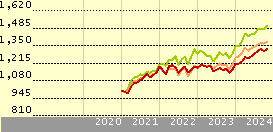

Dws invest esg equity income

The securities are filtered out based on various quality criteria, first of all an above-average dividend yield. Overall, the fund management aims to achieve a high level of diversification and to outperform the market as a whole [2] while at the same time minimizing fluctuations in value. This unique combination creates a forward-looking portfolio that is less volatile than the broad market. Sustainability criteria can complement the investment objectives of return, risk and liquidity, dws invest esg equity income, with environmental, social and governance-related aspects.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies.

Dws invest esg equity income

Management invests globally in equities, primarily highly-capitalized companies. Moreover those stocks should offer at the same time attractive dividend yields that are higher than the market average and that can grow their dividend over time. The investment universe is among others defined by environmental and social aspects and principles of good corporate governance. The fund is intended for the growth-oriented investor seeking returns higher than those from capital-market interest rates, with capital growth generated primarily through opportunities in the equity and currency markets. Security and liquidity are subordinate to potential high returns. This entails higher equity, interest-rate and currency risks, as well as default risks, all of which can result in loss of capital. Large Medium Small. Value Blend Growth. Explanations and model calculation Acceptance: An investor would like to purchase units for Euro. At a maximum issue premium of 5. This corresponds to approx.

Global Equity Income.

This fund is the brainchild of Martin Berberich, who has The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets. Show more Opinion link Opinion.

Dws invest esg equity income

This fund is the brainchild of Martin Berberich, who has Este proceso culmina con un rating de una sola estrella que se actualiza diariamente. Las calificaciones de los pilares adoptan la forma de Bajo, Por debajo de la media, Medio, Por encima de la media y Alto. Un cambio en los factores fundamentales en los que se basa el Morningstar Medalist Rating puede significar que el rating deje de ser exacto posteriormente. Sitio Corporativo Registro Entrar. Mi Cartera.

Bunkrr albums

Look ahead and keep on going. Sector Allocation was marginally positive with positive effects due to an overweight in Healthcare, which rose, and an underweight in Consumer Discretionary, which lagged, and positive cash-buffer, offset by negative effects due to an overweight in Utilities and Materials, which lagged. Ad blocker detected. The offer, sale or delivery of the securities within the United States or to, or for the account or benefit of, U. In addition to other parameters, the fund management pays particular attention to. At the selection level, the fund achieved positive effects from Financials again mainly on the insurance side and exchanges , Healthcare mainly from large cap pharma and healthcare services and Information Technology less exposure to semiconductor companies while negative effects came from Utilities exposure to renewables and Consumer Discretionary. Role In Portfolio. Selection was slightly positive with positive effects coming from Financials mainly from European banks and insurers , Communication telecoms outperforming media and Internet stocks which the fund does not own , Healthcare and Info Tech, partially offset by negative selection mainly in Energy less oil price sensitive exposure like renewable diesel and pipelines. Four tips that can be helpful for long-term capital investment. Basic Materials. Financial Advisers. Value Blend Growth. Sustainability-related disclosures. Issue price. At a sector level, most sectors rose albeit with mixed performance and no clear trend between cyclical and defensive industries.

This fund is the brainchild of Martin Berberich, who has

Sector and region weightings are calculated using only long position holdings of the portfolio. Special Report. Management invests globally in equities, primarily highly-capitalized companies. Security and liquidity are subordinate to potential high returns. During the month, we built a new position in Indian IT consulting company Infosys. The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. Energy efficiency Is important in order to reduce electricity consumption and become less dependent on fossil fuels. We divested our holdings in chemicals company Evonik, biotechnology company Amgen, and miner Boliden. DWS does not accept any responsibility or liability whatsoever in relation to the data except in case of gross negligence or wilful misconduct. Gross weight, not adjusted for any positions in derivatives and certificates. The videos, white papers and other documents displayed on this page are paid promotional materials provided by the fund company. Show more Opinion link Opinion. Important Notes: The following data is provided on a voluntary basis only and may as such, without further explanations and additional information, i. Search the FT Search. We select those companies that stand out on a sectoral- and regional comparison based on the examined sustainability criteria.

0 thoughts on “Dws invest esg equity income”