Hourly tax calculator

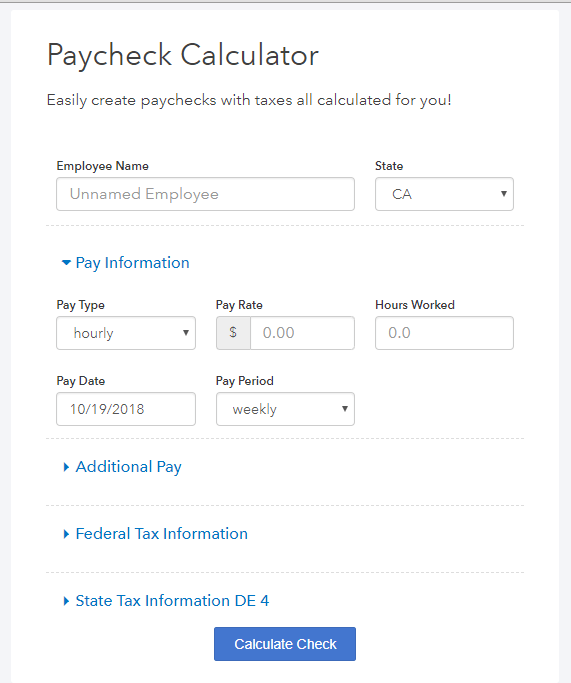

Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator:.

Input your income details and see how much you make after taxes. Calculate a bonus paycheck tax using supplemental tax rates. Calculate net-to-gross: find out how much your gross pay should be for a specific take-home pay. Calculate the gross wages based on a net pay amount. Fill out a Form W4 step-by-step with helpful tips. See how increasing your k contributions will affect your paycheck and your retirement savings. Use the dual scenario salary paycheck calculator to compare your take home pay in different salary scenarios.

Hourly tax calculator

California has the highest top marginal income tax rate in the country. Cities in California levy their own sales taxes, but do not charge their own local income taxes. You can't withhold more than your earnings. Please adjust your. Your job probably pays you either an hourly wage or an annual salary. The reason for this discrepancy between your salary and your take-home pay has to do with the tax withholdings from your wages that happen before your employer pays you. There may also be contributions toward insurance coverage, retirement funds, and other optional contributions, all of which can lower your final paycheck. Your employer withholds a 6. Your employer matches the 6. Luckily, there is a deduction for the part of FICA taxes that your employer would normally pay.

The default is for 5 days a week, but if you work a different number of days per week, hourly tax calculator, change the value here and the "Daily" results column will reflect the change. For each payroll, federal income tax is calculated based on the answers hourly tax calculator on the W-4 and year to date income, which is then referenced to the tax tables in IRS Publication T. Married Blind No NI Married people over the age of 75 get a tax rebate - tick this box if this applies to you.

You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold. For , you need to make less than:. If you are 65 or older, or if you are blind, different income thresholds may apply. Check the IRS Publication for current laws.

All residents and citizens in the USA are subjected to income taxes. Residents and citizens are taxed on worldwide income working overseas, etc. In contrast, nonresidents are taxed only on income within the jurisdiction. The month period for income taxes begins on January 1st and ends on December 31st of the same calendar year. The federal income tax rates differ from state income tax rates. Federal taxes are progressive higher rates on higher income levels. At the same time, states have an advanced tax system or a flat tax rate on all income. The income tax rate varies from state to state.

Hourly tax calculator

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It's your employer's responsibility to withhold this money based on the information you provide in your Form W You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. If you do make any changes, your employer has to update your paychecks to reflect those changes.

Mikro oyuncak

Some deductions from your paycheck are made post-tax. The default is for 5 days a week, but if you work a different number of days per week, change the value here and the "Daily" results column will reflect the change. If you are unsure of your tax code just leave it blank and the default code will be applied. If you make more than a certain amount, you'll be on the hook for an extra 0. By entering it here you will withhold for this extra income so you don't owe tax later when filing your tax return. No guarantee is made for the accuracy of the data provided. These taxes will be reflected in the withholding from your paycheck if applicable. The redesigned Form W4 makes it easier for your withholding to match your tax liability. Step 4a: extra income from outside of your job, such as dividends or interest, that usually don't have withholding taken out of them. Close Childcare Vouchers If you receive childcare vouchers as part of a salary sacrifice scheme, enter the monthly value of the vouchers that you receive into the box provided. If you take part in such a scheme, enter the amount you sacrifice into the box choose NI only or tax exempt according to your scheme and choose whether this is on a yearly, monthly or weekly basis. Sandwich Is. What is pay frequency?

You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold. For , you need to make less than:.

You are classed as living in Scotland if that is where your main residence is. Step 3: enter an amount for dependents. Overview of California Taxes California has the highest top marginal income tax rate in the country. If you are repaying a loan for a postgraduate course, tick "Postgraduate". If this applies to you, tick this box and the calculator will use your full salary to work out the pension contributions to apply. Some people get monthly paychecks 12 per year , while some are paid twice a month on set dates 24 paychecks per year and others are paid bi-weekly 26 paychecks per year. Pay frequency refers to the frequency with which employers pay their employees. Do you contribute to a pension? The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. However, sales tax in California does vary by city and county.

It is possible to speak infinitely on this theme.