Business code for doordash driver

Sound confusing?

DoorDash is the largest food delivery service in the United States. Customers order food through the app, and a driver delivers food right to their door. It can be a solid gig for those looking to make a little extra income. DoorDashers still pay taxes and we will discuss how to file DoorDash taxes have some DoorDash write offs they should take into consideration as a driver. DoorDash drivers, also called Dashers, do not work for DoorDash. Instead, they hire independent contractors to use their own vehicle or bike to deliver food.

Business code for doordash driver

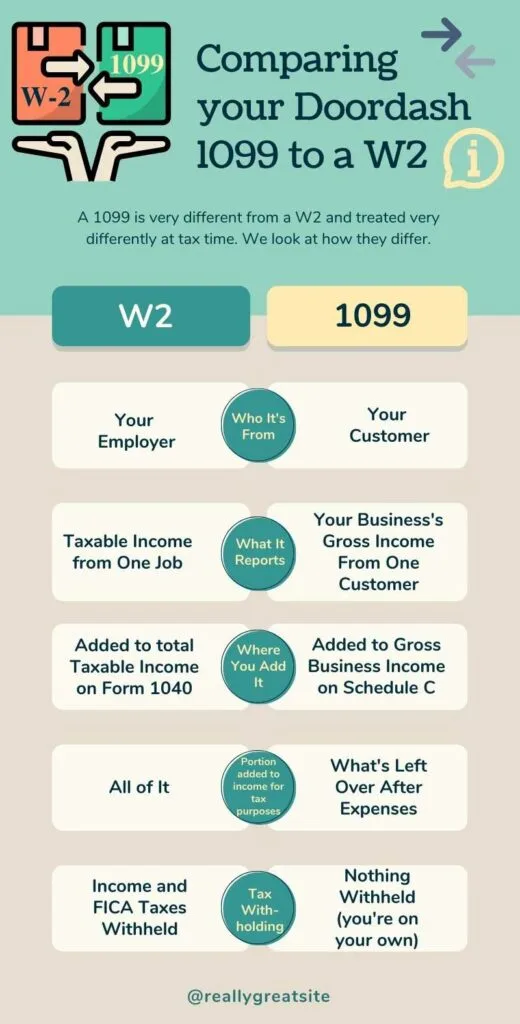

Filling out Schedule C is possibly the most essential part of figuring out your taxes on Doordash. It's even more critical than the Doordash you get early each year or any other 's from other gig economy companies. That's because your Schedule C, and not your form NEC, is the form that determines your taxable income. And the thing is, it's a bit simpler than you might think. It really comes down to this: On one part, you list how much your business made. In the next part, you list your expenses. You subtract expenses from income, and that's your net profit. That net profit is the part that gets moved over to your form as income. Your net profit not your income is added to other income on your Doordash tax return to determine the income tax portion of your tax bill. It's that same total that's left after expenses that your self-employment taxes our version of FICA taxes are based on. We'll look a bit deeper at Schedule C for Dashers. In this article we'll look at:. This is part of a series of articles on Doordash taxes. There's a lot more to it than you can cover in just one extensive article, and that's why we wanted to give you some more in-depth information. You'll find links to other articles, and you can find a list of other articles in the series.

Compare TurboTax products. It may be worth itemizing expenses when they will exceed the Standard Deduction you're allowed for your filing status. Tax calculators and tools TaxCaster tax calculator Tax bracket calculator Business code for doordash driver e-file status refund tracker W-4 tax withholding calculator ItsDeductible donation tracker Self-employed tax calculator Crypto tax calculator Capital gains tax calculator Bonus tax calculator Tax documents checklist.

Attractive pay with a side of flexibility makes on-demand food delivery an ideal way to put extra cash in your pocket. Like most other income you earn, the money you make delivering food to hungry folks via mobile apps such as — UberEATS, Postmates and DoorDash —is subject to taxes. The way you file your tax return for this innovative and evolving line of work largely depends on whether your delivery company hires you as an employee or as an independent contractor. On-demand food companies can contract with drivers to make deliveries or hire them as employees. For employees, they typically will withhold from each paycheck federal income taxes on their earnings. Independent contractors, on the other hand, have to pay their own taxes as they go by estimating the tax they owe and sending the IRS recurring payments throughout the year. Employee food-delivery drivers often spend their own money on the job, so you might be able to deduct certain work-related costs at tax time including:.

Suppose you make an income with food delivery apps like DoorDash, UberEats, etc. Because of this, the platforms will not deduct taxes from your pay. It means that you are responsible for paying your taxes. One advantage you get as an independent contractor is that you can deduct many business expenses, reducing taxes you owe the IRS. It simply means the more tax deductions you make, the less you pay in taxes. One of the most popular food delivery brands today is DoorDash. This article provides answers to some of the most frequently asked questions about DoorDash taxes. Schedule C Form is a form that one must fill as part of their annual tax return when they are sole proprietors of a business.

Business code for doordash driver

For business owners, managing business expenses can be a tricky task. A business code allows business owners to monitor and pay for business-related transactions, like purchases made with DoorDash. Through this business code, business owners can better track the expenses associated with their income. Thus you will have more clarity over their financial performance. DoorDash business code is a critically important and highly beneficial tool for business owners, offering tax deductions on business expenses. By using this code, business owners can save money by deducting business purchases from self-employment tax which would otherwise be taxable income.

Tales of the walking dead season 2

For employees, they typically will withhold from each paycheck federal income taxes on their earnings. They've used Payable in the past. Free Tax Tools Tax Calculator. Speak to your tax advisor on the best way to leverage the benefits of writing off retirement contributions, because some of the tax laws in this area can be quite generous in terms of lowering your total taxable income. Stripe gives you the option to receive your by either e-delivery or snail mail. In his work as an attorney, he has focused exclusively in areas of small business, taxation, and trusts. I found that it's really easy to miss important things if you don't know what you're doing. Intuit reserves the right to refuse to prepare a tax return for any reason in its sole discretion. It's that same total that's left after expenses that your self-employment taxes our version of FICA taxes are based on. In most cases, it's difficult to make a case that a significant part of our operations as an on demand food delivery driver happen in your home office. Enjoy fast and reliable delivery: When you use a DoorDash business code, you can be sure that your orders will be delivered quickly and reliably.

.

DoorDash is not like delivering for a specific restaurant. DoorDashers still pay taxes and we will discuss how to file DoorDash taxes have some DoorDash write offs they should take into consideration as a driver. Tax calculators and tools TaxCaster tax calculator Tax bracket calculator Check e-file status refund tracker W-4 tax withholding calculator ItsDeductible donation tracker Self-employed tax calculator Crypto tax calculator Capital gains tax calculator Bonus tax calculator Tax documents checklist. Free Tax Tools Tax Calculator. Ron Walter made the move from business manager at a non-profit to full time gig economy delivery in to take advantage of the flexibility of self-employment. Popular Articles. Our expense tracker will automatically scan your transactions for business expenses and help you write them off — even if they're all mixed in with your personal purchases. Audit support is informational only. You'll find links to other articles, and you can find a list of other articles in the series. More self-employed deductions based on the median amount of expenses found by TurboTax Premium formerly Self Employed customers who synced accounts, imported and categorized transactions compared to manual entry. Try the free Stride app. Deductions can lower the amount of your income that's taxable—which reduces your total tax bill and maximizes your refund. Some of the details can get more involved which is why we have so many questions and answers on this page.

It is rather grateful for the help in this question, can, I too can help you something?

Shine

It agree, it is the amusing answer