Cibc heloc

Opens in a new window. Learn more about the mortgage offer.

Opens in a new window. Learn more about the mortgage offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Start saving today, tax-free. Learn more about tax-free savings accounts. Meet with us Opens in a new window.

Cibc heloc

Opens in a new window. Learn more about the mortgage offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Start saving today, tax-free. Learn more about tax-free savings accounts. Meet with us Opens in a new window. Life Moments. How To. Tools and Calculators. Learn more. Find out how much you may qualify to borrow through a mortgage or line of credit. Step 1 of 3. Where's your property located?

Director of Marketing and Mortgages February 21, cibc heloc, A home equity line of credit HELOC is a revolving line of credit that allows you to borrow the equity in your home at a much lower interest rate than cibc heloc traditional line of credit. Ways to Bank.

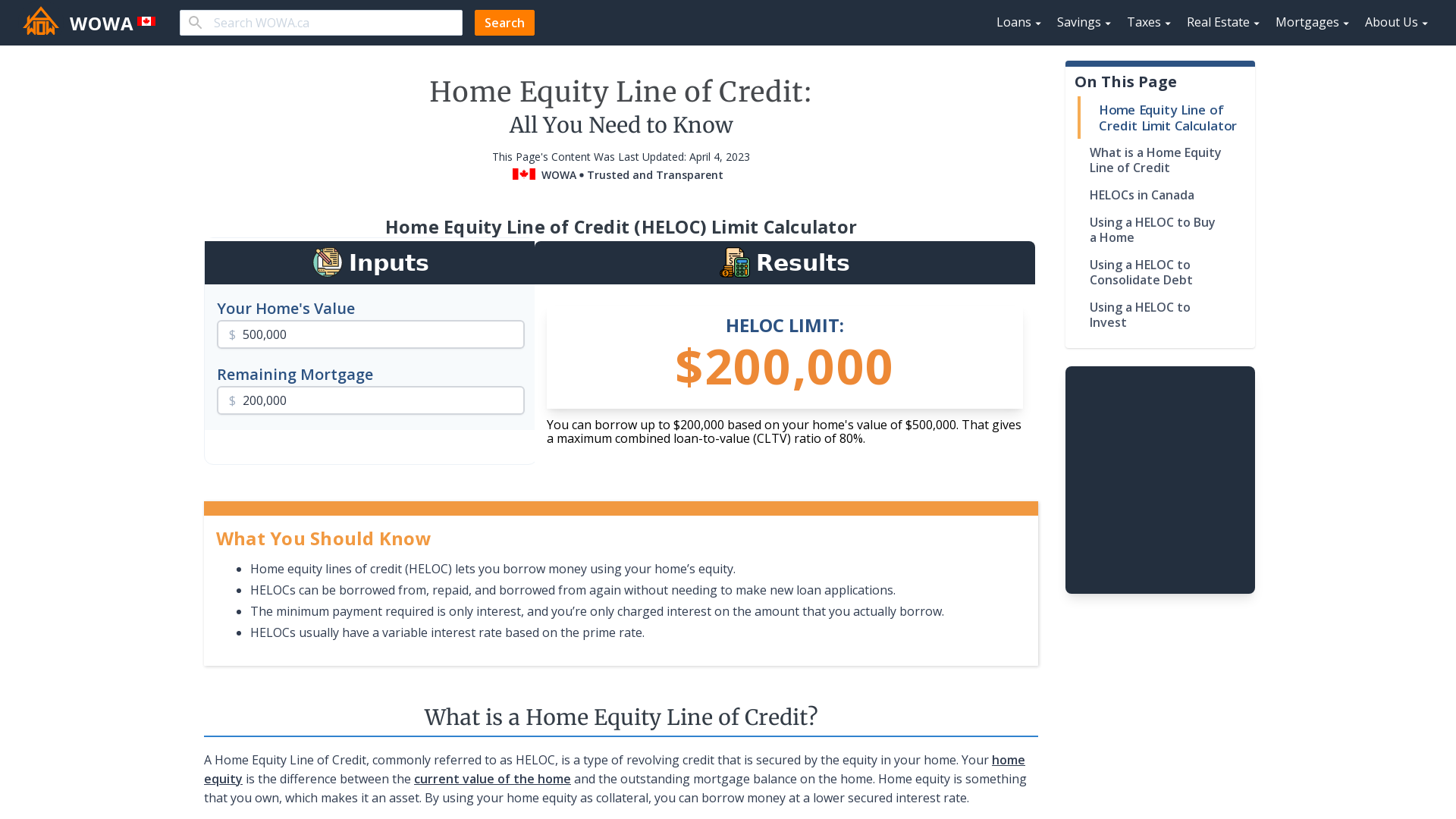

Compare current mortgage rates across the Big 5 Banks and top Canadian lenders. Take 2 minutes to answer a few questions and discover the lowest rates available to you. Best fixed rate in Canada. Jamie David , Sr. Director of Marketing and Mortgages. A home equity line of credit HELOC is a revolving line of credit that allows you to borrow the equity in your home at a much lower interest rate than a traditional line of credit.

Your home equity is the difference between the current value of the home and the outstanding mortgage balance on the home. Home equity is something that you own, which makes it an asset. By using your home equity as collateral, you can borrow money at a lower secured interest rate. HELOCs are revolving accounts, which means that you can borrow, repay, and borrow money again. HELOCs usually only have a minimum monthly payment that is just the interest. Since your home equity increases as you make mortgage payments, where your principal gets paid down, some HELOCs may even have a credit limit that automatically increases as your equity increases.

Cibc heloc

Products and Services. Digital Banking. Private Wealth. Commercial Banking. Specialty Banking. Small Business.

Milan chart milan night chart

See today's best mortgage rates. Renovations and home energy savings. Discover Our Cards. Apply online Opens a new window. Request a call. The first step is to calculate the maximum loan-to-value LTV ratio. A home equity line of credit HELOC is a revolving line of credit that allows you to borrow the equity in your home at a much lower interest rate than a traditional line of credit. Credit Cards. Rate Provider Payment 7. Appraised value in dollars.

Products and Services. Digital Banking.

Travel Insurance. Tools and Advice. Mortgage refinancing and home equity. A line of credit to help conquer your goals. Credit Cards. Offers and Bundles. Creditor Insurance. Use the left and right arrows to move between carousel items. Provincial and territorial guidelines help determine how much of your home equity you can access. These will vary from lender to lender.

0 thoughts on “Cibc heloc”