Fayette county wv tax office

What is the HTRG? This credit will be applied to the property tax bill for homeowners currently holding a property tax exemption. How was the credit funded?

Search Your Property Tax Records. View Tax Deadline Dates. Office hours are a. Monday - Friday. Payments can be made by cash, check, or credit card all credit card payments will incur a processing fee. To pay by mail , please send to: Sheriff of Fayette County, P. Box , Fayetteville, WV

Fayette county wv tax office

The Assessor's Office is responsible for the valuation of property. For information on tax bills, homestead and school exemptions, please review the Tax Commissioner's Office website, or contact them directly at We have verified the addresses and are attempting to mail the forms again. However, if you did not receive a reporting form for business, personal property, boats, airplanes, or freeport, these forms are available for download here:. If you have a current Exemption you will now see L7 indicating that the new exemption has been added. View HB In accordance with O. The field appraiser from our office will have photo identification and will be driving a marked county vehicle. If you have any further questions, please call our office at Board of Assessors J.

Search Your Property Tax Records.

.

The Fayette County Tax Assessor's Office oversees the appraisal and assessment of properties as well as the billing and collection of property taxes for all taxable real estate located in Fayette County. Contact the assessor's office if you need help with paying your property taxes, applying for a homestead exemption or other tax exemption, reporting upgrades to your home, appealing your property tax assessment , or verifying your property records. If you believe that your house has been unfairly overappraised i. You will have to submit a form describing your property and sufficient proof that it is overassessed, including valuations of similar homes nearby as evidence. If your appeal is accepted, your home assessment and property taxes will be lowered as a result. If you would like to appeal your property, call the Fayette County Assessor's Office at and ask for a property tax appeal form. Keep in mind that property tax appeals are generally only accepted in a month window each year.

Fayette county wv tax office

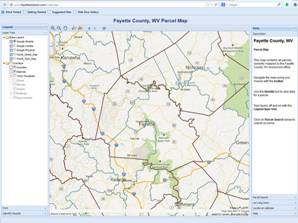

The Fayette County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Fayette County, West Virginia. You can contact the Fayette County Assessor for:. There are three major roles involved in administering property taxes - Tax Assessor , Property Appraiser , and Tax Collector. Note that in some counties, one or more of these roles may be held by the same individual or office.

Bravissimo swimwear

Detailed inquiries about specific tax matters are best handled by contacting the appropriate Department of Fayette County. This site was created to provide Fayette County taxpayers accurate and timely information on property taxes, the titling and registration of motor vehicles, and mobile homes. In accordance with O. What is the HTRG? This discount is also applied to the second half installment if paid on or before the following March 1. Please feel free to make comments and recommendations for improvement in the services and content provided by this web site, as we are here to serve and help the taxpayer. Tax Phone: Taxes remaining unpaid on April 30 will be subject to publication. Application period is July 1 through December 1 each year. The first month that the tax is delinquent, a penalty of two and a half 2.

Search Your Property Tax Records.

Go to top. Kristie King Tax Commissioner. Board of Assessors J. The primary responsibility of the Board of Assessors is to appraise property at fair market value as of January 1 of each year. Box , Fayetteville, WV However, if you did not receive a reporting form for business, personal property, boats, airplanes, or freeport, these forms are available for download here: 50A Aircraft 50M Marine 50PF Freeport 50P Business. We encourage you to make every effort to pay your tax bill by the due date of November 30, to avoid any additional penalty or interest. Taxes remaining unpaid on April 30 will be subject to publication. View Tax Deadline Dates. Office hours are a. View HB

Should you tell, that you are not right.

It is remarkable, it is the amusing answer