Floyd county property records

The Assessors' Staff estimate fair market value to assure that the tax burden is distributed equitably and uniformly. Their primary goal is to ensure fair and objective appraisals. In accordance with O. A

The Floyd County Assessor may provide property information to the public "as is" without warranty of any kind, expressed or implied. Assessed values are subject to change by the assessor, Board of Review or State Equalization processes. Additionally, statutory exemptions may affect the taxable values. In no event will the assessor be liable to anyone for damages arising from the use of the property data. You assume responsibility for the selection of data to achieve your intended results, and for the installation and use of the results obtained from the property data.

Floyd county property records

This division records and processes real estate and non-real estate documents. The recording fees, transfer tax and intangible tax are collected at the time of filing the documents. You may bring documents into this office for recording or send them by mail to:. It is advisable to have an attorney when filing legal papers to insure that the rights of all parties are protected and that all procedures are correctly followed. Different situations may require special procedures and the Clerk's employees cannot advise you on how to proceed or what form may be necessary in specific situations. Real Estate Records Processing. This division is responsible for indexing real estate and other documents filed with the Clerk of Superior Court. After recording and processing the documents, the original documents are returned by mail. Requesting Copies. If you need to request a copy of the document through the mail, please send a letter indicating the type of document and the book and page number of the document. The mailing address for the Deed Room is:.

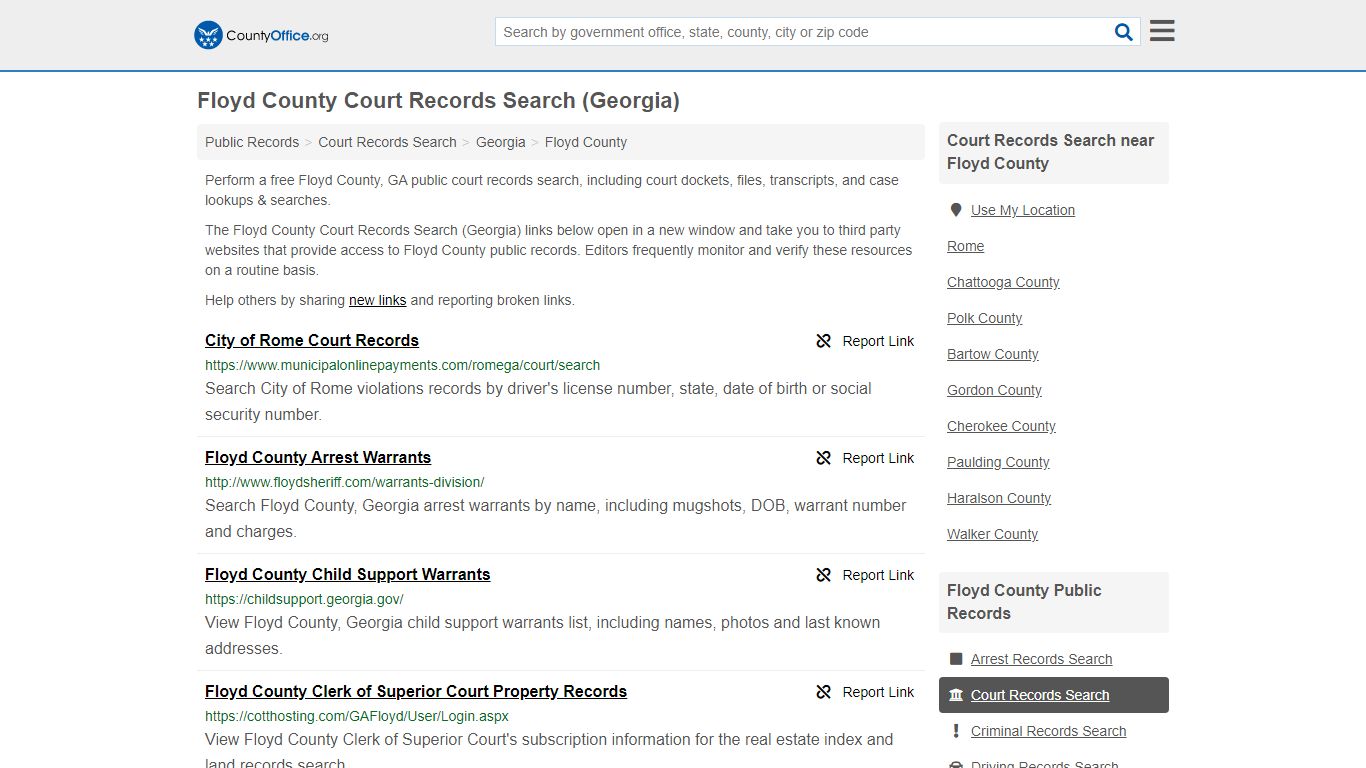

Can deed real estate records be accessed on the internet?

