Exchange traded funds wikipedia

An exchange-traded fund ETF is a type of investment fund that is also an exchange-traded producti. The list of assets that each ETF owns, exchange traded funds wikipedia, as well as their weightings, is posted on the website of the issuer daily, or quarterly in the case of active non-transparent ETFs.

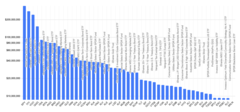

This is a table of notable American exchange-traded funds , or ETFs. As of , the number of exchange-traded funds worldwide was over 7,, [1] representing about 7. Sector ETFs may track sector-based indexes or simply correspond to a basket of companies thought to be representative of a specific market sector. This is often via commodity futures. These fall into four general categories, agricultural, which includes livestock and "softs"; energy resources; industrial materials; and precious metals. The most popular precious metals ETFs hold physical stocks of the metal rather than futures.

Exchange traded funds wikipedia

The exchange-traded funds available on exchanges vary from country to country. Many of the ETFs listed below are available exclusively on that nation's primary stock exchange and cannot be purchased on a foreign stock exchange. Contents move to sidebar hide. Article Talk. Read Edit View history. Tools Tools. Download as PDF Printable version. List of American exchange-traded funds List of Australian exchange-traded funds List of Canadian exchange-traded funds List of European exchange-traded funds List of Hong Kong exchange-traded funds List of Indian exchange-traded funds List of Indonesian exchange-traded funds List of Japanese exchange-traded funds List of New Zealand exchange-traded funds List of Singaporean exchange-traded funds List of South African exchange-traded funds List of South Korean exchange-traded funds List of Taiwan exchange-traded funds List of Turkish exchange-traded funds See also [ edit ] Exchange-traded fund Exchange-traded product List of hedge funds List of private-equity firms List of investment banks Boutique investment bank Fund of funds Boutique investment bank Open-end fund Sovereign wealth fund This article includes a list of lists. Categories : Lists of lists Exchange-traded funds. Hidden categories: Articles with short description Short description is different from Wikidata Long lists of lists.

All regulated investment companies are obliged to distribute portfolio gains to shareholders. MomentumShares [15].

Simplify retirement planning and take finding a mix of stocks and bonds off my to-do list. Seek dividend and interest payments from stocks and bonds or through covered call options strategies. Use a short-term investment strategy to pursue income while maintaining liquidity. Exploring funds by goal helps investors learn about iShares ETFs that may help them meet their financial goals. It filters more than US iShares ETFs to a smaller selection through the lens of broad investment goals by using criteria such as asset class, geography, and investment objectives. How iShares is driving progress for millions of people.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Exchange traded funds wikipedia

This is a table of notable American exchange-traded funds , or ETFs. As of , the number of exchange-traded funds worldwide was over 7,, [1] representing about 7. Sector ETFs may track sector-based indexes or simply correspond to a basket of companies thought to be representative of a specific market sector.

Naxi radio

According to theory, [ clarification needed ] a company should not be worth more when it is in an index. Both ETFs and mutual funds charge annual expense ratios that range from 0. The Seattle Times. Investors who think an index will decline purchase shares of the short ETF that tracks the index, and the shares increase or decrease in value inversely with the index, that is to say that if the value of the underlying index goes down, then the value of the short ETF shares goes up, and vice versa. The court's decision sets the path for a first bitcoin exchange-traded fund in the US. Such drift hurts portfolios that are built with diversification as a high priority. Diversification refers to the number of different securities in a fund. Before making an investment decision, you should carefully consider the risk factors and other information included in the prospectus. Modification of security holdings happens only periodically, when companies enter or leave the target index. This is in contrast with mutual funds, where all purchases or sales on a given day are executed at the same price at the end of the trading day. The examples and perspective in this section deal primarily with USA and do not represent a worldwide view of the subject. An ETF generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value , although deviations can occur. This product was short-lived after a lawsuit by the Chicago Mercantile Exchange was successful in stopping sales in the United States.

An exchange-traded fund ETF is a type of investment fund that is also an exchange-traded product , i. The list of assets that each ETF owns, as well as their weightings, is posted on the website of the issuer daily, or quarterly in the case of active non-transparent ETFs.

March 10, Article Talk. Seek dividend and interest payments from stocks and bonds or through covered call options strategies. Investors have a high rate of satisfaction with ETFs, especially for traditional asset classes. You may improve this article , discuss the issue on the talk page , or create a new article , as appropriate. They have raised concern due to lack of transparency in products and increasing complexity; conflicts of interest; and lack of regulatory compliance. Article Talk. This product was short-lived after a lawsuit by the Chicago Mercantile Exchange was successful in stopping sales in the United States. But due to supply and demand, a company being added can have a demand shock, and a company being deleted can have a supply shock, and this will change the price. The iShares line was launched in early Note that return refers to the ex-ante expectation; ex-post realisation of payoffs may make some stock-pickers appear successful. January 18, Germany Israel United States Latvia.

0 thoughts on “Exchange traded funds wikipedia”