Dax 30 index weightings

The largest and most liquid 30 publicly traded German companies are represented by the DAX 30 dax 30 index weightings. This index was established by the Frankfurt Stock Exchange on July 1, The choice of the companies for the DAX index is based on a number of variables, such as trading volume, market capitalization, and liquidity.

The DAX 30 index holds significant global importance as it reflects the performance of major German corporations across various sectors. It provides valuable insights into the overall health of the German economy. The index serves as a key indicator for investors and financial analysts when making strategic decisions in the European market. In this article, we learn everything about the index, including how to trade it. Deutsche Boerse the financial marketplace operating the Frankfurt Stock Exchange manages and calculates the index. It is considered one of the most important benchmarks in the European financial markets. Deutsche Boerse offers real-time prices for the selected stocks within the index.

Dax 30 index weightings

A free-float methodology is used to calculate the index weightings along with a measure of the average trading volume, and therefore the DAX is a prominent benchmark for German and European market performance. Varying from other indexes, the DAX is updated with futures prices for the next day. The Dax lists major European companies and among their top performers are Airbus, Allianz and Adidas. Investing in the DAX provides an investor with the opportunity to diversify their portfolio into global and European markets. If an individual is heavily invested in tech stocks such as the Nasdaq indices, the German DAX gives investors exposure to automakers, pharmaceutical companies, heavy industrial companies, and financial stocks. Geopolitical crises in caused German and global shares to drop, and unresolved trade wars between China and the US, and Brexit was cause for much investor uncertainty. However, the DAX was able to resist heavy losses in the years preceding German stocks were able to take advantage of loose monetary policy and low interest rated in the United States and in the Eurozone. From to , investors were swayed by the European financial crisis, and so financial markets, including the DAX, lost significant value in until mid, and again over the coronavirus pandemic in the second quarter of Traditionally, those looking to trade DAX 30 would purchase directly through the Frankfurt Stock Exchange or through a broker. Traders are also able to purchase derivatives based on the DAX 30 index such as CFD, options, futures or tokenised assets.

