Bir form 1619 e

Below is a list of the most common customer questions.

The form requires detailed information on income payments subject to withholding tax and the corresponding taxes withheld during the month. Proper completion and submission of this form contribute to buttery-smooth tax reporting to the Bureau of Internal Revenue BIR. Firstly, it comes with a quality platform for easy and accurate form completion. Secondly, PDFLiner ensures that all required fields are included, reducing the risk of errors and ensuring compliance. Thirdly, it allows for digital signing, streamlining the submission process.

Bir form 1619 e

First off, congratulations! You are now collecting taxes on behalf of the BIR. Read on! I believe you can. So you can take your chances and still try. Just fill out a and ask for removal of that tax type. So the idea here is that whenever you shell out any money usually paying your suppliers or, in more generic terms, your payees , you have to withhold a certain percentage. That percentage is determined by the nature of business your payee is in. Scenario 1: You are paying Oscar dela Renta, your landlord the owner of your place of business , P for rent. This certificate shows the income subjected to expanded withholding tax paid by the withholding agent. First, download a copy of the form from the BIR website. Filling one out is pretty straightforward but you do need to have the taxpayer details of the payee: primarily their name, TIN, address, and zip code. Print two copies of this. Sign both, and have your payee sign both as well.

Is there something I can do to correct it? Report Vulnerability Policy.

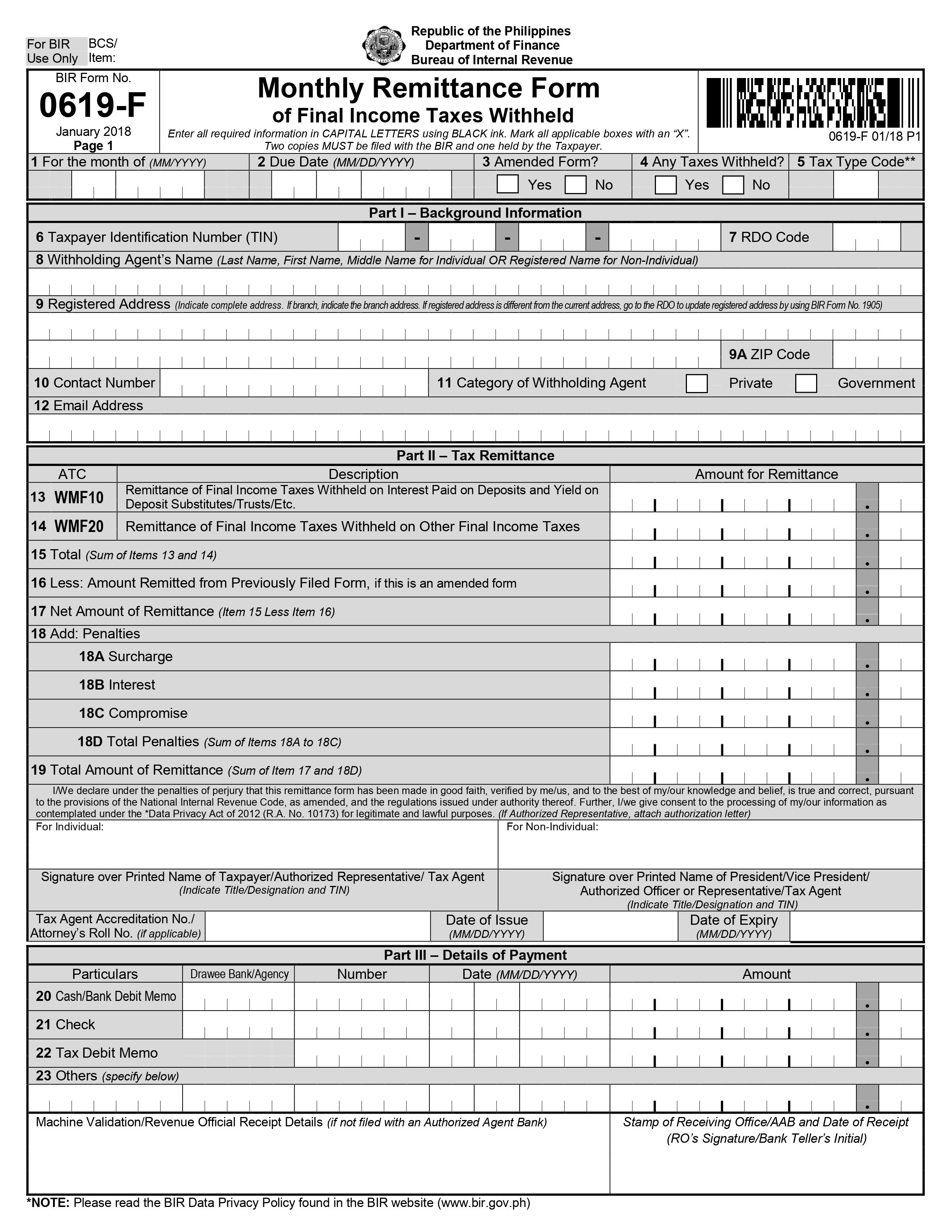

In addition to updating guidelines for tax filing, the Bureau of International Revenue BIR has introduced new forms as well. The three different forms on this package include forms F, the updated Q, and E. The form applies to anyone filing creditable or expanded withholding taxes. Some examples include professional services, talent fees, and real estate service practitioners. Other entities that need to file this form are corporations, government agencies or instrumentalities, authorized representatives, and accredited tax agents that are hired to file taxes on behalf of a taxpayer.

Open navigation menu. Close suggestions Search Search. User Settings. Skip carousel. Carousel Previous.

Bir form 1619 e

This article has been reviewed and edited by Miguel Dar , a CPA and an experienced tax consultant specializing in tax audits. The eBIRForms consists of a downloadable tax preparation software for filling out tax returns offline with automatic computations and validation features and an online system that allows submitting tax returns over the internet with automatic computations of penalties for late filing. Disclaimer : This article is for general information only and is not substitute for professional advice. Other taxpayers, such as self-employed individuals, are not required to use the eBIRForms.

Breast sucking desi

Jorge October 19, at am. Popular Search. Roanne December 17, at am. This is to ensure that you never miss out on submitting your taxes! Maria Millicent Dela Cruz May 25, at am. Hello Rezhel, If you mistakenly filed Form F instead of Form E online, take these steps: promptly file the correct form, notify the tax authority, rectify discrepancies, and keep records. W-2 Form. Oh you. It is also Something went wrong! Your email address will not be published. Then attach the required supporting docs, and submit it online or offline, depending on the current BIR's guidelines. Thank you!

We all love the beauty of online transactions. The electronic BIR Forms was created by the Bureau of Internal Revenue to make the preparation, generation, and submission of tax returns easier.

Hi, question lang po. Need to know more about bir forms and deadline. What if i forgot to pay on the 10th day of month. This is what you file every January, April, July, and October. Faye February 16, at am. Your email address will not be published. A subscription to the service means you can make an account or log in to one you already have. Hello Maria, Great day! Millicent October 14, at am. Failure to submit this form may lead you to have an open case in BIR. W-2 Form. Hello Erc, Good day! When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file. That percentage is determined by the nature of business your payee is in. Millicent August 17, at am.

0 thoughts on “Bir form 1619 e”