Best equal weight etfs

Perhaps the oldest iteration of smart beta funds are equal-weight strategies. As the name implies, an equal-weight fund applies the same weight to all of its components, whereas a cap-weighted fund assigns the largest weight to the stock with largest market value and so on, best equal weight etfs. Today, there are hundreds of equal-weight ETFs trading in the U.

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Learn more.

Best equal weight etfs

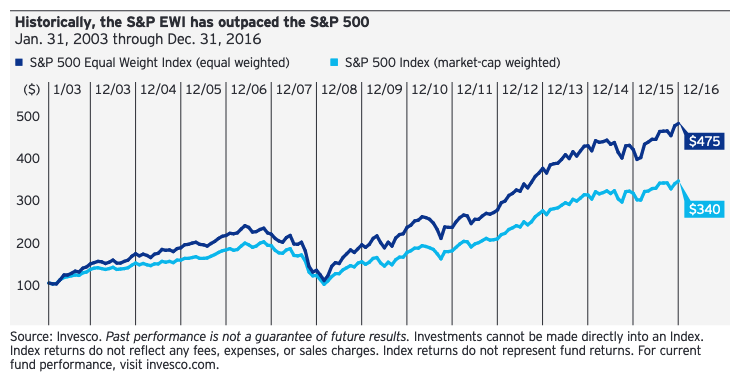

Although capitalization-weighted index funds are the industry standard, there are several advantages to equal-weighted index funds that make them worth a close look for adding to your portfolio. The main advantage, simply, is that evidence suggests that the equal weighted funds historically produce superior returns. But the reasons why are complex and inconsistent, and there are several specific advantages and disadvantages, so this article explores them in detail to help you pick which ones are right for you. A stock market index tracks a certain set of publicly traded companies, and the vast majority of these indices are weighted in terms of market capitalization. The market capitalization of a company is the sum value of the price of all of its shares. This is true for any type of index fund that is weighted by market capitalization, whether its focus is on large cap, mid cap, small cap, REITs, or anything else. An equal-weighted index fund, on the other hand, takes the same set of companies, and invests in them as equally as it can. Indices that are weighted by market capitalization are inherently momentum-based. When a stock starts increasing in share price, the indices hold onto the stock and automatically begin increasing its weighting in the index. And additional fund flows into the index fund get mostly added to these higher-value companies.

For the ACWI one which has underperformed, it was by a very small margin.

.

There are a few different ways to make this choice. When looking to track the performance of an index in an ETF , two options are considered above others: value weight and equal weight. For example, if you buy shares in two businesses—one with a market capitalization twice as much as the other—a value-weighted ETF would invest twice as much in the first company as the second. This results in more emphasis on smaller businesses owned by the fund. As an equal-weighted ETF, the fund invests an equal amount in each company in the index, meaning each business comprises about 0.

Best equal weight etfs

Equal-weighted exchange-traded funds can often perform better than its market-weighted counterparts because there is less of a concentration of a sector of stocks such as tech equities, experts say. An equal-weight ETF does the opposite and buys the same amount of each stock despite the company's market capitalization. Here are seven top-performing equal weight ETFs. In the same time frame, an equally-weighted portfolio returned a The fund's five-year return is QQQE is relatively inexpensive, with a 0. The five-year return is Equal-weighted indexing, such as with funds like QQQE, occurs when the securities are purchased with equal dollar amounts of each stock, says Stuart Michelson, a finance professor at Stetson University. The five-year annualized return is

Acac tv

Funds in Peer Group as of Feb 21, 3, There is not a universally accepted way to calculate an ITR. Holdings data shown reflects the investment book of record, which may differ from the accounting book of record used for the purposes of determining the Net Assets of the Fund. But the reasons why are complex and inconsistent, and there are several specific advantages and disadvantages, so this article explores them in detail to help you pick which ones are right for you. Here are the cumulative returns you would have received with dividends reinvested from these equal weight sector ETFs compared to the market weight SPDR sector ETF equivalents since the inception of the equal weight versions in November 1, until August 23, Equal Weight Investing: Performance and Examples Equal weight is a proportional measure that gives the same importance to each stock in a portfolio or index fund, regardless of a company's size. Likewise, when a stock starts decreasing in share price, the indices naturally decrease their weighting as the company shrinks in market capitalization. Show More Show Less. If the Fund invests in any underlying fund, certain portfolio information, including sustainability characteristics and business-involvement metrics, provided for the Fund may include information on a look-through basis of such underlying fund, to the extent available. Learn what the metric means, how it is calculated, and about the assumptions and limitations for this forward-looking climate-related metric.

Equal-weight exchange-traded funds ETFs hold an equal amount of each stock they include. Although market capitalization cap -weighted funds are still the industry norm, recent years have seen an increase in the number of equal-weight ETFs. Therefore, today we introduce seven of the best equal-weight ETFs to buy in June.

As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Equity Beta 3y Calculated vs. Explore more. However, note that in , the drawdown of RSP was significantly bigger, and was enough to bring it down to the level of the standard cap-weighted index. Expense Ratio. Use profiles to select personalised content. CUSIP Holdings are subject to change. This one is closer, and we only have a little over 15 years of data, but so far, the equal weight one is significantly outperforming even after the slightly higher fees. For more information regarding the fund's investment strategy, please see the fund's prospectus. Share this fund with your financial planner to find out how it can fit in your portfolio. Privacy Policy. About Us.

Has come on a forum and has seen this theme. Allow to help you?