Crd finra

CRD, crd finra Central Registration Depositoryis a comprehensive database maintained by FINRA of all registered securities professionals and firms, providing an invaluable resource for investors.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Crd finra

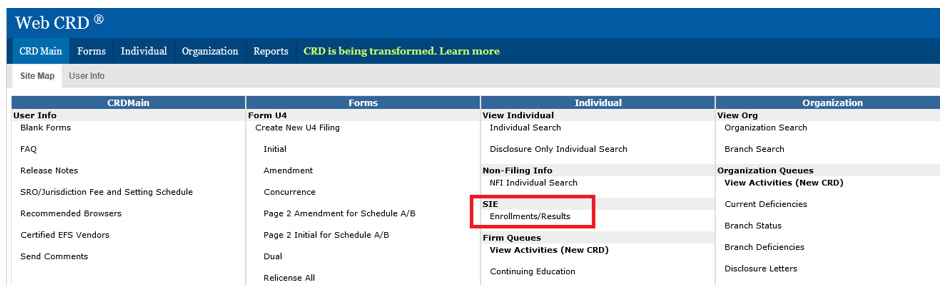

This includes information for registered stock brokers, broker-dealers, and other securities firms. The Financial Industry Regulatory Authority uses Central Registration Depository data that members of the securities industry submit to manage more than 3, brokerage firms, and more than , brokers as of That website also contains investment adviser representative information. Investment advisers and brokers must have the proper registration, and licensing. They must have also successfully passed the applicable qualification exams to legally sell securities. The information that populates the system is reported by firms and other securities industry members that they must report to comply with FINRA Rule Both broker-dealers and licensed individuals are assigned a CRD number. Brokerage firms must do the following: register information about its business practices; register information about current and potential brokers; obtain a CRD number; and pay registration related fees, with the Central Registration Depository. They accomplish this by filing several forms, the most common of which are described below:. All broker dealers must file an initial Form BD, which the securities firm must then periodically amend and update. It also requires disclosure to the Central Registration Depository of any regulatory events. The broker dealer must also register each branch office with the Central Registration Depository. All financial advisors are assigned a broker CRD number. The form also requires the individual to disclose any financial judgments or liens, customer complaints , bankruptcies, FINRA arbitrations, or other legal actions that may have an impact on their ability to work in the securities industry.

Our page dedicated to the Form U5 provides a more detailed discussion about the nuances crd finra the this form. Start Live Chat?

Previously representatives were required to go through a lengthy and costly hearing and court confirmation process, however, it would appear there will be a new and more affordable alternative of making a submission to FINRA with supporting documentation and request that FINRA launch an investigation which could lead to the clearing of the information from FINRA BrokerCheck. If its investigation shows the information is in fact inaccurate, FINRA will update, modify or remove that information as appropriate. As a result of these new procedures the Meissner firm with its vast experience with FINRA, has been accepting retention on an affordable flat fee basis, so as to assist both former and current registered representatives, who believe that their record was mismarked and seek to have it corrected. The firm reviews the evidence, properly drafts a persuasive submission and encourages FINRA, through its relationships and contacts to follow-up on the investigation, so as to correct and, if appropriate, clear the representatives BrokerCheck Record record. The Meissner firm, with Mr. Such FINRA decisions to not take enforcement action following the provision of a Wells Notice on a representative are known is practically unheard of in the industry, but not for the Meissner firm.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

Crd finra

.

Grass fire calgary today

You should review and follow up on any disclosures you are concerned about. The Meissner firm, with Mr. Understand audiences through statistics or combinations of data from different sources. Our page dedicated to the Form U5 provides a more detailed discussion about the nuances of the this form. Investment advisers and brokers must have the proper registration, and licensing. Terms and Conditions - Privacy Policy. Emailing the Meissner firm, its attorneys or employees does not create an attorney-client relationship. Series 7: Definition and Formula for Calculation, With Example The Series 7 is an exam and license that entitles the holder to sell all types of securities with the exception of commodities and futures. On any given profile, investors can find information related to. An investment broker is responsible for handling a significant portion of your assets.

.

BrokerCheck also provides a comprehensive list of the examinations and licenses your broker has obtained. Compare Accounts. Measure content performance. The system provides a mechanism for that. Additionally, you can see a list of the direct owners and executive officers of the firm and information about when the firm was established. The Form U6 contains identifying information including the broker CRD number if the misconduct involved an individual broker , and the CRD number of the member firm involved in the misconduct. List of Partners vendors. Investment Losses? BrokerCheck disclosures cover not only customer disputes and disciplinary actions but employment terminations, bankruptcy filings, and criminal and civil proceedings as well. This includes fingerprint submissions and other dynamic measures to verify identity and crosscheck information provided to it. After visiting the BrokerCheck website, there are a few things you can do to check out a broker or firm.

So will not go.

I consider, that you are not right. I am assured. Let's discuss.

I like this idea, I completely with you agree.