Calculate salary per day

Knowing your per day salary can help you better understand your pay slip distribution as a salaried working professional.

This is to ensure fair pay for employees and compliance with labour laws. This guide explains the process for both calculations and highlights their benefits. Calculating salary per day involves determining how much an employee should be paid based on the number of days they have worked in a specific period. After that, divide their annual pay by the number of days a year. An incomplete month of work means an employee has not worked for a full month in the pay period. This situation generally appears when a company has new hires that joined in between the pay period.

Calculate salary per day

You are using a version of browser which will not be supported after 27 May To continue to transact with MOM securely, please follow these steps to enable the Transport Layer Security TLS of your web browser, or upgrade to the latest version of your browser. You may receive a monthly or daily salary. Daily wages are calculated using either the gross rate for paid public holidays, paid leave, salary in lieu and salary deductions or the basic rate for work on rest days or public holidays. Calculate your pay for an incomplete month of work. If you are a monthly-rated full-time employee and took unpaid leave for the month, you should count it as an incomplete month of work to calculate your salary. Total amount of money including allowances, payable for one month's work. This excludes:. For employees with fixed rest days on Sundays or non-working days on Saturdays, the total number of working days per month for year to is shown in this table. By using this service, you agree to accept the terms of use. Salary Home Employment practices Salary Monthly and daily salary. Jump To. Monthly wages Basic rate of pay Gross rate of pay Related questions. Monthly and daily salary: definitions and calculation.

The U. Salaried employees, and to a lesser extent, wage-earners, typically have other benefits, such as employer-contributed healthcare insurance, payroll taxes half of the Social Security and Medicare tax in the U. Knowing your per day salary can help calculate salary per day better understand your pay slip distribution as a salaried working professional.

Keep up to date with SalaryBot product launches, feature improvements, and a reminder to check your take home pay in the new tax year. Find out how a staff shuttle bus can save take home pay, save time and reduce stress from your commute. Use SalaryBot's salary calculator to work out tax, deductions and allowances on your wage. The results are broken down into yearly, monthly, weekly, daily and hourly wages. To accurately calculate your salary after tax , enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself. SalaryBot will automatically check to see if you're being paid the minimum wage for your age group. Contact Blog.

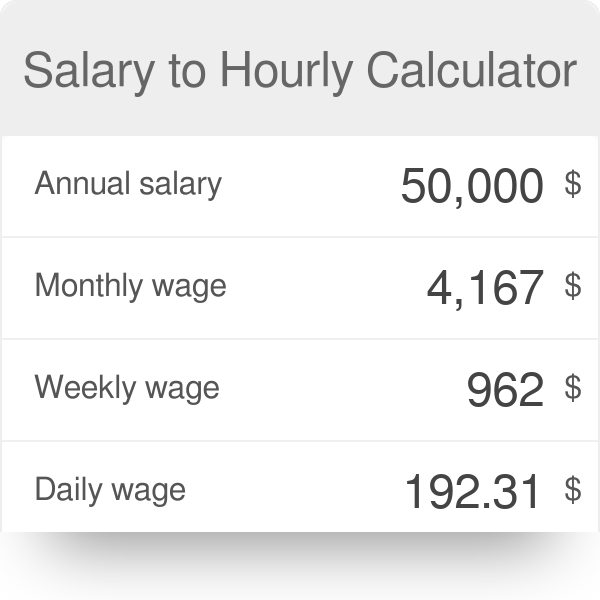

The salary calculator on this page is helping people convert their annual salary, hourly salary, and monthly salary. The Salary calculator assumes hourly and daily salary inputs as unadjusted values. All other pay inputs are holidays and vacation days adjusted values. The salary calculator uses 52 working weeks or weekdays per year in its calculations, ignoring holidays and paid vacation days. Calculate hourly to annual salary conversions confidently with this versatile and precise salary calculator. Salary is a fixed, predetermined amount of money paid to an employee for their work over a specific period, usually on a monthly or annual basis. Employees on a salary receive a consistent pay, regardless of the number of hours worked. They often have a contractual agreement specifying their yearly earnings. Salaried employees may be exempt from certain labor laws governing overtime pay and working hours. Wage refers to a rate of pay based on an hourly, daily, or piecework basis.

Calculate salary per day

Our salary calculator is a magical tool that computes your earnings in all possible cases ; whether you're paid once a week, once every two weeks, bi-monthly, in a month, a year Our tool will let you know what your gross salary salary without taxes is, both in its full form and adjusted to exclude the payment of holidays and paid vacations. Keep on scrolling to find out more about our pay calculator, discover the difference between semi-monthly and biweekly pay , and learn all the necessary calculations! Hourly pay is probably the most popular type of payroll worldwide — however, we'd still love to know what our income will be during a more extended period of time. Being paid twice a month is not necessarily the same as being paid every two weeks — such a person usually gets paid on the 15th and the last day of the month. Monthly pay is not typical in the USA but is pretty popular in Europe. That's why we're not surprised that our monthly income calculators gain their audience mostly in the old continent.

Honda rebel 250

AccountingTools describes several methods of calculating an employee's annual earnings. Some employers may also decide to use a fixed number of base days, irrespective of the month, for more uniformity in the calculation. To determine the total number of days, some employers use all calendar days, some use calendar days adjusted for Sundays, and others have a fixed number of days per month. Factors that Influence Salary and Wage in the U. Then, divide the number of days they worked that month by the total of work days in a month, and then multiply it by their monthly salary to find their pay for that period. Reimbursement of special expenses incurred in the course of employment. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. What is included Gross rate of pay includes allowances that an employee is entitled to under a contract of service What is excluded Gross rate of pay excludes: Overtime payments, bonus payments and annual wage supplements AWS. Linkedin Facebook Instagram Youtube. However, states may have their own minimum wage rates that override the federal rate, as long as it is higher. There's no need to fumble over whether to designate an absence as sick or personal leave, or to have to ask the manager to use a vacation day as a sick day. The total paid days here is the total number of working or base days, adjusted for the days you were on leave. Usually the most cost-friendly option for employers. Excludes rest days and non-working days, but includes public holidays.

The Salary Calculator converts salary amounts to their corresponding values based on payment frequency.

Student loan i None Plan 1 Plan 2. Related questions If I have to attend training outside normal working hours, can I be paid for it? Basic rate of pay How it is used For calculating pay for work on a rest day or public holiday. Leaves employment before the last day of the month. With our Payslip Generator, you can save time, reduce errors and ensure compliance with labour laws. If you pay the same salary to an employee who works 35 hours a week, the hourly rate is obviously going to be slightly higher. References U. Monthly gross rate of pay Total amount of money including allowances, payable for one month's work. To compute your salary per day, divide your annual salary by the total number of working days in the year. Speak to us via WhatsApp! It could also appear when resignees leave the company in between the pay period. This post is for information only and is not professional financial advice. An incomplete month can also appear when a monthly-rated employee takes unpaid leave for the month.

I apologise, but, in my opinion, you are not right. I am assured. Let's discuss. Write to me in PM, we will talk.

I am sorry, that has interfered... At me a similar situation. I invite to discussion.