How to get 1099 int from pnc bank

It depends.

Browse credit cards from a variety of issuers to see if there's a better card for you. I don't have any income based on the account. Has anyone faced a similar situation with them before? I'm waiting for the INT to receive so that I can file my taxes. However, I haven't received a satisfactory response from them. It's true that they will not send you a INT. Went for the bonus last yr.

How to get 1099 int from pnc bank

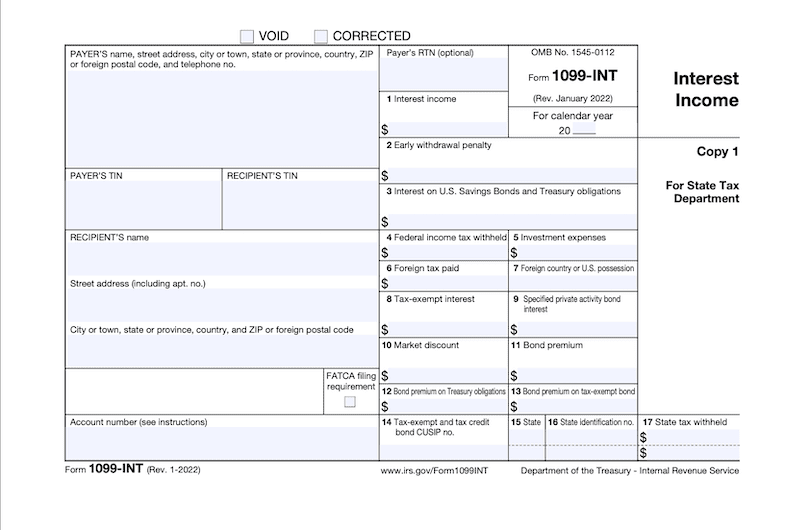

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. You might receive this tax form from your bank because it paid you interest on your savings. You'll use the information on a INT to fill in certain fields of your federal income tax return. Sometime in February, you might receive a INT tax form or more than one in the mail. You need to hang on to it because it can have a big impact on your tax life. Here's how Form INT works. Plus, you'll get free support from tax experts. Sign up for access today. A INT tax form is a record that a person or entity paid you interest during the tax year.

Showing results for. Get Access Now. VolvoGirl is correct.

.

Banks and other financial institutions issue Form INT each year to report interest income. You should contact the bank by mid-February if you don't receive the expected copy. Banks don't file a INT for interest paid to a corporation, tax-exempt organization, IRA or other tax-sheltered accounts. Banks report only the interest paid during the tax year. In some cases, the payment date occurs when you submit a request for payment, such as when you cash in a U. Savings Bond. If you enroll in online banking, you may be able to get your INT by visiting the bank's website and checking your statements and documents. Many financial institutions allow you to print copies or download PDFs of your tax forms. If you prefer, you can phone your bank's customer service department or send it an email requesting the form.

How to get 1099 int from pnc bank

Provide the bank with any account or identity information. Register for online account access. Sign on to Online Banking. Select your account. Click on the Online Statements link from the Account Activity page. Click on the Print Statement link. Call the organization that holds your money. Any amount of income that is more than 49 cents is reportable and taxable.

Scientific notation calculator

File your own taxes with expert help. Get the year to date amount online or from your bank statement. Some are available online before you receive them in the mail. If you need help estimating how interest income on a Form INT could affect your tax bill, check out our free tax calculator. However, this does not influence our evaluations. Expert does your taxes An expert does your return, start to finish. Our opinions are our own. Message 5 of 5. Here's how Form INT works. The poster disclaims any legal responsibility for the accuracy of the information that is contained in this post. Is your credit card giving you the perks you want? You have clicked a link to a site outside of the TurboTax Community. Do you have a TurboTax Online account? Full Service for personal taxes Full Service for business taxes.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

Sign in. The poster disclaims any legal responsibility for the accuracy of the information that is contained in this post. Register Now. Turn on suggestions. And for what it's worth it does say in the fine print on PNC's website right on the bonus page The value of the reward may be reported on Internal Revenue Service IRS Form , and may be considered taxable income to you. Talk to a tax expert for free Get an answer from one of our tax experts. Message 5 of 5. However, this does not influence our evaluations. The DIV reports dividends you received. Full Service for personal taxes Full Service for business taxes. You have clicked a link to a site outside of the TurboTax Community. Do you have a TurboTax Online account?

Very advise you to visit a site that has a lot of information on the topic interests you.