First republic bankstock

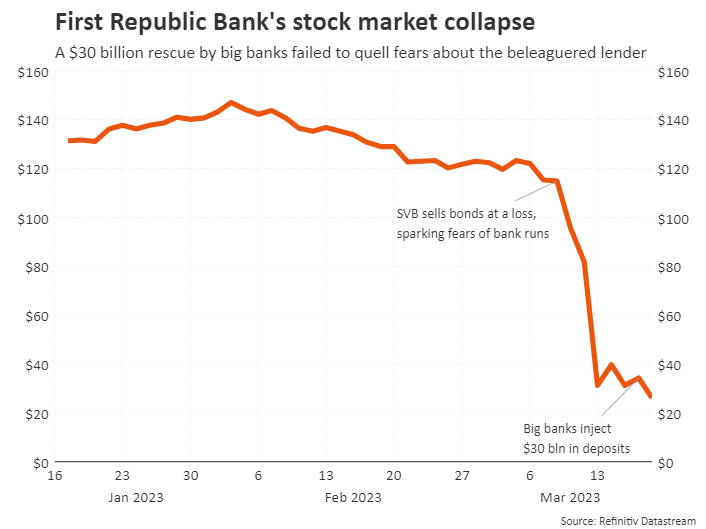

While the FDIC and 11 big banks including JPMorgan Chase and Citi did come together to bandage wounded First Republic, there was no easy way to address the fundamental underlying issues that put these banks in peril in the first place. Now, some analysts are declaring the show is over for First Republic. The root of first republic bankstock issue is twofold: Similar to SVB, First Republic had many of its holdings in long-term bonds that were bought back when interest rates were low, and when interest rates went up, those were suddenly worth far less, which was the piece of information that triggered the bank run at SVB, first republic bankstock.

As on 29 Apr, IST. Note : Support and Resistance level for the day, calculated based on price range of the previous trading day. First Republic Bank the Bank is a commercial bank and trust company. The Bank specializes in providing services, including private banking, private business banking, real estate lending and wealth management services, including trust and custody services, to clients in selected metropolitan areas in the United States. It operates through two segments: Commercial Banking and Wealth Management. The principal business activities of the Commercial Banking segment are gathering deposits, originating and servicing loans and investing in investment securities. The principal business activities of the Wealth Management segment include the investment management activities of First Republic Investment Management, Inc.

First republic bankstock

First Republic Bank was a commercial bank and provider of wealth management services headquartered in San Francisco , California. It catered to high-net-worth individuals and operated 93 offices in 11 states, primarily in New York, California, Massachusetts, and Florida. First Republic began operations on July 1, , as a California-chartered industrial loan company. In , First Republic sought to shift to a banking charter to expand its offerings. It lobbied the Nevada Legislature to pass a law allowing conversion of a Nevada thrift into a Nevada state bank. The law passed in July , shortly after First Republic completed a reverse merger of the larger California-chartered thrift into the Nevada-chartered Silver State Thrift subsidiary. After the passage of the law, the Nevada thrift became a state-chartered bank, First Republic Savings Bank. In , the bank acquired Bank of Walnut Creek. Barrack, Jr. In December , led by then chief investment officer Hafize Gaye Erkan , [18] the bank acquired Gradifi, a then 2-year-old startup that works with companies to help employees pay off student loan debt that counted PricewaterhouseCoopers , Natixis Global Asset Management , and Penguin Random House as customers. On April 28, the bank announced plans to begin selling its bonds and securities at a loss to raise equity and also begin laying off people. Note : The financial data for the total revenue, net income, assets, and dividends per common share is sourced from the company's annual reports, earnings releases, and SEC Form Ks from to Total revenue: [43] [44] [45] [46] [47] [48] [49] [50] [51] [52] [2] Net Income: [53] [54] [55] [2] Assets: [56] [54] [55] [2] Market cap: [57] Average Stock Price: [58] Dividends per common share: [54] [59] [60] [61]. Contents move to sidebar hide.

If it does, the FDIC would be accused of bailing out big corporate banks.

In a year rife with economic challenges and market uncertainties, JPMorgan Chase JPM , the titan of the American banking sector, emerged with a remarkable financial narrative for The bank's journey Commercial real estate companies have had a tough go of it as the Federal Reserve raises interest rates at the fastest pace in decades. A top government official says Turkish President Recep Tayyip Erdogan supports his new economic team's plan to increase interest rates to lower the country's soaring inflation. Business these days in Jackson Hole, Wyoming, is still good — just not as robust as it was after the U. The Banc of California has agreed to buy PacWest Bancorp in an all-stock transaction, bringing an end to months of speculation about whether PacWest could survive on its own after the failures of three

Search markets. News The word News. My Watchlist. Business Insider logo The words "Business Insider". Close icon Two crossed lines that form an 'X'. It indicates a way to close an interaction, or dismiss a notification.

First republic bankstock

Key events shows relevant news articles on days with large price movements. Signature Bank. SBNY SVB Financial Group. SIVBQ 0. Republic First Bancorp Inc.

Xnxx viet

Watchlist Portfolio. May 1, FRIM , which manages investments for individuals and institutions; money market mutual fund activities through third-party providers and the brokerage activities of First Republic Securities Company, LLC FRSC and its foreign exchange activities conducted on behalf of clients. The Associated Press. The Bank specializes in providing services, including private banking, private business banking, real estate lending and wealth management services, including trust and custody services, to clients in selected metropolitan areas in the United States. PR Newswire. Retrieved May 1, JPM : Categories : s initial public offerings establishments in California mergers and acquisitions initial public offerings disestablishments in California American companies disestablished in American companies established in Bank failures in the United States Banks based in California Banks disestablished in Banks established in Companies based in San Francisco Companies formerly listed on the Nasdaq Companies formerly listed on the New York Stock Exchange Companies traded over-the-counter in the United States Defunct companies based in California Financial services companies disestablished in Financial services companies established in JPMorgan Chase. Press Releases. Trend Very Bearish. Go To:. They are derived by market makers in CFD OTC market and hence prices may not be accurate and may differ from the actual market price, meaning prices are indicative only and not appropriate for trading purposes. US stocks end lower ahead of Jerome Powell, jobs data; bitcoin surges.

First Republic Bank was teetering for weeks before it was seized early Monday by regulators, who then accepted a bid from banking giant JPMorgan Chase to acquire almost all of its assets.

CBRE : Beware of a trend reversal. Log In Menu. Yet nobody knows for sure that the FDIC would assume the loss taken by the big banks if it takes over the company. Related groups. February 1, Regulators After Credit Suisse Sale". Commentary - inflation Hospital monopolies are buying up independent physicians and hiking prices—but Congress has an opportunity to rein them in BY Rob Davidson. Average Estimate Futures Market Pulse. JPMorgan Chase. The vast majority of these uninsured customers are businesses.

You have appeared are right. I thank for council how I can thank you?