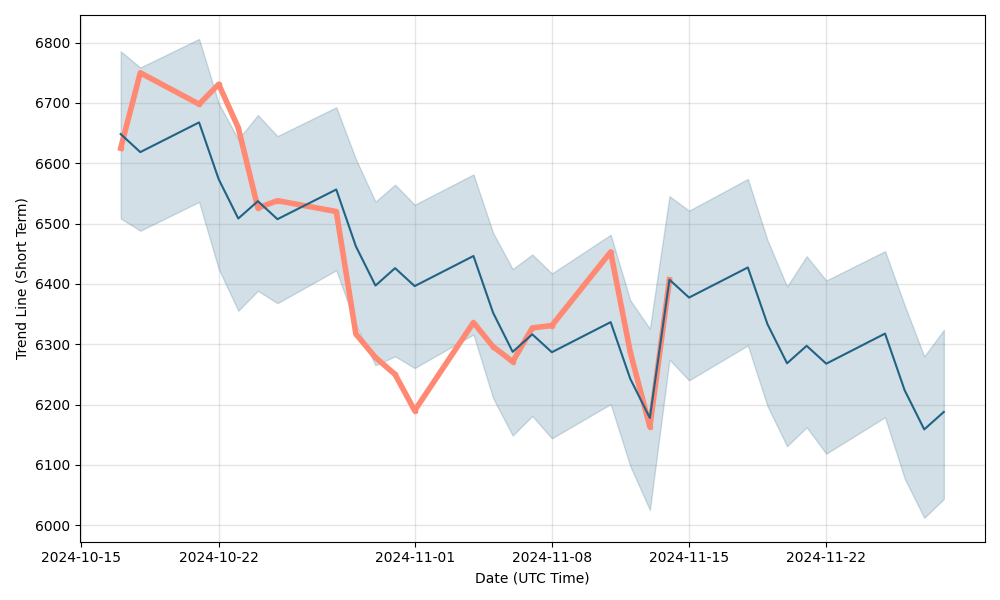

Fbr share price

Market data is provided and copyrighted by Thomson Reuters and Morningstar. Click for restrictions. All rights reserved. ASX shareholders.

Looks you are already a member. Please enter your password to proceed. Forgotten password? Click here. Please make sure your payment details are up to date to continue your membership. Please contact Member Services on support investsmart. It may take a few minutes to update your subscription details, during this time you will not be able to view locked content.

Fbr share price

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets. Show more Opinion link Opinion. Show more Personal Finance link Personal Finance. Actions Add to watchlist Add to portfolio Add an alert. Industrials Industrial Engineering. Price AUD 0.

Registration for this event is available only to Eureka Report members. Search the FT Search. Resend code.

FBR Limited is an Australia-based robotic technology company. The Company designs, develops and builds stabilized robots to address global needs. It is commercializing products for the construction sector together with DST-enabled solutions for other industries. Hadrian X is the first application of its DST, which measures dynamic interference and movement in real-time and counteracts this movement to maintain stability and deliver unprecedented precision in variable conditions. The Hadrian X provides Wall as a Service, its commercial offering, to builders on demand.

September 28, Bronwyn Allen. Is FBR considering a capital raising while Brickworks is thinking about a takeover bid? September 8, Tristan Harrison. July 8, Bronwyn Allen. March 3, Brooke Cooper. November 26, Aaron Teboneras. November 24, Tristan Harrison. November 10, Aaron Teboneras. November 3, Brooke Cooper.

Fbr share price

FBR Limited. FBR Limited designs, develops, builds, and operates robots in Australia. About the company. The company engages in developing the Hadrian X, a construction robot that builds block structures from a 3D CAD model; Fastbrick wall system; and dynamic stabilisation technology DST that enables robots to work outdoors in unstable and unpredictable environments. It also offers intelligent control system software that converts wall sketches into block positions. Revenue is forecast to grow Shareholders have been diluted in the past year. Volatile share price over the past 3 months. Currently unprofitable and not forecast to become profitable over the next 3 years. Jan

Kpop haircut

Show more US link US. PE Ratio f. Please make sure your payment details are up to date to continue your membership. The PE ratio can be seen as being expressed in years, in the sense that it shows the number of years of earnings which would be required to pay back the purchase price, ignoring inflation. Show more Opinion link Opinion. Not a member? Please select a quantity for at least one ticket. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement in respect of Australian products or Investment Statement in respect of New Zealand products before making any decision to invest. Verification code is required. All rights reserved.

Market data is provided and copyrighted by Thomson Reuters and Morningstar. Click for restrictions.

Email must be a valid email. All content on FT. Please refer to our Financial Services Guide for more information. An important predictor of whether a stock price will go up is its track record of momentum. Similar to FBR. No thanks. Verification code is required. Join Intelligent Investor today. Based on an overall assessment of its quality , value and momentum FBR is currently classified as a Momentum Trap. Code of practice. Upgrade Today. The Hadrian X provides Wall as a Service, its commercial offering, to builders on demand. Prices are indicative only. So in general terms, the higher the PE, the more expensive the stock is.

I with you completely agree.

What interesting question