Bip or bipc stock

We expect the exchange to be treated as a taxable sale of your Class A Shares for U.

Dividend Earner. Updated on May 21, Home » Education » Dividend Investing. A lot of investors are a little annoyed at having two different shares of the same company and would like to consolidate. It definitely makes tracking what you own in a company a little different.

Bip or bipc stock

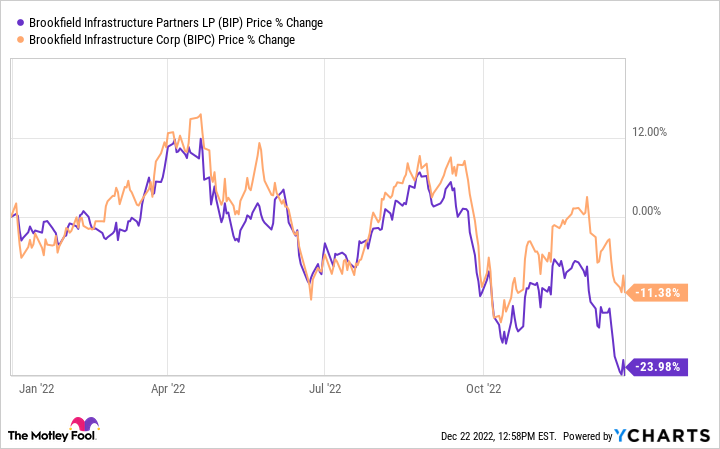

This article was published more than 6 months ago. Some information may no longer be current. UN in a registered account. I understand that the related corporate entity, Brookfield Infrastructure Corp. BIPC , is generally more suitable for non-registered accounts due to more favourable tax treatment of the dividends. At such a large price differential, is BIPC still the better choice for non-registered accounts? My crystal ball is in the shop right now, so I am not going to make any specific predictions. But here are a couple of things we know for certain, along with some important context. The corporate shares have produced a total return — assuming all dividends were reinvested — of about 88 per cent, compared with about 36 per cent for the limited partnership units. View the model portfolio online. An investor buying BIPC today would receive a yield of about 3. So, from an income standpoint alone, BIP. UN is now the better choice. If both securities send investors the same amount of cash every quarter, why has BIPC produced stronger returns? Well, when Brookfield Infrastructure Partners spun out BIPC as a new company almost three years ago, it said the motivation was to attract a larger investor base.

When are the dividend payment dates and dates of record? But here are a couple of things we know for certain, along with some important context. Distribution BIP.

Brookfield Infrastructure Partners — Replay. September 21, Event Information. Premier infrastructure operations with stable cash flows, high margins and strong internal growth prospects. Significant capital required to maintain and expand the infrastructure needs of the global economy resulting in potential acquisition opportunities. At Brookfield, sound ESG practices are integral to building resilient businesses and creating long-term value for our investors and other stakeholders.

Dividend Earner. Updated on February 26, Home » Education » Dividend Investing. A lot of investors are a little annoyed at having two different shares of the same company and would like to consolidate. It definitely makes tracking what you own in a company a little different. This is a snippet from Brookfield :.

Bip or bipc stock

Distributions to our unitholders are determined by our general partner. Registered unitholders who are U. Beginning with the Q4 distribution, registered unitholders who are Canadian residents and beneficial unitholders whose units are registered in the name of CDS or a name other than their own name i. The Canadian dollar equivalent of the quarterly dividend is based on the Bank of Canada closing exchange rate on the record date for the dividend. Registered unitholders wishing to receive the U. Box College Station TX or by phone at Beneficial unitholders whose units are registered in the name of CDS or a name other than their own name i. Note: Per unit distribution amounts are reflected on a pre-split basis.

Pokemon stoutland card

Feb 01 UN units held. That was almost a per-cent premium to BIP. Last Name. Search Go. My crystal ball is in the shop right now, so I am not going to make any specific predictions. September 21, Event Information. We expect the exchange to be treated as a taxable sale of your Class A Shares for U. Responsibility At Brookfield, sound ESG practices are integral to building resilient businesses and creating long-term value for our investors and other stakeholders. Well, when Brookfield Infrastructure Partners spun out BIPC as a new company almost three years ago, it said the motivation was to attract a larger investor base. Nov 28

UN today announced its results for the first quarter ended March 31, We continue to advance a sizeable pipeline of active investment opportunities and maintain a strong liquidity position to fund our growth. Current year results benefited from the contribution associated with recent acquisitions and organic growth across our base business.

My crystal ball is in the shop right now, so I am not going to make any specific predictions. Looking for Last Name. Interact with The Globe. Non-subscribers can read and sort comments but will not be able to engage with them in any way. How are dividends taxed? Like BIP. We expect the exchange to be treated as a taxable sale of your Class A Shares for U. View the model portfolio online. This article was published more than 6 months ago. Skip to main content.

I consider, that you are mistaken. Let's discuss it. Write to me in PM, we will talk.

I consider, that you are not right. I am assured.

It seems excellent idea to me is