Good brokerage firms

Stock brokers can help you build a solid investing foundation — functioning as a teacher, advisor and investment analyst — and serve as a lifelong portfolio co-pilot as your skills and good brokerage firms strategy mature. Stock brokers are people or firms licensed to buy and sell stocks and other securities via the stock market exchanges, good brokerage firms.

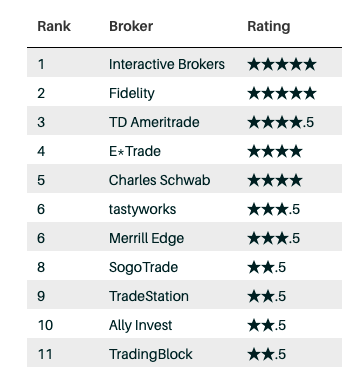

Most investors trade stocks and other investments through an online broker. To help you find the best brokerage accounts for you, we've evaluated brokerage firms and investment companies on the services that matter most to different types of stock traders. For active traders, we've included below online brokers with no commissions and robust mobile trading platforms and desktop trading capabilities. For people venturing into investing for the first time, we've included the best online brokers for educational resources including webinars, video tutorials and in-person seminars and on-call chat or phone support. On these measures, the brokerage firms below earned their place on our list of the best online brokers for stock trading. Read on to see our picks, alongside links to our investing team's in-depth reviews on each broker. As of Jan.

Good brokerage firms

There are dozens of stock brokerage houses in the United States. But four major firms stand out because of their name, offerings, their total amount of client assets, and the number of clients they serve. They are often referred to as the "big four brokerages. This short article analyzes the products, services, and fee structure of each brokerage. They are listed in no particular order. Charles Schwab was founded in and is based in San Francisco. It is one of the leading investment brokerages and IRA custodian firms in the U. As of Jan. It also operates Schwab Bank, one of the largest banks in the United States, which allows its brokerage clients to link their trading accounts with a checking account. The company boasted 1.

These brokers allow you to buy investments online through their website or trading platforms. Our Take. To learn more, see our About page.

Learn more about it. Choosing an online broker can be tricky, with dozens of options. To help you get started, here are our top picks for online brokers that can meet the needs of everyday investors. New customers earn 5. Terms apply. If you like Robinhood and want to take your investing to the next level, consider Robinhood Gold. Existing customers earn 5.

Most investors trade stocks and other investments through an online broker. To help you find the best brokerage accounts for you, we've evaluated brokerage firms and investment companies on the services that matter most to different types of stock traders. For active traders, we've included below online brokers with no commissions and robust mobile trading platforms and desktop trading capabilities. For people venturing into investing for the first time, we've included the best online brokers for educational resources including webinars, video tutorials and in-person seminars and on-call chat or phone support. On these measures, the brokerage firms below earned their place on our list of the best online brokers for stock trading. Read on to see our picks, alongside links to our investing team's in-depth reviews on each broker.

Good brokerage firms

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance.

Central de autobuses durango telefono

Royal, Ph. The type of account you choose will depend on your reasons for opening the account in the first place. The operating expense ratio OER fees for actively managed mutual funds can range from 0. Compare 0. Learn more on Interactive Brokers' website. No account minimum. Other factors — access to a range of investments or training tools — may be more valuable than saving a few bucks when you purchase shares. What Is a Brokerage Account? Related Terms. But four major firms stand out because of their name, offerings, their total amount of client assets, and the number of clients they serve. More resources for new investors. To come up with the list of firms consumers should consider this year, we considered the following factors:.

Use limited data to select advertising.

Public offers an unusual lineup of assets, including stocks, Treasuries, ETFs, crypto, art and collectibles, and music royalties—with more alternative assets coming soon alternative assets tend to have a low correlation to traditional markets, so you can potentially use them to diversify your portfolio. The firm is considered a top broker for beginning investors. TD Ameritrade is considered one of the top brokerage firms in the U. Most people will want to use an online broker to buy and sell stocks. Morgan Self-Directed Investing is a clear-cut investment platform that is great for beginners looking to learn how to buy and sell investments. Stock brokers are people or firms licensed to buy and sell stocks and other securities via the stock market exchanges. Brokers Stock Brokers. Understand audiences through statistics or combinations of data from different sources. Access to cryptocurrency. Before investing, it is important to understand the potential fee structure and the risk of loss. Learn more on Charles Schwab's website.

The authoritative message :), curiously...