Gold price prediction 2026

Gold price forecast is an analysis of the factors that affect the supply and demand of the precious metal, as well as the identification of patterns, fractals, and trends emerging in the market.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. The market may be charging higher today but the same cannot be said for ASX gold miners. This was driven by comments out of the US Federal Reserve, which, despite holding rates steady, suggested that the rate hike cycle might not be over. According to a recent note out of Goldman Sachs, its analysts are expecting the gold price to remain in or around current levels for the foreseeable future. This is likely to be good news for many ASX gold miners, which are printing money with the precious metal at current levels.

Gold price prediction 2026

Our outlook for gold prices in — is based on the possible outcomes of economic policies, geopolitical tensions, and currency dynamics. In this analysis, we delve into critical factors that will exert a profound influence on gold's price structure over the next three years. One of the more paramount influencers of gold prices is the Federal Reserve's monetary policy. The shift from quantitative tightening to quantitative easing, coupled with a series of anticipated rate cuts, sets the stage for a dynamic rally in gold. In , the Federal Reserve is expected to implement rate cuts ranging from 0. The impact of these cuts on gold prices is twofold. On one hand, lower interest rates make non-interest-bearing assets like gold more attractive. On the other, it could signal concerns about economic health, prompting investors to seek the safety of precious metals. Moving into , the projected interest rates of 3. As rates drop further to 2.

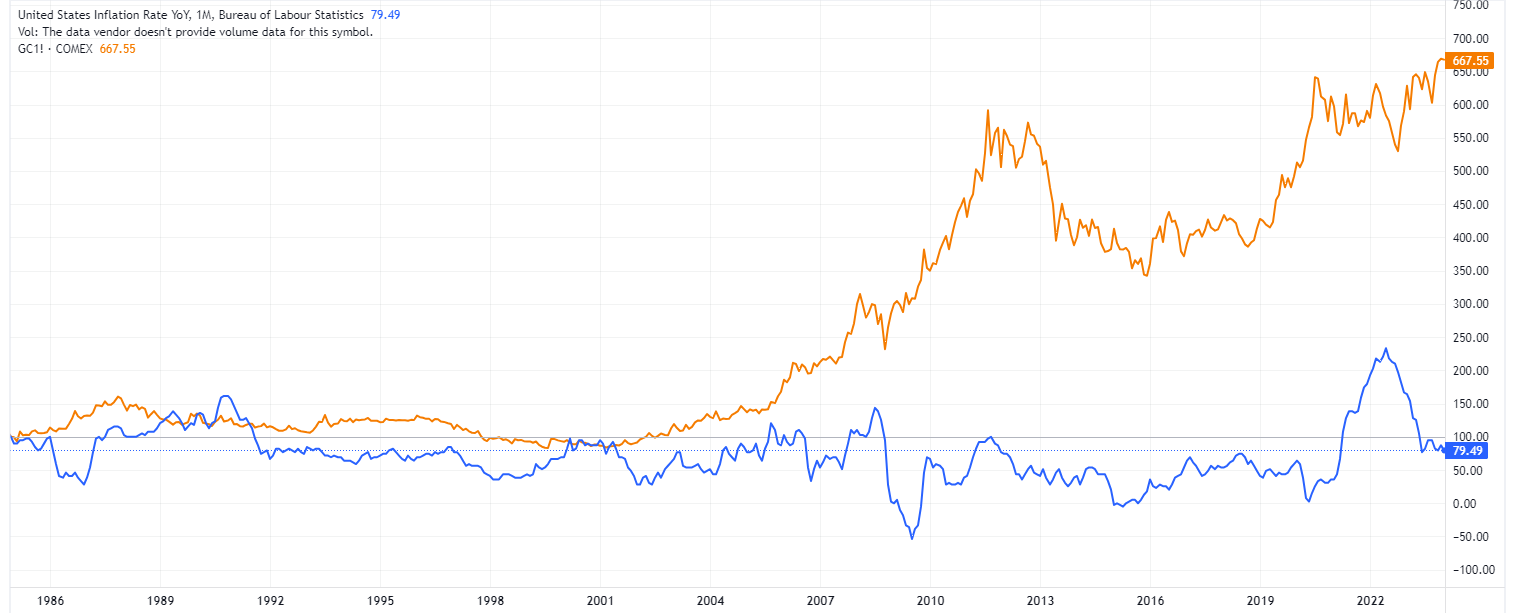

As the chart above suggests, the previous two unsuccessful attempts by buyers to consolidate the price in zone 1 caused a correction within zone 2.

Gold — is the oldest financial asset. Over the millennia, it has lost neither its popularity nor its purchasing power. The price of an ounce covers the same set of goods as before Christ. The price of gold is largely determined by the balance of supply and demand. But market expectations of a recession are making serious adjustments.

Our outlook for gold prices in — is based on the possible outcomes of economic policies, geopolitical tensions, and currency dynamics. In this analysis, we delve into critical factors that will exert a profound influence on gold's price structure over the next three years. One of the more paramount influencers of gold prices is the Federal Reserve's monetary policy. The shift from quantitative tightening to quantitative easing, coupled with a series of anticipated rate cuts, sets the stage for a dynamic rally in gold. In , the Federal Reserve is expected to implement rate cuts ranging from 0. The impact of these cuts on gold prices is twofold.

Gold price prediction 2026

Gold is an established and mature market for investable assets. Although it has been a significant commodity in the past, with major uses in electronics and jewellery, it is often considered a safe haven for investment due to several reasons. The fact that Gold works as a safe haven asset, one that often moves in anti-correlation to the traditional markets, means that the Commodity is a great hedge against financial troubles, but it is also an asset that has shown steady and solid growth in value for a long time. Gold is not an asset that is prone to big price swings, or high volatility, but it is known to almost constantly be growing as its uses and market desire keep growing. Forecasting Gold prices for the next decade can often lead to positive gains over this long period of time.

Urban grill in newtown ohio

But because of its negative correlation, when the dollar loses value — such as through inflation — then the gold price often goes up. But the main driver, which cannot be doubted, is the increase in money supply. Therefore, we should not expect a long and pronounced trend. It is important to remember that market sentiment can change very quickly. In these uncertain times, a diversified and informed approach to investment is paramount,. One possibility is to buy when the market dips. There are numerous attempts to consolidate in area 1, which indicates the potential for a bullish movement. Today, the Gold price is holding above support and could be ready for another phase of growth. At the end of July , change 3. Governments, investors, and industry experts closely monitor the supply dynamics of gold due to its scarcity, which has been a reason for its value for centuries. The probability of such an event happening is negligible.

Prepare for future growth with customized loan services, succession planning and capital for business equipment.

This communication may not be redistributed or retransmitted, in whole or in part, or in any form or manner, without the express written consent of J. Private Bank. The market may be charging higher today but the same cannot be said for ASX gold miners. When inflation is expected to rise or exceed nominal interest rates, and the stock market is expected to decline, investors may turn to gold as a store of value, driving up its price. Many analytical agencies see gold prices to be at the beginning of a long uptrend. Changes in the strength of the US dollar can impact the price of gold since it is priced in US dollars. At the end of December , change 6. Technical analysis based on margin zones methodology was provided by an independent analyst, Alex Rodionov. If they found Gold, they could get the government to make tradable coins out of it. At the moment, the quotations are under pressure. Forward Protocol.

0 thoughts on “Gold price prediction 2026”