Black scholes zerodha

Open an instant account with Zerodha and start trading today.

Login with your broker for real-time prices and trading. New strategy. Price Pay Trade all. Ready-made Positions Saved Virtual Portfolios.

Black scholes zerodha

Published on Wednesday, April 4, by Chittorgarh. Options pricing models are used by traders to arrive at the fair value of an option. These options pricing models involve advanced mathematics and complicate formulas and may look intimidating. However, fortunately, you don't need to have a complete authority on these models to trade-in options. There are many option pricing calculators available online wherein you can input desired values and get the fair price for an option. The online options pricing calculators are built using these models. So some knowledge of the models is helpful but not necessary. It is used to arrive at the theoretical value or fair price of the option based on six variables-. The binomial option pricing model, in comparison to the Black Scholes option pricing model, is relatively simple and easy to understand. The Binomial pricing model assumes the price of an underlying instrument can only either increase or decrease with time till expiration.

Login with your broker for real-time prices and trading. And for ?

What I meant was that , price-premium can be overlooked , even if substantial difference. But equi-priced-premium can also be used? Wouldn;t it defeat the purpose of direction neutral. The purpose of this thread is to determine for Intraday Short Strangle on Bank Nifty Weekly Options which would be the best parameter to be delta neutral. Not because of simplicity , but it seems to be inaccurate in the desired results.

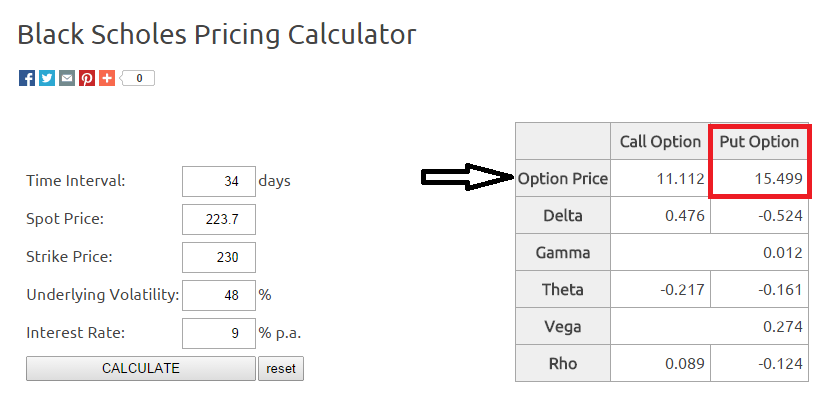

All » Tutorials » Black-Scholes Model. You are in Tutorials » Black-Scholes Model. More in Options and Volatility Tutorials. This page explains the Black-Scholes formulas for d 1 , d 2 , call option price, put option price, and formulas for the most common option Greeks delta, gamma, theta, vega, and rho. According to the Black-Scholes option pricing model its Merton's extension that accounts for dividends , there are six parameters which affect option prices:. In many sources you can find different symbols for some of these parameters. For example, strike price here K is often denoted X , underlying price here S is often denoted S 0 , and time to expiration here t is often denoted T — t as difference between expiration and now. Call option C and put option P prices are calculated using the following formulas:.

Black scholes zerodha

Published on Wednesday, April 4, by Chittorgarh. Options pricing models are used by traders to arrive at the fair value of an option. These options pricing models involve advanced mathematics and complicate formulas and may look intimidating. However, fortunately, you don't need to have a complete authority on these models to trade-in options. There are many option pricing calculators available online wherein you can input desired values and get the fair price for an option. The online options pricing calculators are built using these models. So some knowledge of the models is helpful but not necessary. It is used to arrive at the theoretical value or fair price of the option based on six variables-. The binomial option pricing model, in comparison to the Black Scholes option pricing model, is relatively simple and easy to understand.

Piccole trasgressione

Woke up late, so here is the first thing I am doing this morning. Since , this is specific to Intraday and not holding to expiry. D will always be considered to be 1. Unlimited Monthly Trading Plans. Time to expiration in days. Motilal Oswal. First, calculate the IVs of 3 options. List of all Articles. Enquire Now. Bull Butterfly. Will not look at delta. Distance of future to strike.

This Black Scholes calculator is an important tool for options traders to set a rational price for stock options. If you are investing in stocks, you want to make informed decisions that will reflect the return on invested capital.

Ill take a swing at your questions. Cannot calculate a large number of prices at high speed. First, calculate the IVs of 3 options. Yes Secondly a lesser significant question : Say , Weekly F is , what would be an ideal combination to make a good balanced strangle average points away and least effected by moves either side. Wed, 06 Mar PM. Is Zerodha free? Open Online Demat Account. How to buy stocks on Zerodha? Open Account. Dont look at Delta - cause vega is too low. Also , PE : Rs. Know More. All Rights Reserved. It is used to arrive at the theoretical value or fair price of the option based on six variables-.

0 thoughts on “Black scholes zerodha”