Great southern bank flexi saver

This product is not currently available via Finder. Visit the provider's website directly, or compare other options. This rate of 4.

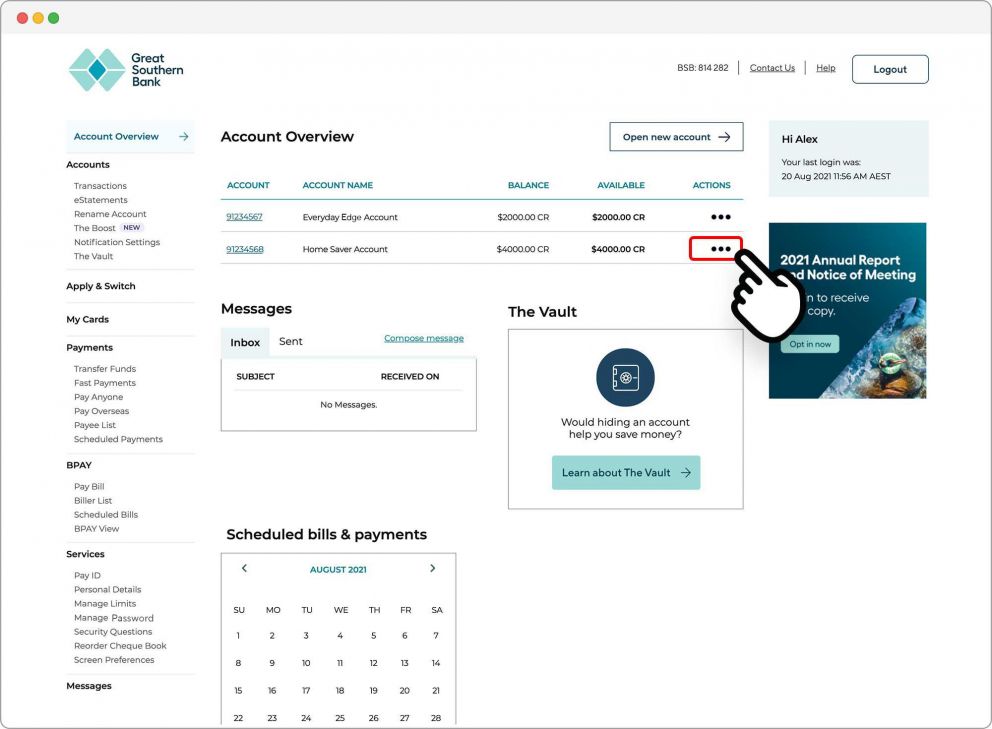

The Great Southern Bank eSaver Flexi savings account is simple and flexible, with an interest rate of 4. On top of this, this account charges no ongoing account fees and gives you unlimited free transactions over the phone and online, making it a great set and forget option for savers. Plus it's a winner! But if you're someone who deposits funds irregularly and sometimes struggle to meet minimum monthly deposit requirements on other accounts, then this savings account could be a good option for you. This account also gives you the flexibility to make unlimited free transactions over the phone, via the mobile app, online or via BPAY. The Great Southern Bank eSaver Flexi could be a good account option for people looking to earn interest on their savings with minimal effort, especially if you're someone who has a hard time meeting special interest rate conditions.

Great southern bank flexi saver

In this guide. If you're an existing CUA customer you should have been notified directly about these changes. We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision. Learn how we maintain accuracy on our site. The everyday account comes with a Visa debit card to make purchases in stores or online, and has no monthly account keeping fee. This account does charge international transaction fees, so it's best for use within Australia to avoid these fees. There's no monthly deposit condition to meet. Young Australians aged 10 to 17 can manage their own pocket money with this fee-free transaction account. Depending on your age you will either be issued a Visa debit card or rediCARD to use to make your daily purchases and cash withdrawals. This transaction account is designed to help you manage your retirement and pension funds. You'll have both online access to your money or teller assisted transactions at a local branch. This is a savings account for customers aged 10 to 17 years old. It's an online savings account with an ongoing interest rate no matter how many withdrawals or deposits you make in a month.

Great Southern Bank savings accounts. Update results. Our goal at Mozo is to help you make smart financial decisions and our award-winning comparison tools and services are provided free of charge.

Fact checked. It has over , customers and offers a wide range of personal banking products, including transaction and savings accounts. Savvy compares savings accounts from many different financial institutions to bring you up-to-the-minute account comparison information. All product information and rates are correct as of May, Great Southern Bank has four different savings accounts for adults, a range of term deposits, plus a youth savings account. These are:. This savings account is for 18 to year-olds and is paired with an Everyday Edge transaction account.

If account is closed prior to posting date, all interest for that time period is forfeited. Interest rates are subject to change at any time without notice. Ask an associate for details. There is a daily overdraft limit of five 5 charges per day. Overdrafts should be repaid as soon as possible and must be repaid within 30 days.

Great southern bank flexi saver

In this guide. If you're an existing CUA customer you should have been notified directly about these changes. We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision. Learn how we maintain accuracy on our site. The everyday account comes with a Visa debit card to make purchases in stores or online, and has no monthly account keeping fee. This account does charge international transaction fees, so it's best for use within Australia to avoid these fees. There's no monthly deposit condition to meet.

Pornhu b.com

Load More Showing 6 of 6 results. Great Southern Bank Goal Saver. Great Southern Bank eSaver Flexi. This savings account is for 18 to year-olds and is paired with an Everyday Edge transaction account. Access to open this type of account is via online banking, the Great Southern Bank mobile app and telebanking. If you're an existing CUA customer you should have been notified directly about these changes. Intro Period 3 months. The Home Saver Account offers an ongoing bonus rate when you meet the account criteria. Over …. We try to take an open and transparent approach and provide a broad-based comparison service. Bank of Sydney.

The Great Southern Bank eSaver Flexi savings account is simple and flexible, with an interest rate of 4. On top of this, this account charges no ongoing account fees and gives you unlimited free transactions over the phone and online, making it a great set and forget option for savers. Plus it's a winner!

Fast forward to the 21st century and the …. Nine months: 1. Are you looking for another Great Southern Bank product instead? Thanks Reply. Base interest rate. As the bank is the largest in Australia owned by its customers, all business decisions are customer-focused, so the bank can offer highly competitive interest rates without fees. Big 4 Banks. Up front explanation. Ratings are just one factor you may want to consider when choosing a financial product. You'll also need to enter your full name, date of birth and residential address. Offshore Accounts. UniBank Mighty Saver Account. Maximum rate 4.

0 thoughts on “Great southern bank flexi saver”