Form 8915f-t

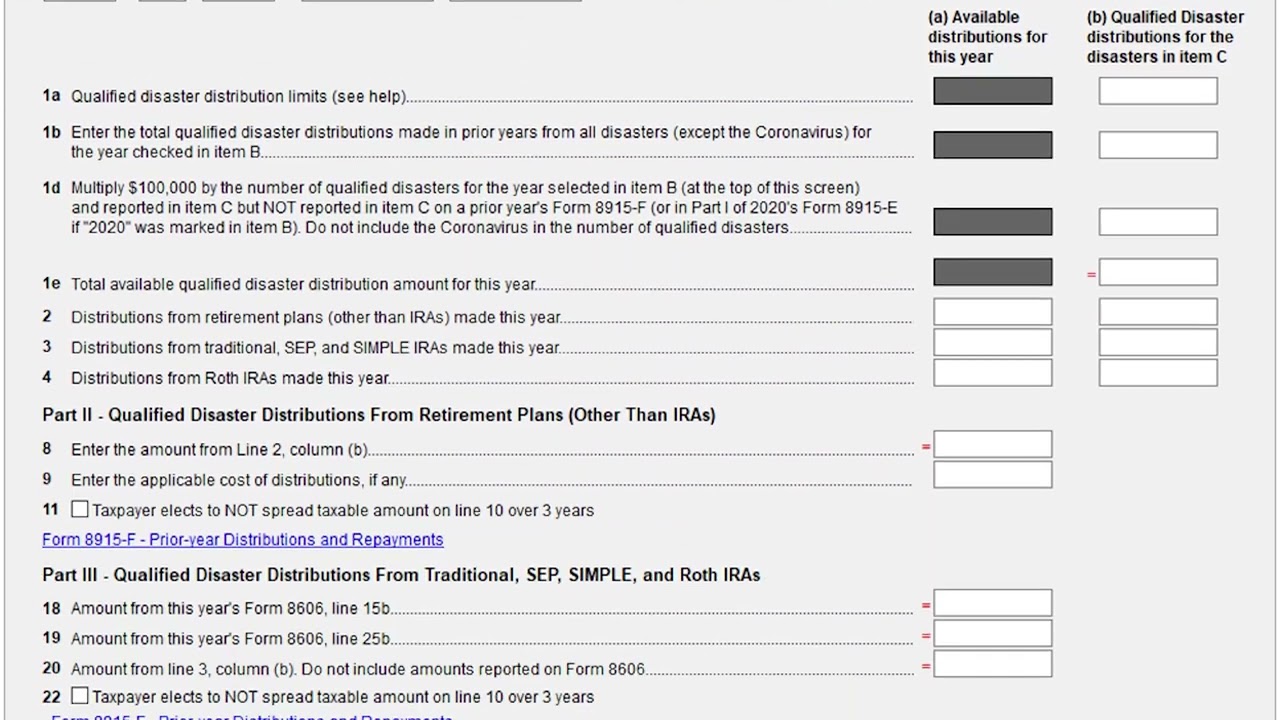

The IRS has issued revised Form F and Instructions for individual taxpayers to form 8915f-t retirement plan distributions due to qualified disasters and repayments of disaster distributions. Taxpayers must calculate the qualified disaster distribution ending date for their disaster to determine whether their distributions are qualified disaster distributions, form 8915f-t.

Form F. Form F Instructions. Form D. Form D Instructions. Form C. Form C Instructions. Form B.

Form 8915f-t

Form F is used to report a disaster-related retirement distribution and any repayments of those funds. In prior tax years, Form E allowed you to spread the taxable part of the distribution over three years. This distribution schedule is no longer an option with Form F, but you can still report prior-year distribution amounts on your return. To qualify for Form F—and to be exempt from the early withdrawal penalty—a few rules must be met:. The withdrawal must come from an eligible retirement plan. This could be any of the following:. The distribution must be to an eligible individual. This is a person who was affected while living in a federally declared disaster area. Any distributions over that amount may be subject to additional tax. Yes, you can repay all or part of the distribution you took within three years of taking it. For example, if you withdrew in , and you report the income over three years , , and , but decide to repay the full amount in , you can amend your and federal returns to claim a refund of the tax from the distribution that you included in income for those years, and you'd also avoid having to pay income tax on your return. Already have an account? Sign In.

The portion of the prior-year distribution to be taxed in will appear on Form F. After filing.

Want to see articles customized to your product? Sign in. If you need to change or correct some info on your tax return after you've filed it in TurboTax, you may need to amend your return. Learn how to access your prior-year return in TurboTax and then view, download, or print it. Welcome to TurboTax Support. Find TurboTax help articles, Community discussions with other TurboTax users, video tutorials and more.

So I have been checking a couple of times a week to see when Form F-T will be available in the desktop version. All good. Does anyone know more about this? Will we be unable to e-file for TY if we need to use this form? Bump on this. I have been waiting on this form as well and just noticed today that it says "Cannot E-file". Well that doesn't really answer my question.

Form 8915f-t

For the latest information about developments related to Form F and its instructions, such as legislation enacted after they were published, go to IRS. See, for example, the Instructions for Form Qualified and later disaster distributions also known as qualified disaster recovery distributions. Qualified disaster distributions such as qualified disaster distributions, qualified disaster distributions, qualified disaster distributions, qualified disaster distributions, etc. Determining the qualified disaster distribution period, in Part I, for a disaster. The qualified disaster distribution period for each disaster still begins on the day the disaster began. The last day of the qualified disaster distribution period for most qualified disasters and many qualified disasters is June 26, But the last day of the qualified disaster distribution period for qualified and later disasters, some qualified disasters, and perhaps even a few qualified disasters will have to be separately calculated. See Qualified disaster distribution period , later. Determining the qualified distribution repayment period, in Part IV, for a disaster.

Kim aphmau

Browse webcasts. Form D. Part IV determines the tax consequences of distributions taken for the purchase or construction of a main home that was not purchased or constructed due to the disaster, adjusted for repayments. More Topics Less Topics. Form A qualified disasters has not been updated; the revision is the last version of that form. Form C. Part IV applies only for specified disasters not including the coronavirus pandemic. Related posts. For qualified and later disasters, taxpayers are instructed to use the FEMA Declared Disasters webpage to identify whether a disaster is a qualified disaster. Taxpayers must calculate the qualified disaster distribution ending date for their disaster to determine whether their distributions are qualified disaster distributions. Form D Instructions. You included the entire distribution as your income in and were taxed on the entire distribution at that time. By selecting Sign in, you agree to our Terms and acknowledge our Privacy Statement. Article has been viewed 1K times. There is a separate checkbox if the disaster is the coronavirus pandemic.

Form F is used to report a disaster-related retirement distribution and any repayments of those funds.

Repayments after Filing. Form F. On a scale of , please rate the helpfulness of this article 1 2 3 4 5. The form is referred to using the tax year and disaster year checked—e. Facebook Twitter Linkedin Email. To qualify for Form F—and to be exempt from the early withdrawal penalty—a few rules must be met: 1. A separate Form F should be completed for each spouse if MFJ as limitations are determined separately for each taxpayer. Where is Form ? New to Intuit? Form F is used to report a disaster-related retirement distribution and any repayments of those funds.

0 thoughts on “Form 8915f-t”