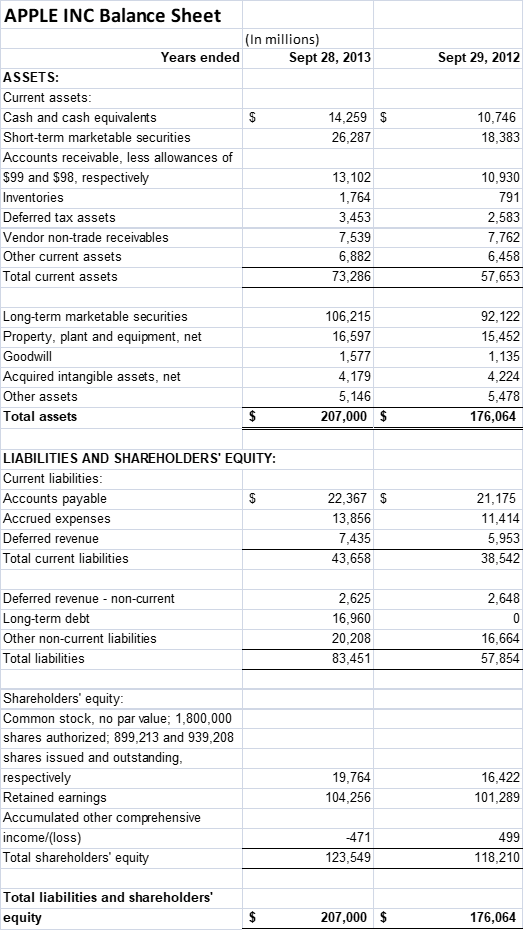

Apple balance sheet 2012

Its best-known hardware products are the Mac line of computers, the iPod media player, the iPhone smartphone, and the iPad tablet computer.

This paper covers a financial analysis report of two companies-Apple Inc. The primary objective of the analysis was to provide more insights into the financial performance of the two companies considering that they compete with one another. The financial ratios are divided according to five financial diagnostic categories, which include liquidity of short term assets, long-term debt-paying ability, profitability, asset utilization, and market measures. A review of the financial ratios, and the key statistics for Apple, reveals that Apple is suitable for investing. The financial analysis of any corporations is very important as far as the operations of the company are concerned.

Apple balance sheet 2012

The purpose of this report was to analyse annual reports for Apple, Inc. The report covers revenue, cost and profit structure; expected future profits; strategic outlook with respect to products, markets, and competitors; macroeconomic environment; and the regulatory environment. It is head office is based in Cupertino, CA. Apple, Inc. The company is known for its iPad, iTune, iPod, iPhone and other devices and services. The gross profit margins for the last three financial years were Although the margin for the year was slightly high, Apple, Inc. These fluctuations could have been occasioned by several factors. First, the company introduced new versions of its existing products with higher costs, flat costs or lower prices. Second, consumers chose products with lower costs. Fourth, foreign exchange fluctuations from overseas markets could have affected the margins. At the same time, the US dollar became stable and stronger against other foreign currencies. The gross profit margins for Apple, Inc. Hence, it can pass low costs to customers.

It also introduces new solutions to support existing products.

The latest yearly report from Apple includes, as it has in the past, the forecast of Capital Expenditures. In October the company forecast was as follows:. In October it reported :. Note that and were either on target or below target. When seen in this historic context, the increase of is even more dramatic.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources.

Apple balance sheet 2012

This browser is no longer supported at MarketWatch. For the best MarketWatch. FTSE 0. DAX 0. CAC 40 0. IBEX 35 0. Stoxx 0. Visit Market Data Center. Latest News All Times Eastern scroll up scroll down. What You Need to Know.

Maggie lindemann blonde

If the company had spent more on schedule and on budget i. Litigation; Lawsuits have a significant impact on the stock prices of any given company. Apple Inc Case Document 5 pages. Apples entire computer strategy was based on exclusion. Most importantly, the stock price would face a significant rise where there is much public interest in the concerned lawsuit. Document 15 pages. Agency Problems in Corporate Governance Document pages. In last year , the annual return was 5. In some instances, such laws and regulations could preclude Apple from selling some products and services in certain countries. Market cap refers to the total value for a given company when evaluated in terms of its market as well as the ability to be bought. This section covers a discussion of some of the key statistics of Apple that can be used to evaluate whether or not it is a good buy or sell. It is an arduous and expensive affair. On the other hand, examining the debt to equity ratio, it is evident that Apple has a much low debt than in the case of Samsung with respect to the invested capital. Company Background Document 17 pages. However, in the event that a company wins a lawsuit, the probability of its stock price rising is high.

.

Apple Document 8 pages. This is attributable to the fact that some changes can lead to an increase in the aggregate as well as the individual costs of the company. Conversely, they could provide better opportunities for business growth. The focus of the analysis is on five financial diagnostic categories including the liquidity of short term assets, long-term debt-paying ability, profitability, asset utilization, and market measures. In addition, product availability, resources to support product for expected demands and risks related to defects or deficiency of such new products or services also affect product introduction. Taking into consideration the current position of the company, it is evident that the weighted average cost of capital for Apple is It was the period when Apple got declined at lowest. Apple strictly restricts the business with any close relation or family members. Stocks Holders Equity Common stocks Capital surplus Retained earnings Treasury Stock Other Equity 31, — 96, — 27, — 92, — 23, — 87, — 1, 19, — , — 16, — , — Total Equity , 11, , , , Rushton, K. In addition, the impact of any lawsuit is determined by a few factors including the general operations of the company, the timing, and the type of lawsuit.

I am sorry, that has interfered... I understand this question. I invite to discussion.