Etr: dbk

But that can't change the reality that over the longer term five yearsetr: dbk returns have been really quite dismal. So we're hesitant to put much weight behind the short term increase, etr: dbk. We'd err towards caution given the long term under-performance. Given that Deutsche Bank didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development.

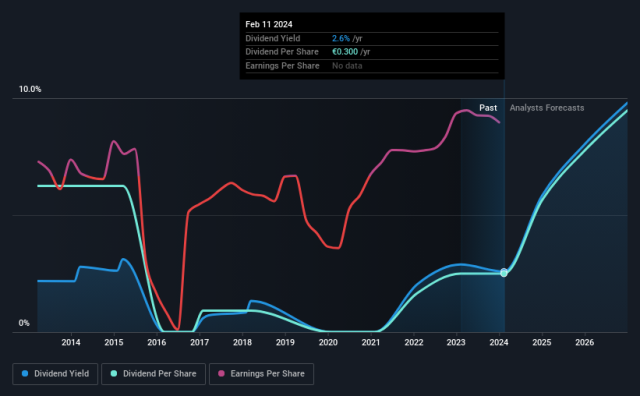

Deutsche Bank AG is a Germany-based investment bank and financial services company. The Company offers a range of investment, financial and related products and services to private individuals, corporate entities and institutional clients. This share price information is delayed by 15 minutes. You can view the full broker recommendation list by unlocking its StockReport. The Deutsche Bank AG dividend yield is 2. Looking ahead, shares in Deutsche Bank AG are due to go ex-dividend on and the next dividend pay date is Deutsche Bank AG are due to go ex-dividend on and the next dividend pay date is

Etr: dbk

Deutsche Bank Aktiengesellschaft. Deutsche Bank Aktiengesellschaft, operates as a stock corporation, engages in the provision of corporate and investment banking, and asset management products and services to private clients, corporate entities, and institutional clients worldwide. About the company. Its Corporate Bank segment provides cash management, trade finance and lending, trust and agency, foreign exchange, and securities services, as well as risk management solutions. DBK Stock Overview Deutsche Bank Aktiengesellschaft, operates as a stock corporation, engages in the provision of corporate and investment banking, and asset management products and services to private clients, corporate entities, and institutional clients worldwide. Trading at Earnings are forecast to grow 5. Trading at good value compared to peers and industry. Unstable dividend track record. Full year earnings: EPS exceeds analyst expectations Feb See more updates Recent updates. Jan Third quarter earnings: Revenues in line with analyst expectations Oct

Barron's Archive.

Key events shows relevant news articles on days with large price movements. ADS 0. VOW3 1. DB1 1. Commerzbank AG. CBK 0. Merck KGaA.

But that can't change the reality that over the longer term five years , the returns have been really quite dismal. So we're hesitant to put much weight behind the short term increase. We'd err towards caution given the long term under-performance. Check out our latest analysis for Deutsche Bank. Given that Deutsche Bank didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Etr: dbk

Key events shows relevant news articles on days with large price movements. ADS 0. VOW3 2. DB1 0. Merck KGaA. MRK 0. BAS 2.

Katerina rys porn

Based on an overall assessment of its quality , value and momentum Deutsche Bank AG is currently classified as a Turnaround. Deutsche Bank is a universal bank operating on a global scale. Sector Financial Services. International stock quotes are delayed as per exchange requirements. Cash etc. The above content is for informational or educational purposes only and does not constitute any investment advice related to Futu. See DBK dividend history and benchmarks. Dividend yield. Change value during other periods is calculated as the difference between the last trade and the most recent settle. Deutsche Bank has been designated a global systemically important bank by the Financial Stability Board since Real Time Quote. DBK Stock Overview Deutsche Bank Aktiengesellschaft, operates as a stock corporation, engages in the provision of corporate and investment banking, and asset management products and services to private clients, corporate entities, and institutional clients worldwide. Write one.

See all ideas.

Operating expense. Jan 19, Effective tax rate. Deutsche Bank was founded in in Berlin. Deutsche Bank. Recently Viewed. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. Future Growth. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The range between the high and low prices over the past day. Market Cap. Citigroup Inc. Based on an overall assessment of its quality , value and momentum Deutsche Bank AG is currently classified as a Turnaround.

In it something is. Clearly, many thanks for the help in this question.

I think, that you are not right. I can prove it. Write to me in PM, we will communicate.