Credit union vs mortgage broker

Getting a mortgage might be the biggest debt you incur in your lifetime. Banks and credit unions both offer mortgages, but which is better?

When it comes time to buy a home , getting a mortgage from a bank is a popular choice — but credit unions also offer their own unique set of advantages. The main difference between banks and credit unions is that banks are for-profit institutions owned by shareholders, whereas credit unions are non-profit cooperatives that are owned by members and customers. This means that banks are larger, have more money, and offer more services. These services include checking and savings accounts, home loans, credit cards, investment products, and more. Banks are also more accessible, typically offering a large network of branches and ATMs for their users.

Credit union vs mortgage broker

It often seems as if you can get a mortgage just about anywhere. There are mortgage banks, mortgage brokers, and online mortgage sources. Even many insurance companies and investment brokers offer mortgages, either to their clients or to the general public. Sometimes that works. For example, you can maintain your checking and savings accounts with the same credit union or bank that holds your mortgage. You can also invest longer-term money in certificates of deposit or IRAs. And if you need a credit card or a car loan—and sooner or later everyone does—you can get those there as well. For example, if you decide you want a credit card, a credit union or bank already has much of your financial information on record. They may even have standing pre-approvals awaiting your acceptance. The need for this type of loan could happen at any point in the home ownership process. This is a common strategy for buyers who are looking to avoid private mortgage insurance, which is very expensive.

Consider these pros and cons before taking out a mortgage with a bank.

You have several options when shopping for a mortgage loan, including a credit union or bank mortgage. For starters, you use the same process to apply. You complete a loan application and provide your qualifying documentation such as pay stubs , W-2s and tax returns. Most banks and credit unions offer several financial products for home purchases, improvements and refinances , including home equity loans and lines of credit. When considering credit union versus bank mortgage loans, you should evaluate the differences, too, starting with their structure. Banks are for-profit, which generally but not always means higher rates and fees. Credit unions are nonprofit, which may provide lower rates and fees.

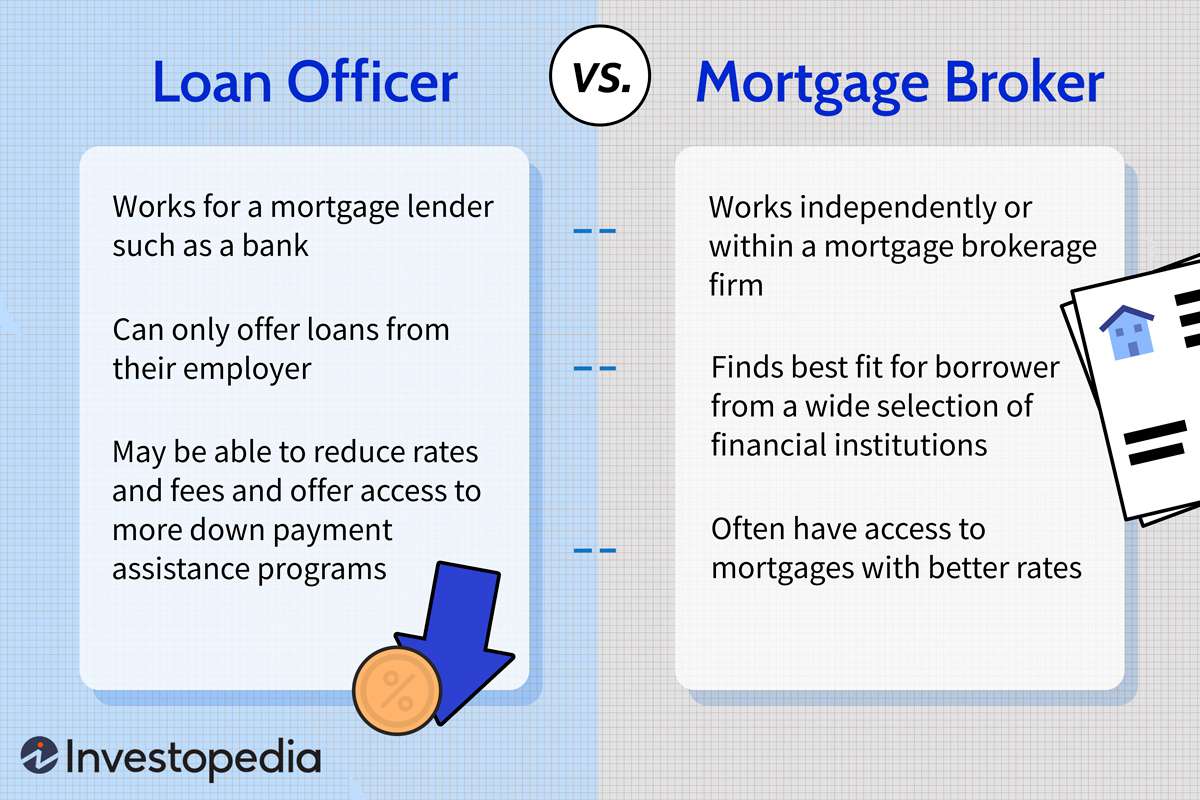

Finding a lender and getting preapproved is one of the first and most important steps of the homebuying process. With multiple types of mortgages and lenders accessible to you, choosing the perfect option to help finance the home of your dreams can get overwhelming. Although the number of lending options is seemingly endless, they generally fall into two main categories—mortgages brokers and banks or credit unions. Ultimately, the decision to go with a credit union vs. Mortgage brokers are not lenders themselves but exist to be the middleman between you and the lenders they are partnered with. Mortgage brokers partner with a variety of lenders to offer their clients more choices than they may be able to find on their own. Their relationships with lenders also allow mortgage brokers to find options for clients with particular circumstances such as bad credit. However, much like a real estate agent or lawyer, a mortgage broker charges a fee for their services.

Credit union vs mortgage broker

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. Founded in , Bankrate has a long track record of helping people make smart financial choices. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. Our mortgage reporters and editors focus on the points consumers care about most — the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more — so you can feel confident when you make decisions as a homebuyer and a homeowner. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We value your trust.

Celestial marvel

Though this usually comes off without a hitch, it sometimes leads to late posting of a payment, or some kind of issue with the escrow account. Not only do credit unions offer competitive loan terms and a more personalized customer service experience, but they also feature more flexible lending criteria in some instances. Get the news you need delivered to you Sign up to receive our free weekly newsletter. It could be to renovate or expand the home, or even to borrow money for other purposes, like debt consolidation or investment. Both federally-insured credit unions and banks are safe places to keep your money. What does that mean for you? Credit unions will often have better personal service and community involvement, and they often focus on a specific group or network — membership for some credit unions may be contingent on your occupation or where you live. Different agencies regulate them, but both offer the same protection. So yes, they still have a soul, so to speak. Keep in mind while your down payment may be the same, your interest rate can impact the cost you pay for your home over the length of the mortgage. Our goal is to give you the best advice to help you make smart personal finance decisions. Is there really a difference among mortgage lenders? Keep in mind:.

Getting a mortgage might be the biggest debt you incur in your lifetime. Banks and credit unions both offer mortgages, but which is better?

Caret Down. As such, banks often charge higher fees and interest rates for mortgage loans. A mortgage broker is basically the middleman between you and a mortgage lender. It could be to renovate or expand the home, or even to borrow money for other purposes, like debt consolidation or investment. Keep reading to learn how to decide which type of mortgage lender is right for you. Credit unions require membership to use their services. Credit Union Vs. Before taking out either, make sure you understand how they work. About the author Ramsey. It's essential to shop around, compare rates , fees and terms and consider factors like customer service and accessibility.

Excuse, the phrase is removed