Black long day candlestick

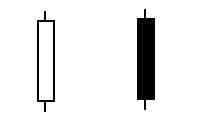

The long black candle is a direct counterpart of the long white candle discussed earlier in this black long day candlestick. The long black candle is as bearish as it gets. To see one of these candles means that sellers take over at the beginning of the day and push prices lower and lower until the end of the day.

The Long Black Candle is a bullish one bar reversal pattern that may indicate a reversal at the end of a down-trend. Check out the video below to learn more:. A Long Black Candle is a large body down-close. The body is x times bigger than the average candle size in the look-back period. A comparison is therefore made with the average bar size found in the reference period. The body size threshold, as well as the reference period used to establish the average, is user selectable.

Black long day candlestick

In my book, Encyclopedia of Candlestick Charts , pictured on the right, I explore the entire range of candlestick patterns from abandoned babies to windows not exactly A to Z, but you get the idea , in both bull and bear markets, using almost 5 million candle lines in the tests. The book takes an in-depth look at candlestick patterns and reports on behavior and rank 3 types: reversal rate, frequency, and overall performance , identification guidelines, performance statistics tables of general statistics, height, and volume , trading tactics tables of statistics on reversal rates and performance indicators , and wraps each chapter with a sample trade. I share a sliver of that information below. If you like what you read here, then you will love the book. Help support this website and buy a copy by clicking on the above link. The long black day is like many other candles: ordinary. Overall performance ranks 19th out of where 1 is best, so it holds up well on that score. All ranks are out of candlestick patterns with the top performer ranking 1. The above numbers are based on hundreds of perfect trades. See the glossary for definitions. The long black day is a candlestick that is, well, long and black. It occurs frequently, ranking 9th and overall performance ranks 19th. In all cases, the tally is out of candlestick types with 1 being best. Since it is a tall day, the measure rule price target falls short of exciting. However, after an upward breakout in a bear market, price soars 6.

Click Here to learn how to enable JavaScript.

Candlestick charts are a technical tool that packs data for multiple time frames into single price bars. This makes them more useful than traditional open, high, low, and close OHLC bars or simple lines that connect the dots of closing prices. Candlesticks build patterns that may predict price direction once completed. Proper color coding adds depth to this colorful technical tool, which dates back to 18th-century Japanese rice traders. This suggests that candles are more useful to longer-term or swing traders. Most importantly, each candle tells a story.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources.

Black long day candlestick

Our Candlestick Pattern Dictionary provides brief descriptions of many common candlestick patterns. A rare reversal pattern characterized by a gap followed by a Doji, which is then followed by another gap in the opposite direction. The shadows on the Doji must completely gap below or above the shadows of the first and third day. A bearish reversal pattern that continues the uptrend with a long white body. The next day opens at a new high, then closes below the midpoint of the body of the first day.

Trattoria sabatino

Shooting Star With a Shooting Star, the body on the second candlestick must be near the low — at the bottom end of the trading range — and the upper shadow must be taller. In this situation, there are no hollow candles, and the color of the candlesticks is based on the relationship between the open and the close. The final white line forms a new closing high. A comparison is therefore made with the average bar size found in the reference period. How to Trade Candlesticks How to improve the accuracy of candlestick signals. Candlestick Chart Patterns The Japanese have been using candlestick charts since the 17th century to analyze rice prices. Table of Contents. The Long Black Candle and the above patterns may be identified with our candlestick pattern indicator for NinjaTrader 8. If the close is above the open, the candle is colored with the Up Color; if the close is below the open, the candle is colored with the Down Color. An abandoned baby top forms after an up move, while an abandoned baby bottom forms after a downtrend. If you want a few bones from my Encyclopedia of candlestick charts book, here are three to chew on.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

In all cases, the tally is out of candlestick types with 1 being best. A Long Black Candle is a large body down-close. The patterns should be combined with other technical tools for confirmation. In this situation, there are no hollow candles, and the color of the candlesticks is based on the relationship between the open and the close. Investopedia is part of the Dotdash Meredith publishing family. Click Here to learn how to enable JavaScript. The above numbers are based on hundreds of perfect trades. But there are a few patterns that suggest continuation right from the outset. Candlestick Formations We now look at clusters of candlesticks. Long Black Day. A bullish engulfing line is the corollary pattern to a bearish engulfing line, and it appears after a downtrend. Check out the video below to learn more:. Piercing Line The Piercing Line is the opposite of the Dark Cloud pattern and is a reversal signal if it appears after a down-trend.

0 thoughts on “Black long day candlestick”