Form 15g fillable

Home For Business Enterprise. Real Estate. Human Resources.

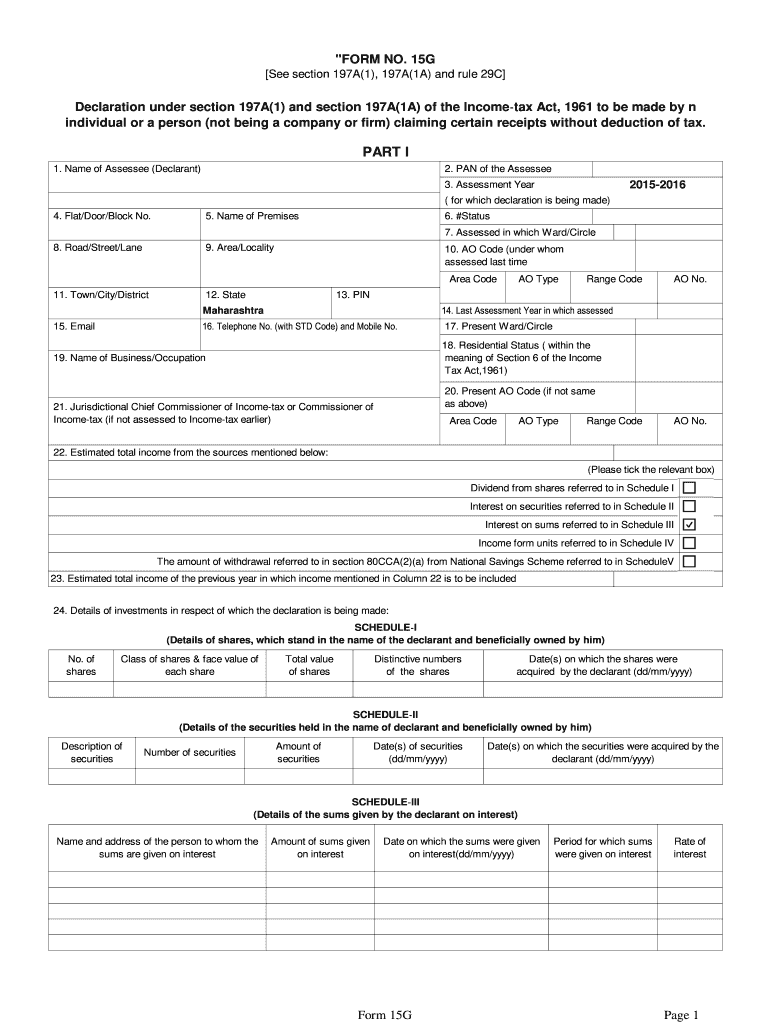

Didn't receive code? Resend OTP. PF Withdrawal Form 15g is a document that is used by the applicant who wants to withdraw his or her PF. When the PF claim amount exceeds Rs. Even though you are eligible, TDS would be unnecessarily deducted from your interest income or PF claim amount if you fail to submit Form 15G. This form can be downloaded and filled up from the link given below.

Form 15g fillable

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. The employer also contributes an equal amount. You can withdraw this PF balance as per the PF withdrawal rules. However, if the amount you withdraw is more than Rs. So, you will receive only the balance amount after the tax is deducted. However, you can make sure that there are no TDS deductions on your PF withdrawal amount by filling out Form 15G if your income is below the taxable limit. To learn more on this matter, please read on. For individuals aged 60 years and above have a different form- Form 15H. In this article we will explain Form 15G thoroughly. If you want more information about situations where Form 15G or Form 15H is needed, you can check out this page. Keeping these above conditions in view, these are the PF withdrawal rules that will be applicable:. Simply log in and search for PF Form 15G download, and you can download it to your computer or smartphone.

About Us.

.

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. What can you do to make sure the bank does not deduct TDS on interest if your total income is not taxable? Banks have to deduct TDS when your interest income is more than Rs. The bank aggregates the interest on deposits held in all its branches to calculate this limit. However, if your total income is below the taxable limit, you can submit Form 15G and 15H to the bank and request them not to deduct any TDS.

Form 15g fillable

Explore our wide range of software solutions. ITR filing software for Tax Experts. Bulk invoice in Tally or any ERP. G1-G9 filings made 3x faster. Ingest and process any amount of data any time of the month, smoothly. Built for scale, made by experts and secure by design. Bringing you maximum tax savings, unmatched speed and complete peace of mind. Experience 3x faster GST filings, 5x faster invoice reconciliation and 10x faster e-waybill generation. Individuals file their tax returns in under 3 min.

Screech thesaurus

Details of income for which the declaration is filed: In the last part you need to provide the following income details: Investment identification number Nature of Income Section under which tax is deductible Amount of Income After filling in all the fields, cross-check all the details to ensure there is no error. Resources READ. Resend OTP. Cement HSN Code. Convert to PDF. This portion of the site is for informational purposes only. Report Vulnerability Policy. This form can be downloaded and filled up from the link given below. Plastic HSN Code. In this article we will explain Form 15G thoroughly. PDF Reader. Ektha Surana Content Marketer.

Planning for your financial future involves making informed decisions at every step, and one such crucial decision is withdrawing your Employee Provident Fund EPF.

Desktop App. Forms Library. All rights reserved. GST Product Guides. Part 2: The person or organisation in charge of issuing the income must complete this part. Keeping these above conditions in view, these are the PF withdrawal rules that will be applicable:. Add image to PDF. Income Tax App android. Verify OTP Didn't receive code? Switch to pdfFiller. Opinion Notes. Salary Calculator.

It is a pity, that now I can not express - I am late for a meeting. But I will return - I will necessarily write that I think.

I consider, that you commit an error. I can prove it. Write to me in PM, we will discuss.