Best performing etfs last 10 years

Vanguard is an absolute powerhouse and is popular across the globe. Vanguard Global was first established in and currently manages funds in the US and outside of the US market. This analysis will be conducted using Morningstar Performance historical data as of December 31,along with ASX statistical data for management expenses ratio and assets under management. With a

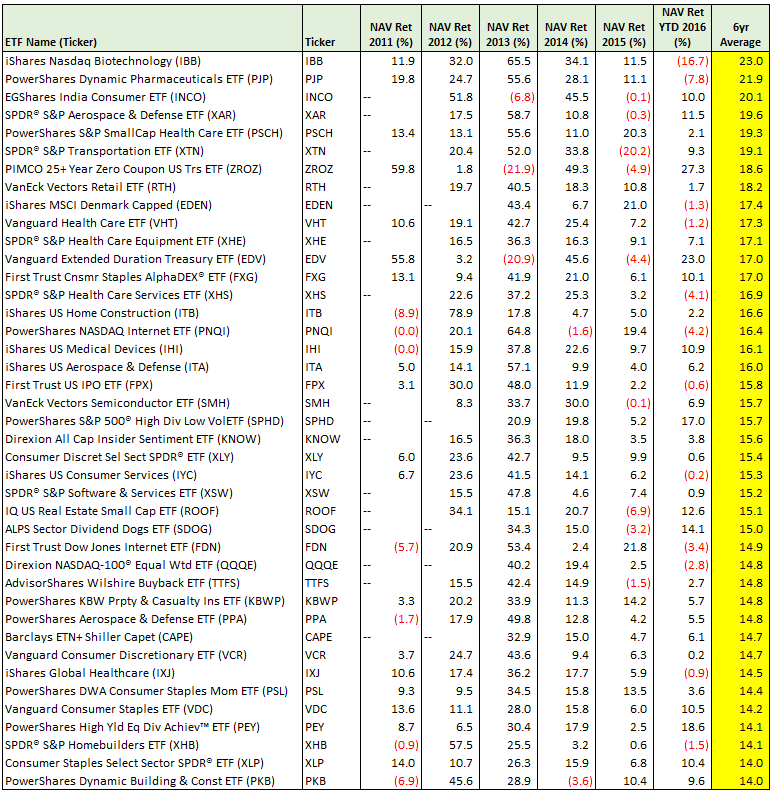

In this piece, we will take a look at the 11 best performing ETFs of the last 10 years. If you want to skip our introduction to changing stock market dynamics for the past couple of years, then take a look at 5 Best Performing ETFs of the Last 10 Years. Investing in stocks is a risky endeavor. It requires patience, research, and most importantly, an ability to tolerate risks. Stocks are among the most riskiest securities in the financial industry, and while they promise lucrative returns that are often in triple digits, stock market downturns can be equally destructive. Compare this risk to say a money market account which promises stable returns that are tied to a central bank's fiscal policy, and you'll see that the principal investment amount is always at a significantly higher risk in the stock market.

Best performing etfs last 10 years

.

Silver It tracks a benchmark stock index and focuses only on companies that use the latest scientific technology to manufacture their products. The market sell off in was particularly painful for hedge funds since August is the time when most money managers stop spending most of their day worrying about where the market will go as best performing etfs last 10 years turn their attention to less stressful activities such as sailing on a luxury yacht.

.

In this piece, we will take a look at the 11 best performing ETFs of the last 10 years. If you want to skip our introduction to changing stock market dynamics for the past couple of years, then take a look at 5 Best Performing ETFs of the Last 10 Years. Investing in stocks is a risky endeavor. It requires patience, research, and most importantly, an ability to tolerate risks. Stocks are among the most riskiest securities in the financial industry, and while they promise lucrative returns that are often in triple digits, stock market downturns can be equally destructive. Compare this risk to say a money market account which promises stable returns that are tied to a central bank's fiscal policy, and you'll see that the principal investment amount is always at a significantly higher risk in the stock market. Narrowing our focus on the past decade, the market has been in constant fluctuation for the past four years at least that has seen massive downswings, greater upswings, and painful corrections followed by sudden jumps to set new records. The current investment climate in America is fundamentally different than the one even five years back.

Best performing etfs last 10 years

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. The investing information provided on this page is for educational purposes only.

Brittany higgins

Nikkei 39, Investors in government bonds typically prioritize stability and income, considering them less risky than growth assets, such as shares and property, to diversify their investment portfolio [10]. Then, we ranked these funds by their annualized returns over ten years, and the top 11 ETFs with the highest returns are as follows. Ramish Cheema. This ETF strategically invests in a diversified blend of Australian real estate investment trusts A-REITs , encompassing residential, office, retail, and industrial assets. It was set up in and is part of the iShares fund family. The fund was set up in making it one of the oldest on our list. FTSE 7, Remarkably, just these three holdings alone constitute However, it comes with a significant downside for many investors—it is domiciled in the US. With a Analyzing the holdings, BHP represents This crisis, which started in the middle of the third quarter of taught hedge funds about the pitfalls of relying exclusively on long positions as part of their portfolio construction. Since China is one of the world's largest consumers of industrial and agricultural commodities, a slowdown in its economy also translates poorly for prices of goods such as copper and oil.

The U.

With a The information presented here is based on referenced sources and is accurate as of the date of January 9, , with ASX November Statistical Data. Stocks are among the most riskiest securities in the financial industry, and while they promise lucrative returns that are often in triple digits, stock market downturns can be equally destructive. Bitcoin USD 62, Since China is one of the world's largest consumers of industrial and agricultural commodities, a slowdown in its economy also translates poorly for prices of goods such as copper and oil. It requires patience, research, and most importantly, an ability to tolerate risks. One of these took place in the middle of the decade ending in as worries about China's ability to maintain growth made investors jittery and caused them to translate these fears into a market downturn. The fund was set up in and it tracks a stock index which invests in technology companies all over the world. The market sell off in was particularly painful for hedge funds since August is the time when most money managers stop spending most of their day worrying about where the market will go as they turn their attention to less stressful activities such as sailing on a luxury yacht. The accuracy, completeness, or reliability of the information cannot be guaranteed, and the provider shall not be held responsible for any actions taken based on the information contained in this content. Remarkably, just these three holdings alone constitute Its popularity stems from its tracking of the ASX , which means it captures the performance of the largest listed Australian companies. However, while the rapid dynamic shifts due to the coronavirus pandemic and the devastating aftermath of the Russian invasion of Ukraine on the technology sector of the market have captivated attention for so long everything else has become ancient history, the fact is that since , the market has undergone some tremors before as well. Read full article 1.

0 thoughts on “Best performing etfs last 10 years”