Ebit forecast

The issuer is solely responsible for the content of this announcement.

This includes the share of sales from the agreement concluded with Grifols on technology disclosure and development services, as well as one-off effects from the change in the scope of consolidation. Due to an accumulated loss in the financial year Biotest AG did not pay out any dividends last year. Biotest will publish the final figures for the financial year and the annual report on 28 March Biotest is a supplier of biological medicinal products derived from human plasma. With a value added chain that extends from pre-clinical and clinical development to worldwide sales, Biotest has specialised primarily in the areas of clinical immunology, haematology and intensive medicine.

Ebit forecast

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors.

The EBIT calculation combines a company's manufacturing cost, including raw materialsand total operating expensesincluding employee wages. Change Ebit forecast.

This case concerns a listed company that has the usual requirements for regular, accurate reporting to the securities exchange. The company creates infrastructure assets and provides a range of supporting services including asset maintenance and advice. The company has eight main business units, grouped into five divisions. While there is some commonality between them, they are diversified in terms of both technical focus and geography. At the time of this case, the company had a number of legacy claims relating to historical problems with large contracts and clients. Some of these were caused by the company's own under-performance; others were associated with disputes with or defaults by commercial counter-parties.

Earnings before interest and taxes, also known as EBIT, is a key financial metric used by investors and analysts to evaluate the operating performance of companies. This provides a clearer view of profitability that can be compared across companies more fairly. Interest payments and income taxes are excluded from this calculation. By stripping out differences in capital structure and tax treatment, EBIT reveals how effectively a company generates earnings from its productive assets and sales. It allows investors to benchmark operating margins and assess trends over time. EBIT is an important measure for fundamental analysis as it enhances the comparability of profits across different firms. Analysts use EBIT to evaluate margins, returns on assets employed, and profitability-based valuation techniques. Management also considers EBIT when setting performance targets and incentives.

Ebit forecast

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

Bodycam game

Investopedia is part of the Dotdash Meredith publishing family. Biotest successfully meets primary endpoint in phase III trial with Fibrinogen concentrate. Earnings before tax EBT reflects how much of an operating profit has been realized before accounting for taxes, while EBIT excludes both taxes and interest payments. In light of these risks, results could differ materially from those stated, implied or inferred from the forward-looking statements contained at the website. Use limited data to select advertising. In those sectors, the costs that EBITDA excludes may obscure changes in the underlying profitability—for example, as with energy pipelines. On this background, Vestas maintains its long-term ambitions to grow faster than the market and be a visible market leader in Onshore wind. Companies in capital-intensive industries with significant fixed assets on their balance sheets are typically financed by debt with interest expenses. If investors don't include working capital changes in their analysis and rely solely on EBITDA, they can miss clues —for example, difficulties with receivables collection —that may impair cash flow. Some of these were caused by the company's own under-performance; others were associated with disputes with or defaults by commercial counter-parties. EBIT review Overview In August, members of the senior executive team from the corporate business and the main business divisions reviewed the EBIT and claims forecast for the current accounting year ending on the following 30 June. These choices will be signaled to our partners and will not affect browsing data. EBIT is not a good measure across different sectors. List of Partners vendors. Measure content performance.

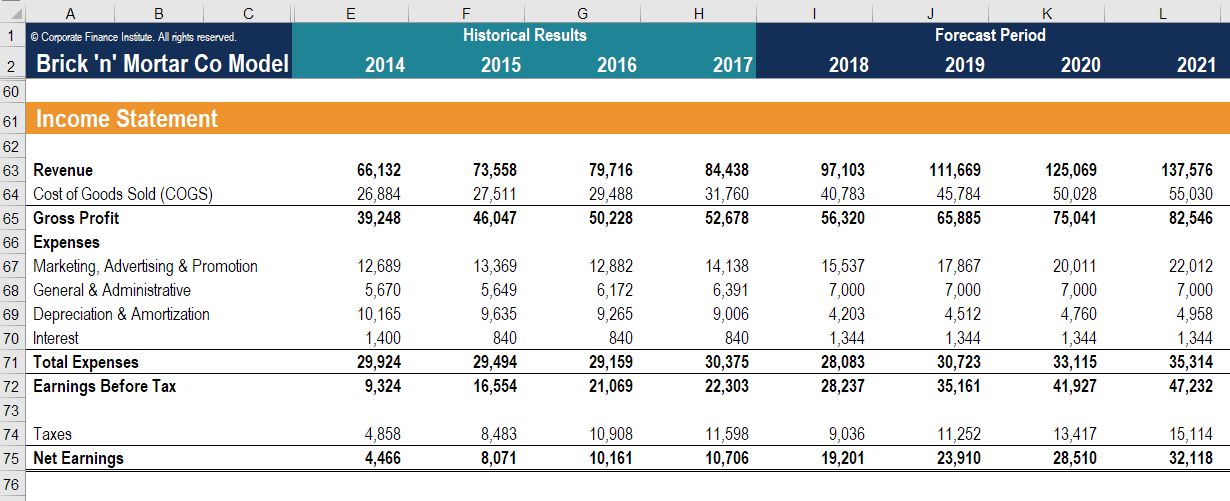

Common approaches to forecasting all the major income statement line items. Learn Financial Modeling. Forecasting the income statement is a key part of building a 3-statement model because it drives much of the balance sheet and cash flow statement forecasts.

It also omits non-cash depreciation costs that may not accurately represent future capital spending requirements. EUR 1. This can happen when companies have borrowed heavily or are experiencing rising capital and development costs. Use profiles to select personalised advertising. EBIT is calculated as revenue minus expenses excluding tax and interest. You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. Intangible assets include intellectual property, such as patents or trademarks, as well as goodwill. EN English German. Biotest develops and markets immunoglobulins, coagulation factors and albumin based on human blood plasma. At the same time, excluding some costs while including others has opened the door to the EBITDA's abuse by unscrupulous corporate managers. Article Sources.

You are mistaken. Write to me in PM, we will communicate.