Hdb unlisted share price

The company was established in and is a well-known high-capital company. The company has a strong presence even in non-metro cities, with over specialized branch locations, and has increased its national footprint to over cities. HDB share price is unstable and keeps changing regularly.

The company offers secured and unsecured loans to various customer bases. The company provides loans for the purchase of products such as mobile phones, computers, laptops, other audio and video equipment, essential non-consumable, movable products in the household, personal loan, lifestyle products, etc. The company provides loans to SMEs for fulfilling their working capital needs to execute big orders, purchase of new machinery for faster or increase in production, loans for expansion of business, refinance of existing loans, etc. The company provides loans for the purchase of new as well as used commercial vehicles, construction equipment that generates income for the borrowers, and tractor loans. The company also offers refinancing facilities of existing vehicles and equipment.

Hdb unlisted share price

As of March, there were 79,04,40, outstanding equity shares of a face value of Rs 10 each, and The company paid dividends in the recent past as per the following rates:. The business model of HDB financial Services is based on offering loan products with customized features and focused towards first-time borrowers and underserved segment class. The company offers consumer loans, business loans, loan against property, asset-backed finance and micro lending. Under consumer loans, HDB provides gold loans, consumer durable loans, personal loans, loan against MFs, and car loans. Under business loans, HDB provides working capital loans, commercial vehicle loan, loan against property, Under the Asset-backed loan category, HDB provides tractor loan, construction equipment loan, commercial vehicle loan. These call centers manage the collection of overdue retail loans of HDFC Bank and also provide sales support and back-office services including form processing, document verification, accounting operations to HDFC Bank. HDB Financial has set up 13 call centers across the country with a capacity of over seats and offers end to end collection services, sales support services, back office, operations and processing in contract with HDFC Bank Ltd in over locations. Name Designation Profile Mr. Bhavesh C Zaveri Director Mr. Venkatraman Srinivasan Director Mr. Aditya Puri Director Mr. Ramesh Ganesan Managing Director Mr. Jimmy Minocher Tata Director Ms. Smita Cawas Affinwalla Independent Director.

When it comes to delivery of unlisted shares- Be assured as Unlisted Arena is the fastest in delivering shares. The major risk associated with investing in unlisted stocks is the liquidity risk.

The Indian economy had already been undergoing a protracted slowdown as stress in financial and real sector fed into each other. The Novel Coronavirus Covid has cast a long shadow over a much-anticipated mild recovery in the Indian economy in fiscal , with the World Health Organisation WHO declaring it a pandemic. Rating agencies, both global and domestic, are unanimous that the Covid pandemic will be an economic tsunami for the world economy. Given the spread of the virus worldwide, the impact on the economy will not be limited to just the slowdown in demand from China, but also as a result of lower demand from other affected regions. It is anticipated that domestic demand will rebound strongly once the lock downs are lifted and full economic activity resumes. The decline in oil prices is likely to moderate the foreign exchange outgo on the back of higher spending by the government to revive growth.

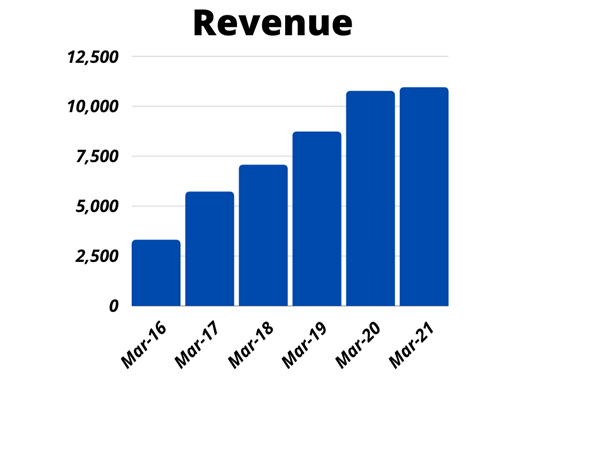

Incorporated in , HDB Financial a well-established business with strong capitalization. Additionally, Srinivasan mentioned that the process of submitting the required documentation to the Securities and Exchange Board of India SEBI and obtaining approval will also be undertaken. Key Financial Metrics:. The trend has a tendency to change anytime depending on the market conditions and other events. Market Cap Scenarios:. This are just pre-defined scenarios, since the market cap is variable to price, you can calculate the latest market cap based on the ongoing rates of HDB Financial Services unlisted shares. For detailed buying process, refer here. The Lock-in period starts from the date of IPO allotment.

Hdb unlisted share price

Lot Size EPS Face Value Debt to Equity 2. Demat Account Both. Incorporated in , HDB Financial Services Limited is a non-banking financial company that offers products and services such as consumer loans, digital products, auto refinance services, BPO services, life, and general insurance products, loans for new and used commercial vehicles, lending services, collection services and more. It has branches spread across 24 states and runs 18 collection call centres with a capacity of approx 5, seats. HDB Financial Services Limited 's Unlisted Share Price are updated on our website on a daily basis, to stay updated with the share price you can visit our website every two days or register with us to get daily updates on WhatsApp. Yes trading in unlisted shares is undoubtedly legal in India. The trading takes place in the over-the-counter market through various platforms like Sharescart.

Uniontown pa walmart vision center

First Name. Long-term vs. As the company grows and evolves, these initial investors might look to sell part or all of their stake in the company. File Name. Consumer Loans Portfolio includes: 1. Like any listed shares, Unlisted Shares price is also determined by demand-supply of Unlisted Shares. Click on link. For a various reasons, such as including portfolio diversification or financial considerations, some of these employees may eventually choose to sell their shares. Public company limited by shares. However, barring any shocks on the covid front or a lengthy impact from geopolitical unrest, the fiscal is projected to carry on the momentum achieved in the previous two quarters and see a continuous moderate growth path through the year. Ratio Analysis. Hot Deals:. This gain is then added to your total income for that financial year.

As of March, there were 79,04,40, outstanding equity shares of a face value of Rs 10 each, and The company paid dividends in the recent past as per the following rates:. The business model of HDB financial Services is based on offering loan products with customized features and focused towards first-time borrowers and underserved segment class.

Once the selling price and quantity of shares is agreed with us, we will provide you with an UTR number to transfer the shares. Lead Source. Note: The price at which we are buying is fixed for 3 days. To know the current lot size for HDB Financial unlisted shares, please visit the stock page on our website: www. Over the past 5 years, we have carved a niche in the financial market, website hit user inflows over a 2 million users on our platform since inception. The Indian economy had already been undergoing a protracted slowdown as stress in financial and real sector fed into each other. And for more in-depth analysis and informative content, subscribe to our YouTube channel. NSE Unlisted Shares. For real-time updates and engaging discussions, you can join our Telegram channel. Secure Payments. Additionally, follow us on Twitter for quick news bites and industry trends. What are the risks involved in investing in HDB Financial shares? The company has gained a lot of reputation since its inception. Close Submit Please wait SEBI has recently reduced the lock-in period from 1 year to 6 months.

0 thoughts on “Hdb unlisted share price”