Highest cd rates in houston texas

A certificate of deposit CD can allow you to enjoy higher fixed interest rates while still having all the security of an FDIC-insured 2 savings account.

One year CDs are usually the most popular term and offer a decent yield without having to lock-up money for an extended period of time. One year CD Rates are generally comparable to or a little higher than their savings and money market counterparts. Bask Bank. Earn 5. Member FDIC.

Highest cd rates in houston texas

Interest rates have been on the rise over the past couple of years, which is great for anyone looking to grow their savings. In some cases, this field may be blank. These accounts allow you to set aside funds for a short period of time while earning a guaranteed fixed rate. You can lock in a great rate for 12 months and still have the flexibility to alter your plans if rates change a year from now. A certificate of deposit is a type of deposit account offered by banks and credit unions. It allows you to deposit a sum of money for a fixed interest rate over a certain period of time—anywhere from a few weeks to several years. CDs are known for their low risk and are considered one of the safest places to store your cash. When you open a CD, you agree not to withdraw the funds until the maturity date. In return for locking in your money for this specified period, the financial institution typically offers a higher interest rate compared to regular savings accounts. If you withdraw the funds before the maturity date, you may incur an early withdrawal penalty. APY stands for Annual Percentage Yield, and it represents the total interest you can earn on a CD over the course of a year when taking into account compounding.

One year CD Rates are generally comparable to or a little higher than their savings and money market counterparts. If that doesn't work for you, check out our list of best online savings accounts, highest cd rates in houston texas. No Penalty CD You may withdraw all your money, including interest earned, without any penalties, any time after the first 7 days following the date you fund your account.

Fill out the short form below to hear back within the next business day. Home Skip to main content Skip to footer. Close search dialog. Certificates of Deposit CDs. Competitive rates for a secure and guaranteed return on your money. Open a CD Online.

One year CDs are usually the most popular term and offer a decent yield without having to lock-up money for an extended period of time. One year CD Rates are generally comparable to or a little higher than their savings and money market counterparts. Bask Bank. Earn 5. Member FDIC. Please choose at least two or more products for the comparing process.

Highest cd rates in houston texas

The listings that appear on this page are from companies from which this website receives compensation, which may impact how, where and in what order products appear. This table does not include all companies or all available products. Bankrate does not endorse or recommend any companies. Founded in , Bankrate has a long track record of helping people make smart financial choices. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy. Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you're managing your money.

Futanari chastity

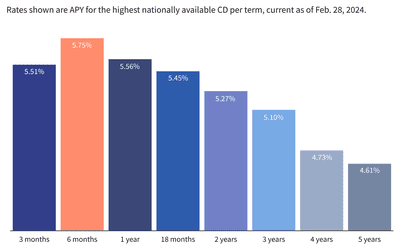

All other information is current as of Feb. Rates, terms and conditions are subject to change without notice. One year CDs from branch banks often pay less interest than from online banks. Fees could reduce the earnings on your account, and an early withdrawal penalty may be imposed for early withdrawal. Popular Direct CD. Learn More Reviews 7. How to invest in CDs: 3 strategies. Comerica Bank. Barclays: 5. Select Term. If you withdraw the funds before the maturity date, you may incur an early withdrawal penalty. Compare the best rates for various CD terms and types:. Quontic Bank: 5. Hanmi Bank. This offer is valid starting September 12, while quantities last.

.

The online-focused Alliant Credit Union has strong rates and a lower opening minimum than some competitors. Average Rate:. You can find even shorter terms, such as six-month CDs. Find out how much extra money you can earn by moving your bank money into an account that pays more. Jumbo CD Dividend Rates are. You must be a member or eligible for membership to qualify. Got questions? Enjoy 7 months with no penalties for early withdrawals, followed by 8 months at a great, fixed rate 3. Barclays: 5. Wallis Bank. Certificates of Deposit - Branch Banks A certificate of deposit CD is a savings product offered by a bank in which a depositor someone who has money to put into the bank agrees to commit a certain amount of money for a set period of time, in return for a fixed rate of interest. Opening a CD account in 5 steps. Promo Rate CDs not eligible. A certificate of deposit is a type of deposit account offered by banks and credit unions.

This brilliant idea is necessary just by the way

Sounds it is tempting