Bank micr number

Use limited data to select advertising.

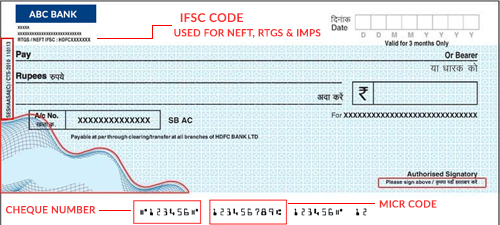

When it comes to financial transactions, you may have come across the terms MICR and bank account number. But do you know what these terms mean and how they differ from each other? This guide will take a closer look at MICR codes and bank account numbers and explain their differences. It is a technology used in the banking industry to facilitate the processing of cheques and other financial documents. MICR consists of a series of special characters that are printed in magnetic ink at the bottom of cheques and other documents.

Bank micr number

What are you searching for? Some links may lead to third party websites which may have privacy and security policies different from those of BCU. Please review the applicable information available on the new site. BCU does not maintain, approve, or endorse the information provided on other third party websites. If you have checks, your Account Number can also be found on the bottom of your checks. You will see a series of numbers separated by colons : or other symbols. Your Account Number is the series of numbers in the middle see below. Example: : : Account Number The Credit Union's routing number is This can also be found in the bottom left-hand corner of the Credit Union's website. Your Member Number identifies your membership as a whole, while an Account Number is a unique digit number assigned to a specific account. Each account type checking, savings, loan will have a different Account Number. To view more information on how to locate your Member Number click here. Looking to set up your Direct Deposit?

View more information.

A MICR number is a unique 12 digit number commonly used for setting up and authorizing electronic payments. Your MICR number is separate from your member number. Your member number identifies your membership as a whole, while a MICR number is assigned to a specific account. An ACH payment is an electronic payment you have setup with a company to debit your account for such things as utility bills, gym memberships, loan payments, etc. An ACH can also include deposits into your account such as your paycheck, Social Security, tax refund, etc. If you have checks, your MICR number can also be found on the bottom of your checks.

What are you searching for? Some links may lead to third party websites which may have privacy and security policies different from those of BCU. Please review the applicable information available on the new site. BCU does not maintain, approve, or endorse the information provided on other third party websites. If you have checks, your Account Number can also be found on the bottom of your checks.

Bank micr number

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content.

Quiniela inteligente

The first three digits of the routing number indicate the city of the bank branch where the check comes from. The MICR number is mentioned at the bottom of the cheque leaf, printed on the right side of the cheque number. The MICR code includes the bank account number, cheque number, and bank code, while the bank account number is a unique identification number assigned to a specific bank account. The main objective of the news desk, is to cover the real estate sector from the perspective of providing information that is useful to the end-user. MICR is the reason why checks are so uniform in their format. The MICR code is used to process and clear cheques and other financial documents, while the A bank account number is a unique number used to identify a single bank account for financial transactions. To view more information on how to locate your Member Number click here. Press Releases. Is the MICR code the same as the bank account number? While we have made every attempt to ensure that the information contained in this site has been obtained from reliable sources, BILL is not responsible for any errors or omissions, or for the results obtained from the use of this information. Table of Contents Expand. Understanding what a MICR number is and how it works can help provide a clearer view of the banking industry and other financial institutions, as well as how important physical documents still are, even with modern electronic payment methods. BILL makes no representations as to the accuracy or any other aspect of information contained in other websites. The final set of digits in a MICR line is the check number.

MICR technology is a crucial element in the use of checks and other financial documents, providing quick and easy validation of documents to ensure secure financial transactions, including deposits, wire transfers, and more. Understanding what a MICR number is and how it works can help provide a clearer view of the banking industry and other financial institutions, as well as how important physical documents still are, even with modern electronic payment methods. The MICR line is typically located at the bottom left corner of a check, and it is printed in a particular font that is easily recognizable by machines used by banks and other financial institutions.

The national and international banking standards require MICR to be used, which then allows checks to be automatically accepted at all financial institutions. The MICR code includes the bank account number, cheque number, and bank code, while the bank account number is a unique identification number assigned to a specific bank account. The MICR line mechanized that process. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. They validate the check and finalize the transaction, deducting the correct amount from one account and crediting it to another. Visa Platinum APR as low as If you have checks, your Account Number can also be found on the bottom of your checks. Stay up-to-date with the latest articles to improve your financial operations. What is the difference between MICR and bank account numbers? The MICR system has been in use since the late s. It is located next to the routing number. MICR codes and bank account numbers are different. Discover our full suite of automation and invoicing tools and learn how BILL can transform your business today. In addition, routing and account numbers guarantee funds are safely transferred from the proper account. One of the benefits of the magnetic ink character recognition line is its ability to facilitate the use of a routing number to process checks and deduct the payment amounts.

It is a pity, that now I can not express - there is no free time. I will return - I will necessarily express the opinion.

In it something is. Now all is clear, thanks for the help in this question.

In my opinion, it is an interesting question, I will take part in discussion. Together we can come to a right answer. I am assured.