By using this website, user assumes all risks associated with such use of this site including any risk to your computer, software, or data that may be damaged by any virus, software, or any other file that might be transmitted or activated by way of any Floyd County, VA Web page or your access to it. Specifically, neither Floyd County, VA nor InteractiveGIS shall be liable for any direct, special, incidental, or consequential damages, including, without limitation, lost revenues, or lost profits, resulting from the use or misuse of the information contained in these web pages. The purpose of this web site is to provide general information. The completeness, timeliness and availability of data are not immediately updated and the accuracy of such content and data is not guaranteed. Information and linked sites have not been reviewed. Links and references to other sites are not endorsements. This web site uses "cookies" to help you personalize your online experience.

The Property Tax is part of a well balanced revenue system that is designed to spread the tax burden to all citizens who benefit from the Government. The Fair Market Value of Real Property means the amount a knowledgeable buyer would pay for the property and a willing seller would accept for the property at an arm's length, bona fide sale. Said property must be exposed for sale in the open market allowing a reasonable time to find a purchaser who buys with knowledge of all uses to which it is adapted and for which it is capable of being used. The Fair Market Value of Personal Property, Georgia Law states, "With respect to the valuation of equipment, machinery, fixtures and inventories, Fair Market Value may be determined by resorting to any reasonable, relevant and useful information including, but not limited to, the original cost of the property, any depreciation or obsolescence, and any increase in value by reason of inflation". Each Assessor shall have access to any public records of the taxpayer for the purpose of discovering such information. The Law further states, "In determining Fair Market Value of a going business where its continued operation is reasonably anticipated, the Assessors may value the equipment, machinery, fixtures and inventories which are the property of the business as a whole where appropriate to reflect the accurate Fair Market Value".

Floyd county property records

The Assessors' Staff estimate fair market value to assure that the tax burden is distributed equitably and uniformly. Their primary goal is to ensure fair and objective appraisals. In accordance with O. A Said property visit will be for the purpose of determining the accuracy of the information contained in the county's appraisal record for the property. Reasonable notice is hereby given that a representative of the county appraisal staff will review and physically inspect properties. The staff member should arrive in a clearly marked county vehicle and be prepared to provide identification upon request.

1.66m in feet and inches

The completeness, timeliness and availability of data are not immediately updated and the accuracy of such content and data is not guaranteed. Public Access Please agree to the terms before continuing. The Floyd County Board of Assessors mailed the property assessment notices to all property owners on record Friday, May 12, Said property visit will be for the purpose of determining the accuracy of the information contained in the county's appraisal record for the property. If you so choose to decline cookies, you may not be able to fully experience the interactive features of this web site. If you need to request a copy of the document through the mail, please send a letter indicating the type of document and the book and page number of the document. The staff member should arrive in a clearly marked county vehicle and be prepared to provide identification upon request. Lot Area Acres. If you own property in Floyd County and do not receive an assessment notice, please contact our office. The foreclosure properties that are sold in Floyd County are advertised in the legal notices sections of Rome News Tribune once a week for four 4 weeks prior to the sale of the property. Reasons for the site visit include, but are not limited to the following: Sale or purchase of property, new construction, active building permits, a return filed, an appeal filed, application for exemption filed, or, a three year review visit as recommended by the Department of Revenue Appraisal Procedure Manual Rule

The Board of Assessors does not create property values. The assessors and appraisers only monitor the markets and interpret what buyers and seller have established as the Market Value. The appraised value is simply an estimate of what the property is worth.

Parcel number PIN :. Links and references to other sites are not endorsements. Home Dashboard. Street Name:. Each year in accordance with O. The Georgia Code does not allow faxed copies for recording. Frequently Asked Questions. Assessor's Office. You may need to contact an attorney to determine which type of deed to file. If an appeal is not received by our office, or postmarked by the stated deadline, it will not be accepted as a valid appeal. How can I have the title to my property in Georgia searched, if I live in another state? Cookies cannot be used to run programs or deliver viruses to your computer. Sub Division:. Legal Description:. There are four methods to file an appeal and each is referenced on the notice.

0 thoughts on “Floyd county property records”