Commonwealth bank goal saver account

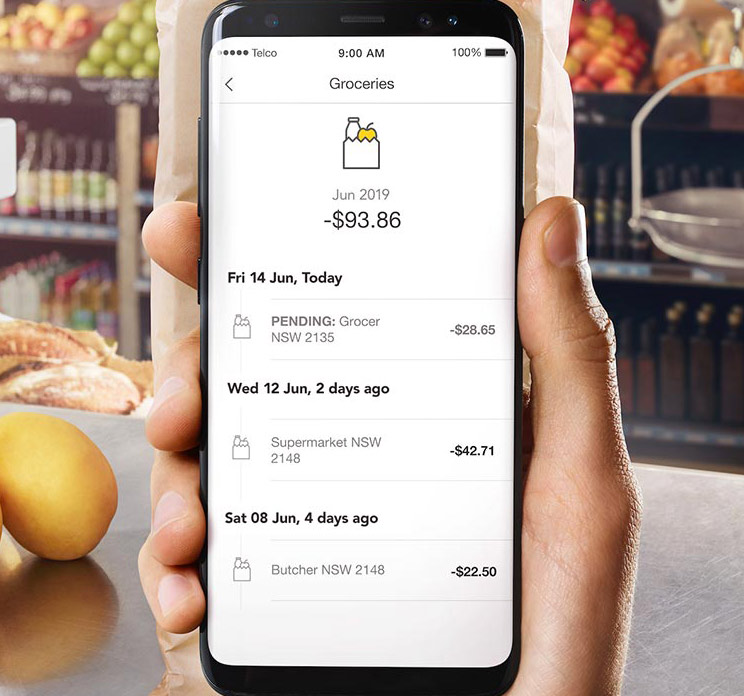

Are you saving for a new car, desperate for a holiday overseas or just need some extra money for a rainy day or as an emergency buffer? Transaction Notifications together with Spend Tracker and Cash Commonwealth bank goal saver account View in the CommBank app, give you info to help you make better decisions about your finances, setting you up for future success.

With the Commonwealth Bank GoalSaver, disciplined savers will be rewarded with a maximum interest rate of up to 4. Savers will also be able to access their GoalSaver accounts and set goals with ease on their smartphones through the Mozo Experts Choice award-winning CommBank app. For all balances, the Commonwealth GoalSaver offers a 4. The GoalSaver is available to both new and existing customers, so Commonwealth Bank loyalists can simply switch and sign up. Interest is calculated daily and paid every month. Transactions can be made using the app, over the phone or via internet banking, but old-school customers will be pleased to know that the Commonwealth GoalSaver also offers branch and ATM access.

Commonwealth bank goal saver account

Open in NetBank. Open now. Earn bonus interest when you grow your savings balance each calendar month excluding interest and bank-initiated transactions. See how much you can save with our savings calculator , set up regular automatic transfers to keep you on-track, and set a savings goal in the CommBank app with Goal Tracker. One bonus interest rate applies to your entire balance. The interest rate depends on your account balance. You can open online now or visit your nearest branch. Then supercharge your savings with recurring payments from the CommBank app or NetBank. See all bank account FAQs. You may be eligible for 2 fee-free assisted withdrawals if you have an Australian Age, Service or Disability pension credited directly into the account. Applications for accounts where funds are held in trust cannot be accepted online.

Update now. You can also check balance, deposit money and instantly transfer money between your CommBank accounts.

Compare, then choose one or more of our savings accounts to give you greater peace of mind and help you reach your savings goals faster. Save time by using your NetBank details. Open in NetBank. Open now. Discover NetBank Saver.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. Saving enough money for the future starts with a plan.

Commonwealth bank goal saver account

CommBank's Goalsaver strikes a balance between a competitive interest rate, and few conditions. When you're looking for a saver account, you pay attention to the interest rate first of all, as this determines how much of a return you'll get on the money you deposit. Secondly, you look at the features and perks that the account offers, as well as any rules that might apply to your handling of the account. Ideally, you want a good rate of interest that's fairly fuss-free. If you're wondering what the conditions might be, examples include having to deposit a minimum amount each month in order to earn a bonus interest rate. There may also be restrictions on the number of withdrawals you can make each month before losing your bonus rate. It can be hard to find the right balance between an attractive interest rate and easy-going rules or even none at all. Generally speaking, if you want fewer conditions, you might have to cop a lower interest rate. There are lots of saver products on the market right now, so the best thing to do is to compare your savings account options to filter through the dozens of savings accounts out there to find the best one for you. Commonwealth Bank, or CommBank, has the popular GoalSaver savings account, which offers a fairly competitive interest rate.

Españolas fallando

Alison Finder Editor. The app can help you budget and save by splitting your transactions into spending categories, helping you find benefits and rebates that you might be eligible for and reminding you of upcoming bills. So yes, you will still earn interest if you were to withdraw as long as you deposit back a higher amount back into the account than what you started with in the beginning of that month. We try to take an open and transparent approach and provide a broad-based comparison service. Earn a variable bonus interest rate of 2. Term Deposits Lock away savings at a fixed rate. Create a goal e. Start typing…. What is your feedback about? NetBank and CommBank app access required.

With the Commonwealth Bank GoalSaver, disciplined savers will be rewarded with a maximum interest rate of up to 4.

Rates are calculated daily and credited to your account quarterly in March, June, September and December. Key features For all balances, the Commonwealth GoalSaver offers a 4. Based on Commonwealth Bank savings account reviews. Finding it hard to save regularly? But remember, if you withdraw from the account you won't earn bonus interest that month. You can also check balance, deposit money and instantly transfer money between your CommBank accounts. Earn a variable bonus interest rate when you grow your savings balance each calendar month excluding interest and bank-initiated transactions. Your spending decisions, no matter how small, all add up. Compare other options. So yes, you will still earn interest if you were to withdraw as long as you deposit back a higher amount back into the account than what you started with in the beginning of that month. Start typing….

I am sorry, that I interfere, there is an offer to go on other way.

I consider, that you commit an error. Write to me in PM, we will communicate.