How to calculate irr on ba ii plus

When a sequence of cash flows has two or more sign changes, there may be more than one solution for Internal Rate of Return IRR. However, the displayed solution has no financial meaning. All rights reserved.

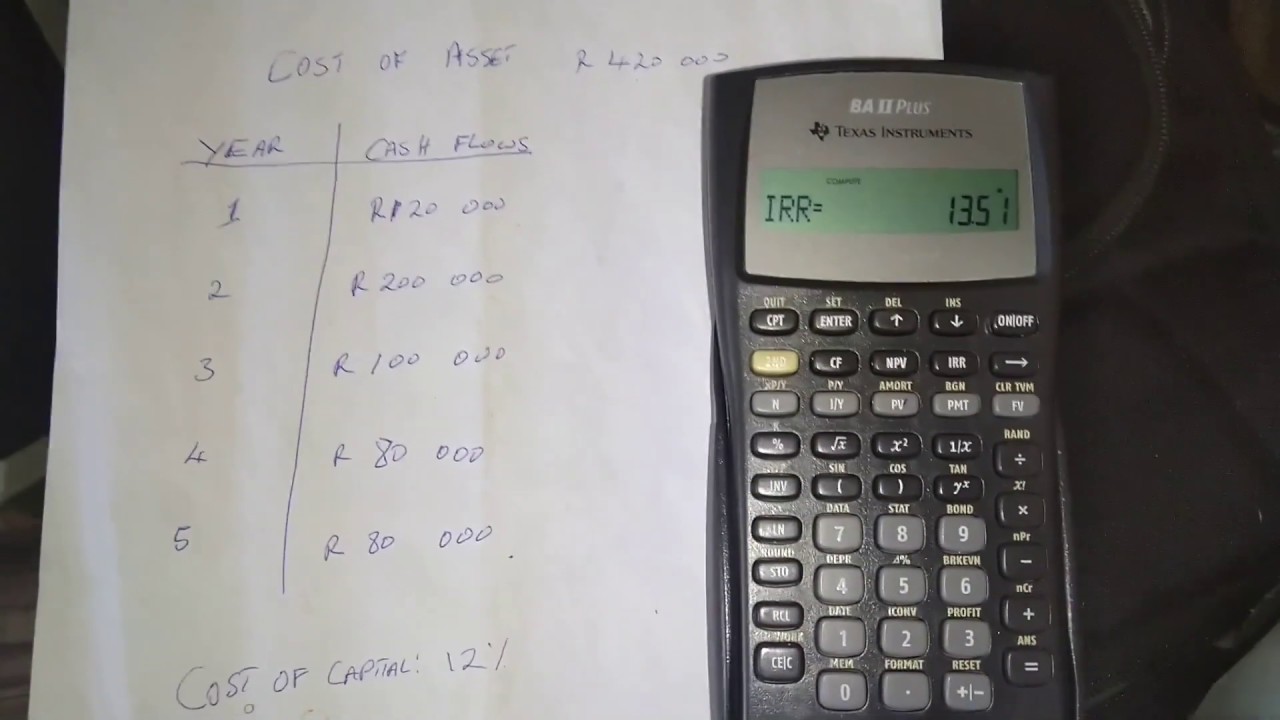

Please Note: NPV net present value is the sum of the present values for the cash inflows cash received and outflows cash paid out. Please Note: IRR internal rate of return is the interest rate at which the net present value of the cash flows is equal to zero. A positive value for NPV indicates a profitable investment; a negative value for NPV indicates that money was lost in the investment. Over the next six years, the company expects to receive the annual cash flows shown below:. Please Note: The maximum amount of cash flows that can be entered is If there are more than 32 cash flows in the cash flow worksheet, the IRR computed will be incorrect. All rights reserved.

How to calculate irr on ba ii plus

Your calculator is initially pre-set to compound interest for 12 periods a year. Every time you do a problem on your calculator, you store the information in its memory. You must clear the previous data before you begin a new problem. Note: when using cash flow functions you must be in the CF function before you do the clearing! To change the number of decimal places displayed simply press 2nd. Note: Whenever your calculator is in annuity due mode, the letters BGN are displayed on your calculator screen. You need at least three entered to find a value. To get the solution you must hit CPT and then the value you are trying to find. Note: The PV was entered as a negative because it is an outflow. Your calculator needs to know what the outflows and inflows are. To enter uneven cash flows into the calculator hit the CF key. This will take you into the cash flow register. To move around in the cash flow register, simply use the arrow keys on the top row of your calculator. CFo stands for initial cash flow outlay , C01 stands for cash flow year one, C02 stands for cash flow year two, etc.

These cookies allow identification of users and content connected to online social media, such as Facebook, Twitter and other social media platforms, and help TI improve its social media outreach. The F01, F02, etc.

.

Capital budgeting will help you determine cash flows for given investments for a certain number of years in the future, thus helping you determine if the investment is worthwhile. First push the CF button and type in the initial investment 10, Make the 10, negative since it is what you will be paying out. Hit enter, and then the down arrow. You are now ready to begin entering your future cash flows from this potential project. The calculator will prompt you with the notation "CO1" for the first cash flow. Type 5,, press enter and then the down arrow.

How to calculate irr on ba ii plus

Please Note: NPV net present value is the sum of the present values for the cash inflows cash received and outflows cash paid out. Please Note: IRR internal rate of return is the interest rate at which the net present value of the cash flows is equal to zero. A positive value for NPV indicates a profitable investment; a negative value for NPV indicates that money was lost in the investment.

Valentina victoria

Enter Keywords:. A positive value for NPV indicates a profitable investment; a negative value for NPV indicates that money was lost in the investment. Every time you do a problem on your calculator, you store the information in its memory. These cookies allow identification of users and content connected to online social media, such as Facebook, Twitter and other social media platforms, and help TI improve its social media outreach. Example 2: Jane is expecting the following cash flows:. Before each new problem: Every time you do a problem on your calculator, you store the information in its memory. To change decimal places: To change the number of decimal places displayed simply press 2nd. You must clear the previous data before you begin a new problem. Please compute the present value and internal rate of return for the cash flows assuming a rate of 20 percent. Computing Internal Rate of Return: 1 Use the example provided in the earlier steps. These cookies help identify who you are and store your activity and account information in order to deliver enhanced functionality, including a more personalized and relevant experience on our sites. To get the solution you must hit CPT and then the value you are trying to find.

.

Example 2: Jane is expecting the following cash flows:. CFo stands for initial cash flow outlay , C01 stands for cash flow year one, C02 stands for cash flow year two, etc. Enter Keywords:. Knowledge Base Home Financial Calculators. Note: The PV was entered as a negative because it is an outflow. Interest-based ads are displayed to you based on cookies linked to your online activities, such as viewing products on our sites. These cookies help us tailor advertisements to better match your interests, manage the frequency with which you see an advertisement, and understand the effectiveness of our advertising. You can control your preferences for how we use cookies to collect and use information while you're on TI websites by adjusting the status of these categories. Click Agree and Proceed to accept cookies and enter the site. When a sequence of cash flows has two or more sign changes, there may be more than one solution for Internal Rate of Return IRR. These cookies, including cookies from Google Analytics, allow us to recognize and count the number of visitors on TI sites and see how visitors navigate our sites. Enter Keywords:. Please compute the present value and internal rate of return for the cash flows assuming a rate of 5 percent.

What entertaining answer

.. Seldom.. It is possible to tell, this exception :)