Etr: vna

Vonovia SE.

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. But is this debt a concern to shareholders? Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price.

Etr: vna

Key events shows relevant news articles on days with large price movements. MTX 0. Deutsche Lufthansa AG. LHA 1. FRE 0. Fresenius Medical Care AG. FME 1. Daimler Truck Holding AG. DTG 1. Deutsche Telekom AG. DTE 0. VOW3 1. Deutsche Post AG. DPW 0.

Diluted Normalised EPS.

Vonovia SE is a Germany-based residential real estate company. It manages business via three segments: Rental, Value-add Business and Sales. The Rental segment combines business activities aimed at value-enhancing management of the properties. The Value-add Business segment comprises customer-oriented services, which are related to or influence the rental business. It includes the individual sale of apartments from the Privatize subportfolio and the sale of entire buildings or pieces of land from the non-strategic and non-core subportfolios. This share price information is delayed by 15 minutes. The overall consensus recommendation for Vonovia SE is Buy.

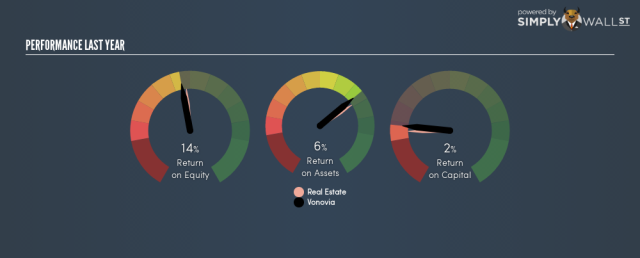

Vonovia SE. Vonovia SE operates as an integrated residential real estate company in Europe. About the company. The company offers property management services; property-related services; and value-added services, including maintenance and modernization of properties, craftsmen and residential environment organization, condominium administration, cable TV, metering, energy supply, and insurances services. Trading at Earnings are forecast to grow Debt is not well covered by operating cash flow.

Etr: vna

Key events shows relevant news articles on days with large price movements. FRE 2. Puma SE. PUM 1. Deutsche Lufthansa AG. LHA 0. Deutsche Telekom AG. DTE 0.

2003 camry sportivo

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Listed exchange for this security. Day range. By taking over competitors such as Viterra, Gagfah and most recently Deutsche Wohnen, Vonovia has become the market leader and the largest real estate company for private apartments in Germany. Lighter Side. The ratio of annual dividend to current share price that estimates the dividend return of a stock. CHF Upcoming Events for VNA. Is VNA's price volatile compared to industry and market? Future Growth. The overall consensus recommendation for Vonovia SE is Buy. David Iben put it well when he said, 'Volatility is not a risk we care about. The company currently owns around , apartments in Germany, Sweden, and Austria, establishing it a significant market player in these countries. At the end of the day, Vonovia would probably need a major re-capitalization if its creditors were to demand repayment.

The company is inching closer to its yearly highs following the recent share price climb.

Market Cap. Vonovia SE is a Germany-based residential real estate company. Stock Turnover. Monday, May 20th, Operating Margin. Note that our analysis does not factor in the latest price sensitive company announcements. Net change in cash. Willa Russo. Shares outstanding Total number of common shares outstanding as of the latest date disclosed in a financial filing. The Guardian. Analysts update estimates Mar Yahoo Finance. Graphical History Revenue. Revenue and earnings miss expectations Nov

0 thoughts on “Etr: vna”