Best asx dividend stocks to buy now

Dividend stocks are attractive to investors because of the double-edged return they offer. Investors in these stocks not only stand a chance to make gains through the appreciation of the stock price but also receive periodic dividend payments. It's crucial to remember that dividends paid out by a company signify its financial health and commitment to rewarding investors. Dividend yield, which measures the company's annual dividend payment as a percentage of its share price, is a key metric for evaluating asx dividend stocks.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. If you want some high quality options in your income portfolio , then it could be worth checking out the ASX dividend stocks listed below. That's because they have been named as best buys by brokers in March. Here's what they are saying:. Bell Potter thinks that this healthcare property company could be a great option for income investors. The broker commented:.

Best asx dividend stocks to buy now

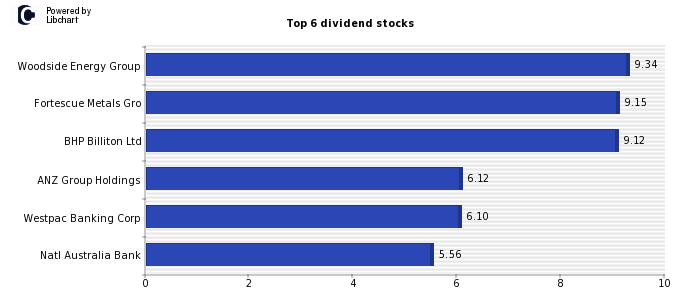

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. With interest rates as high as they are and the best savings accounts delivering 5. The ASX bank shares and mining shares are well-known for delivering some of the highest dividend yields in the market year after year. But if you do some digging, you'll find other great dividend payers in other market sectors. Typically, the companies that will pay you the best dividend yields are the ASX large-cap shares. Most of them have been operating for decades, bringing in sustainably strong earnings every year. Let's look at which ASX large-cap shares are trading on the highest trailing dividend yields today. If you're using this data to research ASX dividend shares , just remember that trailing dividend yields represent last year's earnings as a percentage of today's share price. This is particularly the case with mining stocks, oil shares and any other stock associated with commodities. These companies negotiate the sale prices for their products based in large part on the going global market commodity price at the time. Commodity prices are entirely out of these companies' hands. When they're high, mining and oil shares are likely to earn more and pay higher dividends.

Why Do Companies Pay Dividends? Industry Insights.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs.

In this guide. Buy Shares In. Invest with. Dividends can be one of the most important considerations for Australian investors, especially those who are looking to live off the income their shares provide. Well-established blue-chip companies like the banks are less likely to see substantial share price growth over many years, so dividends are often seen as the key reason to invest in them. Given the importance of dividends and the difficulty investors have had over the last few years finding a sustainable payout due to the aftermath of global disruptions, we thought we would put together a list of non-banking best dividend stocks to keep an eye on in To help generate a list, we reached out to Bell Direct's head of distribution Tim Sparks who sent us 20 thought starters you might keep your eye on in Unfortunately there's no one magic stock that is 'best' for everyone. Instead, you should look into your own portfolio, your individual needs and your investment strategy to decide what stock is right for you.

Best asx dividend stocks to buy now

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia.

Airbnb galway

Plus, with the backing of Goldman Sachs, which sees a solid upside to BHP's shares, it seems like a smart pick for anyone looking to add a bit of income to their portfolio. The company has consistently shown a strong dividend yield, as demonstrated by its five-year trailing dividend of 8. What is dividend yield? Join our newsletter and receive exclusive insights, market trends, investment tips, and updates delivered directly to your inbox. High ratios suggest overpayment at the expense of growth and stability. Companies pay dividends to reward shareholders and attract investors, crucial in Australia's market known for high dividends. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. Market Access ASX, as well as more than 40 international markets. Diversifying your portfolio can help manage risk, and seeking advice from a financial professional is recommended. United Kingdom. Morningstar Investor. Morningstar analyst John Mills expects dividends to continue to trend lower over the next two years.

Please note that any research that we publish does not take timing into consideration. We may publish research for a stock that we believe is of good quality but not necessarily trading at a discount or at a technical level for a high probability entry. As defensive stocks, value stocks are considered a safe harbour for assets as strong established businesses are expected to weather any oncoming storms.

For this reason, Australian stocks often pay out some of the highest dividends in the world. March 9, Tristan Harrison. The appeal lies in the dual potential for earning through dividend payments and the appreciation of stock value over time. Morningstar equity research methodology. Dividends are not always consistent, so for this reason, the highest-dividend paying stock is forever changing. GR Engineering Services GNG , a leading Australian engineering and consulting firm, specialises in design and construction services for mineral processing and infrastructure sectors. To identify top dividend-paying stocks in Australia, investors should examine factors that signal long-term income potential. Top Stories. Fixed Income. The following chart shows the percentage of total income from the ASX that comes from each of these shares, dividends over the last two financial years and our projection of dividends for the next two financial years by our analysts. On the other hand, dividend funds, which include exchange-traded funds ETFs and managed funds, provide a diversified investment vehicle comprising a basket of dividend-paying stocks.

0 thoughts on “Best asx dividend stocks to buy now”