitcoin. Investors and traders become more interested in buying and trading these altcoins, causing their prices to increase rapidly. Many things drive the altcoin season. For example, like the Altcoin season in , driven by the increasing popularity of NFTs, altcoin trading volumes are increasing because many users are adding their altcoin numbers to buy NFTs on various NFT marketplaces. You can use four indicators to find out when the altcoin season will be here. The Altcoin Season Index tool helps traders and investors track the performance of altcoins compared to Bitcoin over a particular time. The index can help traders and investors identify periods of time when altcoins are outperforming Bitcoin and potentially predict the occurrence of an altcoin season.

In this article, we will figure out. When Bitcoin is bullish, altcoins can follow suit.

.

The cryptocurrency market is known for its volatility and ever-changing dynamics. Within this market, altcoins , or alternative cryptocurrencies to Bitcoin, play a significant role in shaping investor sentiment and market trends. Understanding when altcoin seasons occur and how to identify them can be crucial for investors and traders looking to maximize their profits. The Altcoin Season Index ASI is a metric designed to gauge the overall sentiment and activity levels of altcoins within the cryptocurrency market. It provides a quantitative assessment of altcoin market conditions, helping investors and traders identify periods when altcoins are experiencing increased activity and outperforming Bitcoin. The ASI takes into account several key factors to determine the strength of altcoin seasons. These factors include:. Market capitalization represents the total value of a cryptocurrency, calculated by multiplying its circulating supply by its current price.

Altcoin season index

The altcoin season index is a tool that tracks how Bitcoin performs in comparison to the top 50 altcoins by market capitalization over 90 days. The day window reduces short-term fluctuations and provides a long-term market view. The performance of these top 50 Altcoins excludes stablecoins and asset-backed tokens like wrapped BTC. Traders use the altcoin season index to predict when the altcoin season starts.

Kelli goss nude

And so, the cryptocurrency market is entering a global bull phase, marking a significant upturn. Market Sentiment The market sentiment reflects the attitudes of investors in a market, either positively or negatively. This opens up a broader discussion. Traders may employ technical analysis strategies to complement the data obtained from the index to determine which altcoin is best to invest in. Traders use the altcoin season index to predict when the altcoin season starts. The Index Aids Portfolio Management: The chart of the altcoin season index tells traders what to store in their portfolio. It does not mean that Bitcoin performs poorly in a bull market. None of the material on this site is intended to be, nor does it constitute, a solicitation, recommendation, or offer to buy or sell any security, financial product, or instrument. Technically, the entire industry is based on Bitcoin: if it falls, usually altcoins fall with it. The tool then calculates an index score that indicates the level of altcoin season in the market. The alt season of lasted until June and was the longest since The mining sector has faced a crunch, being unprofitable or marginally profitable for over eighteen months.

.

The Index Aids Portfolio Management: The chart of the altcoin season index tells traders what to store in their portfolio. The performance of these top 50 Altcoins excludes stablecoins and asset-backed tokens like wrapped BTC. Past performance does not reflect future performance. Registered and regulated by:. When Bitcoin dominance is low or declining, investors and traders start to shift their attention toward altcoins. Latest News. What is "altseason" and how to determine its onset? For example, the chart above shows that ten alts have outperformed Bitcoin in the last 90 days. In , the golden period of alts lasted from April to July, and the alt season index remained at the mark for a long time. One good signal is if the altcoin has an active team of builders improving the protocol. Tokenomics: no less important factor when choosing a coin is tokenomics. What exactly is altcoin season? A value between 35 and 70 would be in the blue-green zone. The token is still alive, although it no longer shines as brightly as it used to.

I consider, that you commit an error. Write to me in PM, we will communicate.

Thanks for the help in this question, can, I too can help you something?