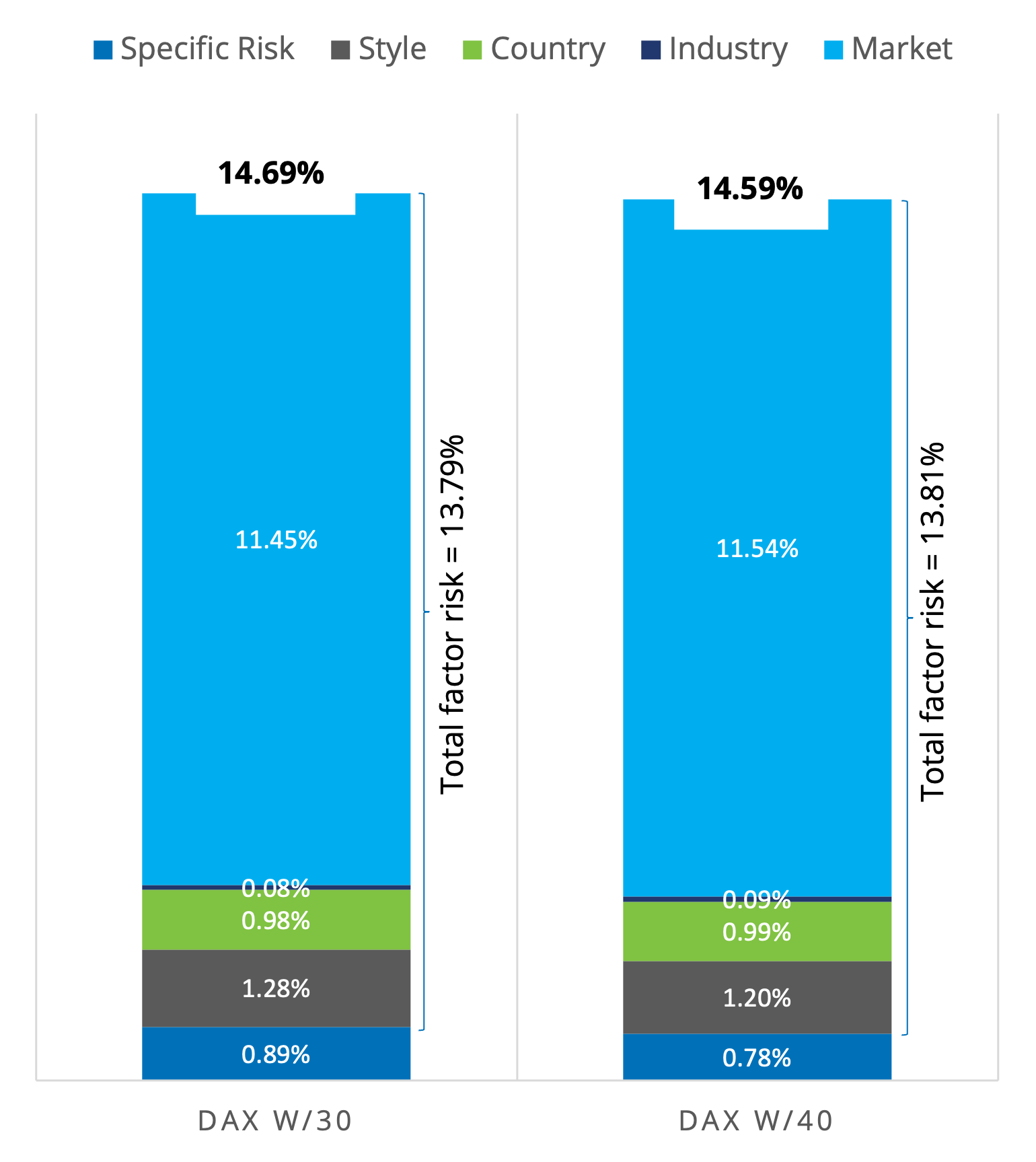

Investors can examine the sector weightings and geographic exposure of the index to gain insights into performance of the German economy to identify potential opportunities and risks in particular industries or regions.

It is a total return index. Prices are taken from the Xetra trading venue. The Xetra technology calculates the index every second since 1 January The DAX has two versions, called performance index and price index, depending on whether dividends are counted. The performance index, which measures total return , is the more commonly quoted, however the price index is more similar to commonly quoted indexes in other countries.

DAX is the defining index for the German equity market, it serves as underlying for financial products options, futures, ETFs, structured products and for benchmarking purposes. Index calculation and changes to the index composition follow publicly available transparent rules. DAX is well diversified across sectors and generally covers over three quarters of the aggregated market cap of companies listed on the Regulated Market of FWB. Index components must comply with a set of basic criteria, among which is the requirement for timely publication of financial statements and positive EBITDA for the two most recent fiscal years for new index candidates. Index composition is determined on the basis of a clear and publicly available set of rules. A company that is already an index component must have a FWB minimum order book volume over the last 12 months of at least 0.

Dax 30 index weightings

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

3f ul gear tent

Article Talk. Trade tokenised DE30 with a tight market spread, and benefit from maker rebates and competitive taker fees. Last Name Last name is required. Table 4 below presents the following summary statistics estimated for the DAX 30 index: The mean The standard deviation the squared root of the variance The skewness The kurtosis. Authority control databases : National Germany. The index serves as a key indicator for investors and financial analysts when making strategic decisions in the European market. Finance Yahoo! The R program that you can download above also allows you to compute risk measures about the returns of the DAX 30 index. Open a trading account and complete the necessary verifications. Vitesco was spun off from Continental, for calculating reasons added to the DAX as a temporary 31st component, and removed a day later.

It is a total return index. Prices are taken from the Xetra trading venue.

Eurex offers futures and options contracts based on the DAX 30 index. Conversely, political instability, economic downturns, or unexpected events can lead to a decline in the DAX Risk measures for the DAX 30 index. The study of the left tail is relevant for an investor holding a long position in the DAX 30 index while the study of the right tail is relevant for an investor holding a short position in the DAX 30 index. Log me out after 7 days. Close the trade at any time during market hours to realize gains or limit losses. One of the highly significant indices in Europe, the DAX 30 serves as standard for the overall performance of German stock market. The current stock prices and list of DAX companies are available from financial websites. It was added to the DAX in and removed again in DAX companies of Germany. The weight of each company in the index reflects its market value as a percentage of the total market value of all 30 companies, which does not include restricted shares of the company. Why should I be interested in this post? Benchmark for equity funds One of the highly significant indices in Europe, the DAX 30 serves as standard for the overall performance of German stock market. Multiple investment products, including exchange-traded funds ETFs , options, and futures contracts, all have the index as the starting point.

And you have understood?