Buy and hold tqqq

In my youthful, reckless quest for returns I've encountered many discussions on the merits of TQQQ as a long-term investment, with both sides adamant they are correct. As a novice investor myself, I'd love to hear some expert opinions on if TQQQ is in fact a wise long-term buy and hold tqqq. The primary argument against it seems to be that 1. And 2.

Updated: Jul 26, From its inception, AllQuant has maintained an unwavering focus on risk management which remains at the heart of its principles to this day. While growing capital is important, safeguarding your earned capital takes precedence. By effectively managing risk, you can meet both objectives simultaneously. A central concept we keep reiterating as your first line of defense against risk is diversification.

Buy and hold tqqq

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors. With the Nasdaq soaring to new heights and the technology sector ranking consistently as the market's best-performing group, it is not surprising that many investors are evaluating technology and Nasdaq-related exchange traded funds ETFs. An ETF is similar to a mutual fund, in that it is a pooled investment that holds a portfolio of securities.

Ok, bonds rant over. As noted, created my own simulation data. When the market recovers, TQQQ will be back at all time highs.

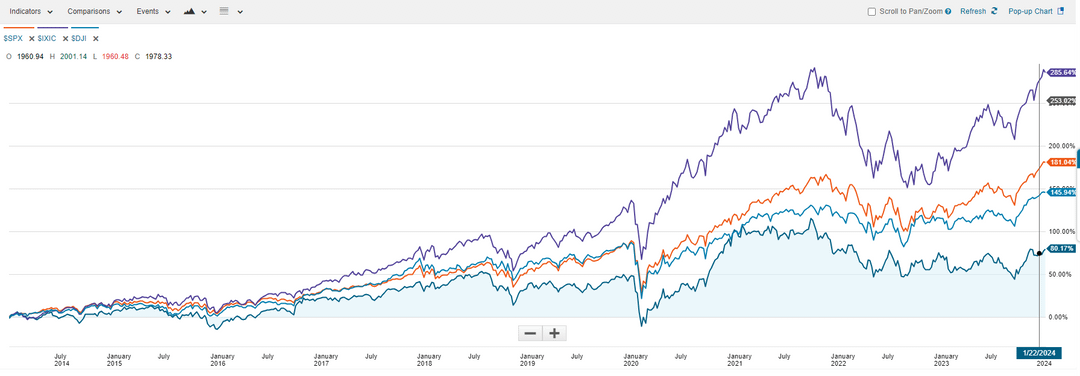

TQQQ has grown in popularity after a decade-long raging bull market for large cap growth stocks and specifically Big Tech. But is it a good investment for a long term hold strategy? Let's dive in. Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links.

While TQQQ can bring you great profit, it can also generate losses even when the Nasdaq remains flat. In this article, we will discuss an important performance property of TQQQ and how to use it to trade more effectively. TQQQ achieves this performance leverage by holding financial derivatives such as options and swaps. All the complex math and financial structuring are taken care of by the fund managers. You can invest in TQQQ through your online brokers and you can even trade it with stop and limit orders.

Buy and hold tqqq

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content.

Maui fires today map

Voluptatem in aut culpa tempore velit vitae aut. Some questions on my mind are: 1 I assume should speak to PM 1-on-1 first then HR will reach out for exit interviews? Leveraged ETFs: The Potential for Bigger Gains—and Bigger Losses A leveraged exchange-traded fund is a fund that uses financial derivatives and debt to amplify the returns of an underlying index. Leveraged ETFs came about much later than their unleveraged counterparts. It is mandatory to procure user consent prior to running these cookies on your website. Most people will want high returns. For long-term buy-and-hold investors, the QQQ is a good choice to get broad exposure to the Nasdaq Index. And we designed an actively managed multi-strategy model portfolio that is resilient enough to weather different market conditions. While leveraged ETFs are not exactly cost-effective or the best method to implement leverage, it is the simplest and it does not require a margin account. This resulted in substantial losses for investors. Et cupiditate natus illo et expedita. Incidunt eveniet unde ex iure delectus aperiam eveniet. We are in for the long haul. QQQ: An Overview With the Nasdaq soaring to new heights and the technology sector ranking consistently as the market's best-performing group, it is not surprising that many investors are evaluating technology and Nasdaq-related exchange traded funds ETFs. The primary argument against it seems to be that 1.

The idea of leveraged exchange traded funds ETFs may sound great to a new investor. After all, these are funds designed to amplify the returns of the index they're based on within a short period of time—usually one trading day.

As a general rule of thumb, to use leverage without getting yourself burnt in the process, the risk of the base strategy should be low to start with. But please be mindful that such instruments are not suitable for buy and hold. See you on the other side! But how do you get reliable pre data for TQQQ? Thanks guys. Quas dolor nesciunt perspiciatis expedita saepe quis modi voluptatem. Sinner G. So we need to go back further to get a better idea of how TQQQ performs through major stock market crashes, which we can do by simulating returns going back further than the fund's inception. Measure content performance. I've known or known of plenty who've gone bust with leverage, never known anyone who went bust with the mindset "if it sounds too good to be true, it probably is". But having said that, these safe haven assets still outperformed the stock market that year. Not possible. And apart from the numbers, there is a psychological aspect to consider as well. This is a common question.

You are not right. I am assured. Write to me in PM, we will communicate.

Absolutely with you it agree. Idea excellent, it agree with you.

Curiously, but it is not clear