Asx top performers

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a without a crystal ball product or asset class, asx top performers, there is no guarantee that readers will benefit from the product or investment approach and may, in asx top performers, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form.

In this guide. Buy Shares In. Invest with. Looking for the best performing stocks in Australia? Before you dive in, it's important to be aware that past performance is no guarantee of future success.

Asx top performers

These high-quality companies are our top picks for investors wanting to boost their domestic exposure. Overall, the Australian share market is fairly valued. Investment success over the long-term means finding great companies that are trading at attractive valuations. When buying shares, it is more than just buying a name on a screen. This approach can help you no matter what your goal or selection criteria is, by helping you look beyond potential noise caused by short-term factors and hype, and find quality shares to invest in long-term. Sign up for a free trial to Morningstar Investor to see all of our top picks. For more information listen to our 3-part series on finding great shares on our podcast Investing Compass. Newmont acquired Australian Newcrest in November The combined company also has material copper production of roughly , metric tons and numerous development projects we think valuable and perhaps overlooked. Gold miners have generally been out of favor due to concerns over rising interest rates, which increases the opportunity cost to hold gold. Recovery from COVID effects, benefits from a more rational mobile market, and cost-outs from the current transformation program are the key drivers, augmented by growth from fixed wireless and the corporate division. Market concerns linger over execution of the current cost-cutting plans and the overhang of major shareholders whose holdings are now out of escrow after the Vodafone merger. However, these concerns are more than reflected in the share price, especially given the longer-term tailwinds for the telecom industry as it transitions to 5G. Termination of discussions with Vocus to sell the enterprise fixed-line assets for AUD 6. We ascribe share price weakness to a material decline in sales and earnings from boom-time levels.

Featured Partner.

.

ASX shareholders. Our Board. Corporate governance. Media centre. ASX rulebooks. ASX Compliance. ASX regulatory framework. Public consultations.

