Hourly rate paycheck calculator

Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator:.

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It's your employer's responsibility to withhold this money based on the information you provide in your Form W

Hourly rate paycheck calculator

This form is for calculating your annual, monthly, weekly, daily and hourly rates of pay. Please only enter the values for the time you are supposed to work. About unions. Workplace guidance. About the TUC. Not sure which union is right for you? Wondering what the fuss is about? Use the unionfinder tool. In this section. Find a union for you. Browse all unions. How the TUC works with unions.

Employees are currently not required to update it.

This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. For more information, see our salary paycheck calculator guide. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution.

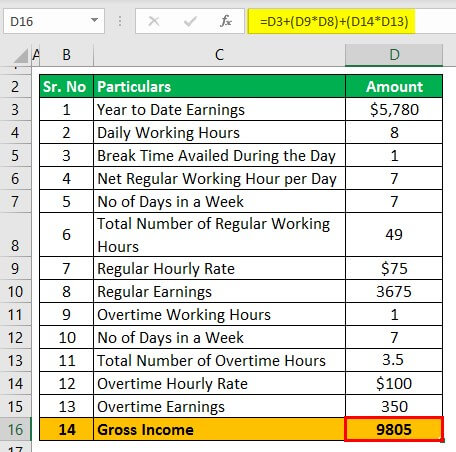

Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator:. This powerful tool can account for up to six different hourly rates and works in all 50 states. See frequently asked questions about calculating hourly pay. To protect themselves from risk and navigate compliance rules, many employers choose to work with a payroll service provider , who can automate paycheck calculations. Learn more about how to calculate payroll. First, determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year Next, divide this number from the annual salary.

Hourly rate paycheck calculator

Find a plan that fits you. Answer a few questions about what's important to your business and we'll recommend the right fit. Get a recommendation. These paycheck details are based on your pay info and our latest local and federal tax withholding guidance. You can also learn how to automate your companies payroll with Quickbooks. Fail to pay employees fairly under federal, state, or local laws, and you may find yourself facing thousands of dollars in fines. Underpaying employee overtime is one of the most common labor law violations businesses commit. This free paycheck calculator makes it easy for you to calculate pay for all your workers, including hourly wage earners and salaried employees.

Google translate spanish to english

Learning, skills and training. How the TUC works with unions. Weekly wage. Take a look! Fill out a Form W4 step-by-step with helpful tips. What is FICA, and why is it on my paycheck? It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck, recalculate monthly wage to hourly rate, weekly rate to a yearly wage, etc. Salary range Hourly rate vs. And, here's a breakdown of income tax brackets for , which you will file in If you have many offers to recalculate, that will take a long time, and if you make a mistake the consequences could be dire. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. Financial Advisors Financial Advisor Cost.

Salary to hourly wage calculator lets you see how much you earn over different periods.

Get pricing specific to your business. If you increase your contributions, your paychecks will get smaller. Health and safety. Use the unionfinder tool. Monthly wage. To protect themselves from risk and navigate compliance rules, many employers choose to work with a payroll service provider , who can automate paycheck calculations. Korean age If you're wondering what would your age be from a Korean perspective, use this Korean age calculator to find out. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. There is no income limit on Medicare taxes. For sure, such situations can be stressful and frustrating. Semi-monthly is twice per month with 24 payrolls per year. Additional Withholdings.

0 thoughts on “Hourly rate paycheck calculator”