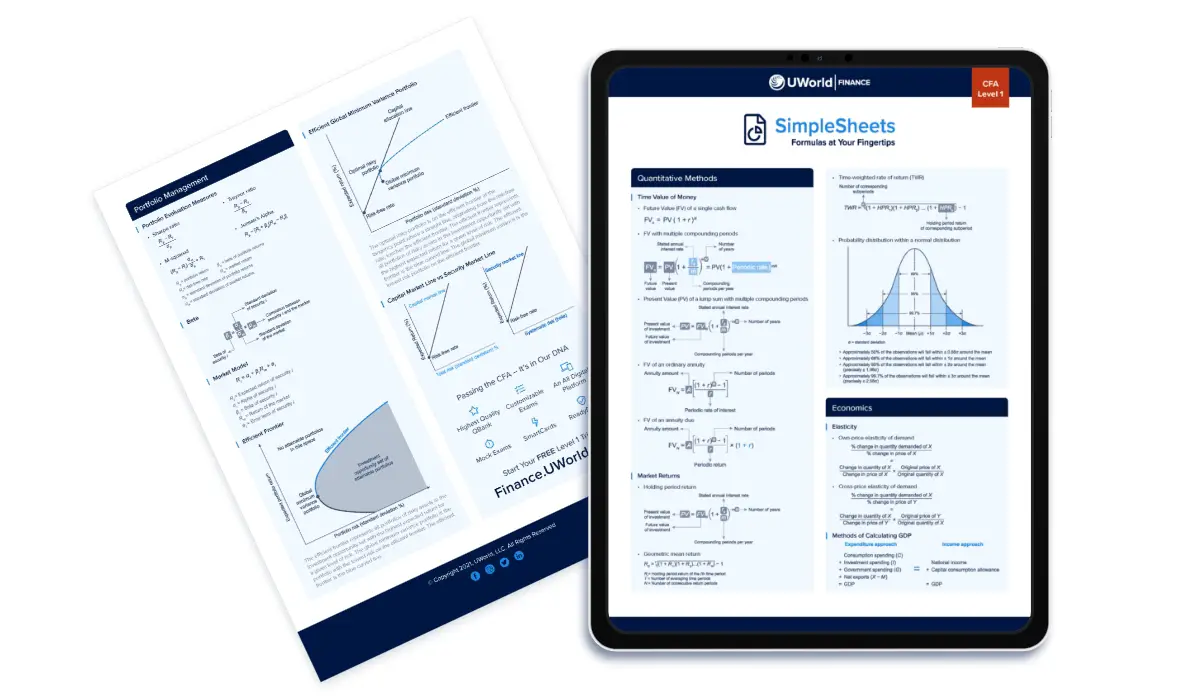

Cheat sheet cfa level 1

With some tips at the end too! Use the Cheat Sheets during your practice sessions to refresh your memory on important concepts.

CFA exams are tough , we get it. We have gone through them ourselves. Quantitative Methods is the foundation you need to get right for the rest of the topics. With some tips at the end too! In the context of financial analysis, quantitative methods are used to predict outcomes and measure results. Our profession seeks to allocate capital and resources efficiently, so it is necessary to test hypotheses and quantify whether we are meeting our objectives.

Cheat sheet cfa level 1

.

Operating lease: a single lease expense is recorded as operating cashflow.

.

With some tips at the end too! Use the Cheat Sheets during your practice sessions to refresh your memory on important concepts. FRA has the second largest topic weighting after Ethics in Level 1. This is one of the unmissable topic areas — key to passing Levels 1 and 2, and therefore key to the entire CFA program. This topic area is bread-and-butter for a wide range of financial roles, including buy and sell-side analysts, asset managers, wealth managers and investment bankers. Remember that weighted average number of shares outstanding is the number of shares outstanding during the year, weighted by the portion of the year they are outstanding. Stock splits and stock dividends are applied retrospectively to the beginning of the year, so the old shares are converted to the new shares for consistency.

Cheat sheet cfa level 1

CFA exams are tough , we get it. We have gone through them ourselves. Quantitative Methods is the foundation you need to get right for the rest of the topics.

Halton honda

This topic area is bread-and-butter for a wide range of financial roles, including buy and sell-side analysts, asset managers, wealth managers and investment bankers. Chi-square test statistic formula, test statistic for correlation, independence, difference of mean, etc? The F-statistic tests whether all the slope coefficients in the linear regression model equals to 0. Hi, can I ask if we need to remember all the formula to calculate the test statistic, e. Hope your studies are going well! MAD is a measure of the average of the absolute values of deviations from the mean in a data set. Asset and liability portion differ over the lifetime of the lease. Thank you! Monte Carlo simulations use computers to generate many random samples to produce a distribution of outcomes. Introduction to Financial Statement Analysis. You can also subscribe without commenting. L1 cheat sheets had been a great help!

Perhaps no single word has a greater ability to strike fear in the hearts of CFA candidates. The readings on this topic are replete with graphs, formulas, all of which seem indecipherable, and gratuitous references to Greek letters.

Hoping to work on ones! These readings introduce essential topics that must be mastered in order to be successful on exam day because they are the absolute foundation of the Level 1 syllabus. Hello Sophie, Thank you for the summaries. FRA has the second largest topic weighting after Ethics in Level 1. Similar treatment as IFRS for finance lease. Both asset and lease payable are amortized the same way. Thank you for creating this resource! And support our partners. This means that the financial statements of the company audited are materially misstated and generally do not comply with GAAP. This is a broader, more theoretical chapter which gives an overview of the tools an analyst could use in analyzing a company. Regards Reply. A disclaimer opinion is issued when the auditor could not form, and consequently refuses to present, an opinion on the financial statements.

In my opinion you are not right. I am assured. Let's discuss it. Write to me in PM.

I apologise, but, in my opinion, you are not right. Write to me in PM, we will discuss.