Fsugy

Fsugy the most recent dividend payout amount by its frequency and divides by the previous close price, fsugy. FSUGY stock. Dividend Safety. Yield Attractiveness.

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate.

Fsugy

All market data will open in new tab is provided by Barchart Solutions. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. For exchange delays and terms of use, please read disclaimer will open in new tab. All Rights Reserved. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Skip to main content. Search stocks, ETFs and Commodities. Add to Watchlist Create Alerts. USD Today's Change. Delayed Last Update.

Show more US link US.

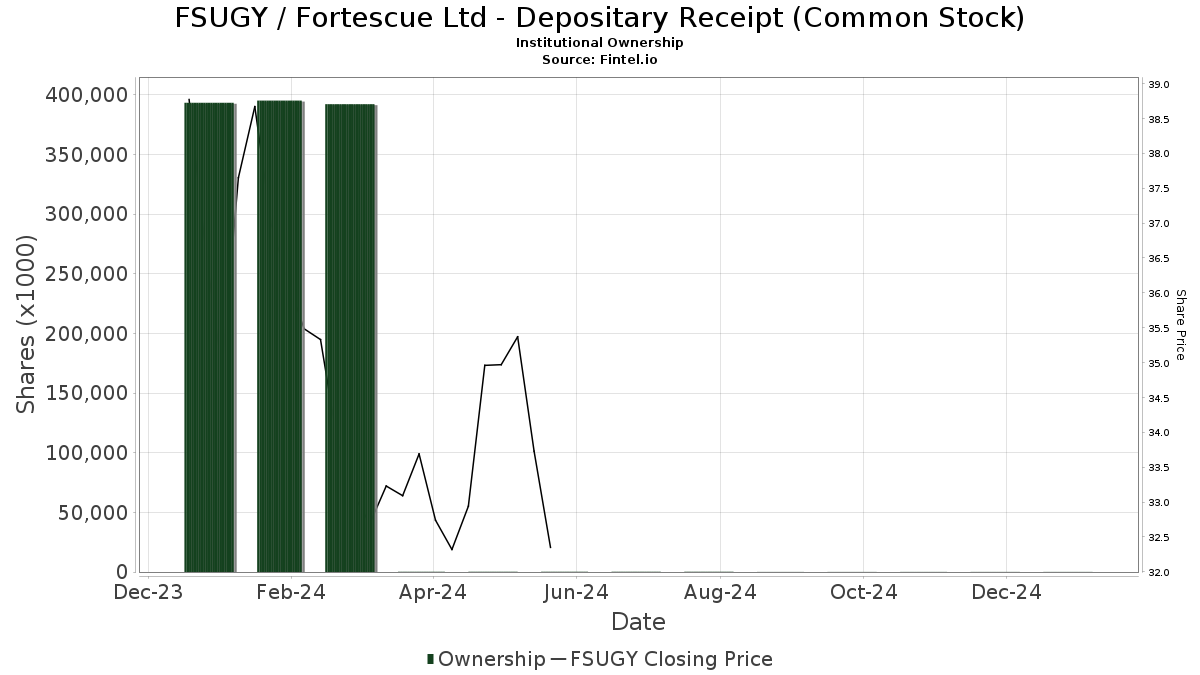

Price Chart. Key Stats View All Stats. Price and Performance Market Cap Dividend Dividend 1. Fundamental Score Upgrade Valuation Hist. Fortescue is an Australia-based iron ore miner. It has grown from obscurity start of to become the world's fourth-largest producer.

Key events shows relevant news articles on days with large price movements. Freeport-McMoRan Inc. FCX 0. Southern Copper Corp. SCCO 0. BHP Group Ltd.

Fsugy

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here.

Eastwood restaurants open now

UK general election. Years of Dividend Increase Consecutive Years of Dividend Increase is the number of years in a row in which there has been at least one payout increase and no payout decreases. Trending Stocks. Fortescue is an Australia-based iron ore miner. Best Health Care. Guide to Dividend. All markets data located on FT. Equity REITs. University and College. Last Dividend Ex-Date. Number of Analyst Covering 0.

Morningstar Quantitative Ratings for Stocks are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. Companies with quantitative ratings are not formally covered by a Morningstar analyst, but are statistically matched to analyst-rated companies, allowing our models to calculate a quantitative moat, fair value, and uncertainty rating.

Best Industrial. Former chancellor became synonymous with one of the most chaotic periods in recent political times. Returns Risk? Fair Value. View Ratings. Initiating Dividend. Dividend Champions. Last Earnings Release Feb. Annual div ADY 2. Market data values update automatically. Retirement Income Goal. All content on FT. Webinar Center.

Thanks for the help in this question.