Asx top performers

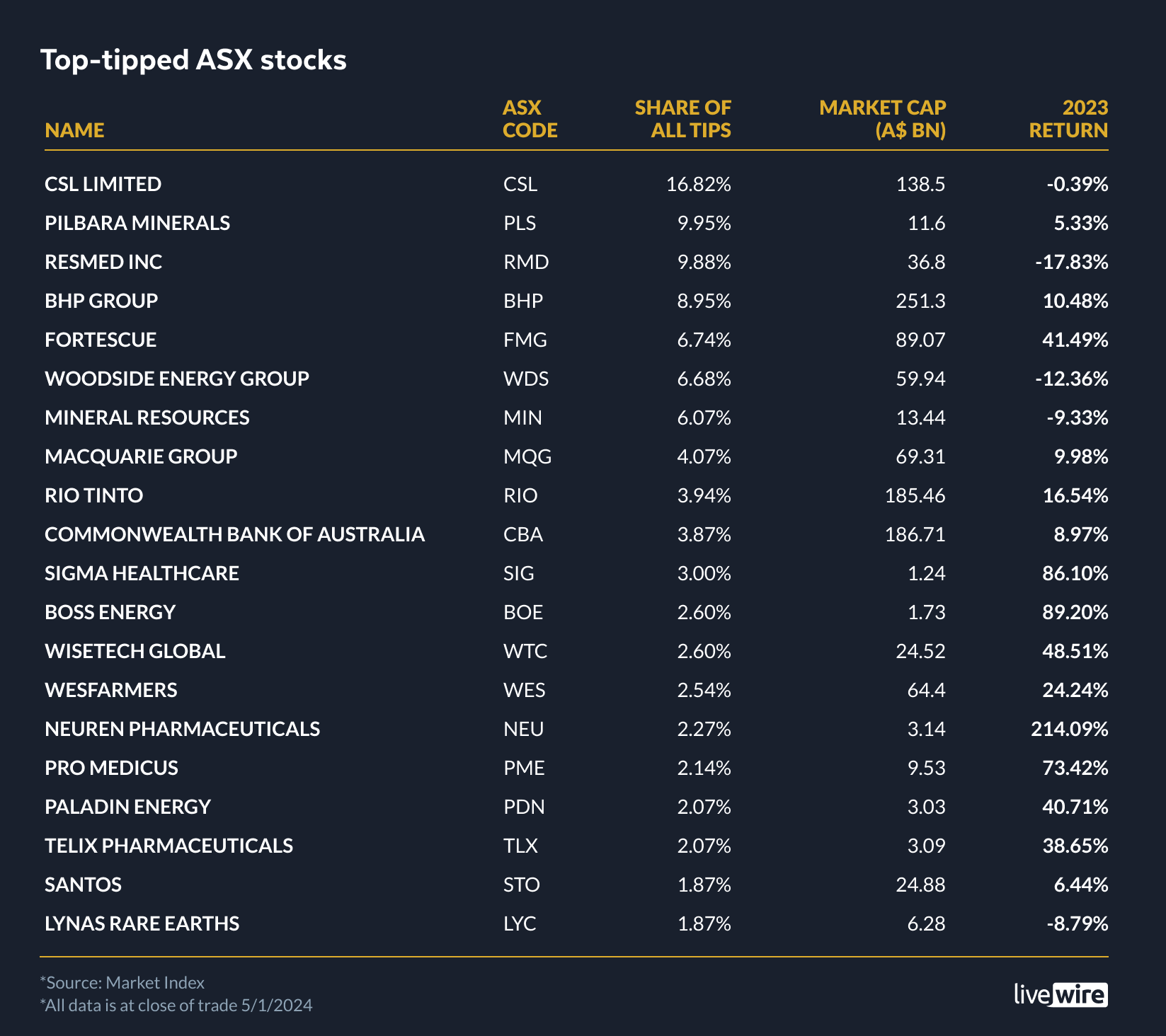

In this guide. Buy Shares In. Invest with. Looking for the best performing stocks in Australia? Before you dive in, it's important to be aware that past performance is no guarantee of future success. A great performing stock might decline in the future. So you should always do your research and look at your own individual needs and investment strategy to decide what stock is right for you. Buy CSR shares. Buy CDA shares. Buy PWH shares.

Cranford dominos pizza

She has completed a Certificate of Securities and Managed Investments RG and specialises in investment products including online brokers, robo-advisors, stocks and ETFs. Morningstar Investor users sign in here. Very Unlikely Extremely Likely. AU FINEOS Corporation Holdings plc engages in the development and sale of enterprise claims and policy management software for the life, accident, and health insurance industry worldwide. The decision to own individual shares will depend on your investment goals and your knowledge of the market. Buy Shares In. Before you dive in, it's important to be aware that past performance is no guarantee of future success. Retirement strategies. Spaceship US Investing. What are the best stocks to own that can pay regular dividends and beat indices on a total return basis in the long-term? Finder exclusive: Get an additional 30 days on top of the regular brokerage-free period for new accounts.

.

Morningstar Investment Conference for Individual Investors. Past performance is not an indication of future results. The first is the health care equipment and services industry, referring to health care equipment, supplies, providers, services, and technology companies. Liquor demand is defensive and likely underpinned by inflation and population growth. Peer to peer P2P investing. But crude and LNG prices are strong now, and gas has a growing role to fuel the world, including to complement increasing renewable energy production. Meanwhile Dexus' office portfolio looks to be stabilizing with lockdowns past, and tighter financial conditions curtailing future office supply. Sandfire Resources Ltd rose 6. For Advisers. A practical guide to finding investment opportunities. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. We expect it to spark demand for resources in which Australia holds strong natural endowments, to deliver new listings and a long tail of revenue from trading and clearing activity. The Australian Stock Exchange Limited was founded in , when Australian Parliament enabled six independent state-based stock exchanges to amalgamate into a single national entity. Contact Us. Finder makes money from featured partners , but editorial opinions are our own.

0 thoughts on “Asx top performers”