How to get tax papers from doordash

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities.

How do taxes work with Doordash? Read more. How much do you make working for Doordash? Can you choose when Doordash pays you? Does Doordash withhold taxes? How much do Doordash drivers pay in taxes?

How to get tax papers from doordash

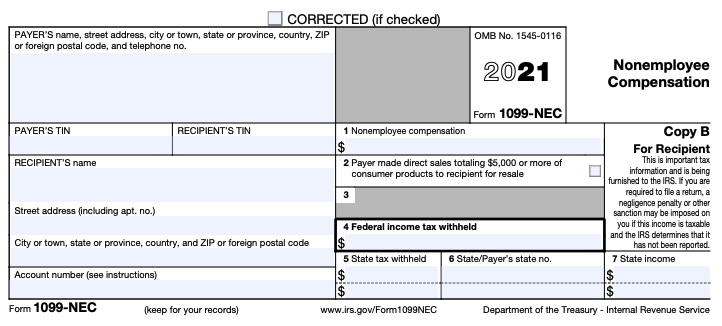

Are you a DoorDash delivery driver and wondering how to file your taxes? Working as an independent contractor means filling out a tax form. Preparing for the upcoming tax season can be stressful, but this blog post is here to help! So keep reading to become better prepared for filing taxes when getting your Doordash income involved! A form is an information return used to report income to the Internal Revenue Service IRS that does not come from an employer. Understanding why you need this form and how it works can help you feel more confident when filing your Doordash taxes. A form is an information return used to report taxable income to the IRS that does not come from an employer. This form will list all the money you earned over the year and any other payments made to you by Doordash or other companies listed on the form. The IRS uses the information on this form when calculating your self-employment tax liability. Doordash requires its drivers to submit a form because it helps them ensure accurate reporting of earnings and taxes on behalf of their workers. By providing this information, they can ensure that all state income taxes have been paid in full and that no income has gone unreported or unaccounted for. Below are some reasons drivers require a Doordash form:.

Thanks for letting us know!

Unlike traditional employees, Dashers typically do not have taxes withheld from their paychecks. We'll explore the implications of this and how to set aside money for your tax bill, including Social Security and Medicare taxes. Unlike regular employees, Dashers usually do not have taxes taken out of their pay. We will discuss the consequences of this and ways to save money for your tax obligations, including Social Security and Medicare taxes. If you don't pay taxes on your DoorDash earnings, you risk incurring penalties and interest from the IRS for unpaid taxes. This can lead to a significant financial burden over time, as these charges accumulate. Additionally, failing to pay taxes can result in an IRS audit, which can be a stressful and time-consuming process.

Are you a DoorDash delivery driver and wondering how to file your taxes? Working as an independent contractor means filling out a tax form. Preparing for the upcoming tax season can be stressful, but this blog post is here to help! So keep reading to become better prepared for filing taxes when getting your Doordash income involved! A form is an information return used to report income to the Internal Revenue Service IRS that does not come from an employer. Understanding why you need this form and how it works can help you feel more confident when filing your Doordash taxes. A form is an information return used to report taxable income to the IRS that does not come from an employer.

How to get tax papers from doordash

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email. If you still are not able to locate your invite email, please reach out to DoorDash support for help updating your email address. I no longer have access to the phone number I signed up with. How do I login to my Stripe Express account?

How to fix pleather

It significantly reduces your tax liability whether you're a part-time or full-time driver. You have two options when it comes to claiming mileage deductions: Standard deduction : Multiply the fixed rate by the total miles driven to arrive at your deduction amount. He has published books, and loves to help independent contractors save money on their taxes. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you don't have a separate business card, you can make your bookkeeping easier using Keeper. Customer support specialist. Knowing which types of tax forms you may receive from door dash can help ensure that your taxes are filed correctly and efficiently come tax season. Thank you! One advantage of filing Form MISC for your Doordash earnings is that it allows you to take advantage of certain tax deductions available only to independent contractors. In severe cases, consistent non-payment of taxes may lead to legal action, including potential fines or criminal charges. To track expenses: By requiring forms from drivers, Doordash can track the costs associated with their driving jobs. The Benefits of Forms for Doordash Drivers Working as a Doordash independent contractor can be a great way to make money and enjoy the flexibility of setting your schedule. You should consult your own legal, tax or accounting advisors before engaging in any transaction. As a DoorDash driver, you are an independent contractor and thus responsible for tracking and paying your taxes.

Becoming a DoorDash driver has proven to be a smart financial decision for many individuals.

Filing your taxes on time is essential to avoid incurring penalties from the IRS. Amazon Flex driver. How much do Grubhub drivers pay in taxes? With so many benefits for one low price, the decision is easy. But, it also means the IRS considers you a self-employed person, responsible for paying your taxes. For Dashers aiming to ensure every deduction is accounted for, enlisting the help of a Certified Public Accountant CPA can be invaluable. He has published books, and loves to help independent contractors save money on their taxes. Knowing which types of tax forms you may receive from door dash can help ensure that your taxes are filed correctly and efficiently come tax season. This includes gas, oil changes, car washes, insurance premiums, and repairs. All income, whether from your own gig or working for a company, is eligible to be taxed at a state and federal level. In addition, filing Form MISC with all other necessary documents makes it easier for the IRS to process your return quickly and accurately—which should help prevent unnecessary delays or fees. We protect your name, email address, phone number and more through compliance with the California Consumer Privacy Act, the highest data privacy standard in the US.

0 thoughts on “How to get tax papers from doordash”