How to transfer money out of spriggy

In the digital age, teaching children about money management has become more critical than ever.

Sign up in minutes. You can even schedule regular top ups. Activate your kids' Spriggy card once it arrives. Spriggy is ready to roll and your kids are ready to kick off their money-smart journey. Schedule pocket money, choose how much you want to pay your kids and how often.

How to transfer money out of spriggy

Spriggy Invest is an investment platform built for families. At Spriggy, we believe that planning for your kids' future is important for getting them started on the right foot. By providing you with a simple set of investment options and a simple way to set a recurring investment we remove the complexity from investing for the future. The benefit is any potential returns you see are based on the performance of multiple companies - instead of just one. You need to review the PDS , that explains the benefits and risks associated with Spriggy Invest and to make sure it is right for you and your circumstances. We designed Spriggy Invest to be as simple as possible. Like all investments, the investments you make through Spriggy Invest come with risk and you should make sure to read the PDS and seek appropriate financial advice, to make sure it is right for you. An exchange-traded fund ETF is a type of investment fund that typically provides exposure to a large number of underlying securities selected in accordance with their investment strategy. ETFs provide a simple pathway for investors to diversify their portfolio into a large number of companies, markets and industries. We provide investment options that are built for families, giving you the ability to invest easily into both Australian and International companies. We also give you the option to make a single investment or set up an investment plan. With a plan you're able to put a little bit away either weekly, fortnightly or monthly. All you then need to do is sit back and watch your portfolio perform. Remember, you need to make sure Spriggy Invest is right for you, please read the PDS and seek your own financial advice. Under each child in the app, you can see their investment.

Follow Spriggy.

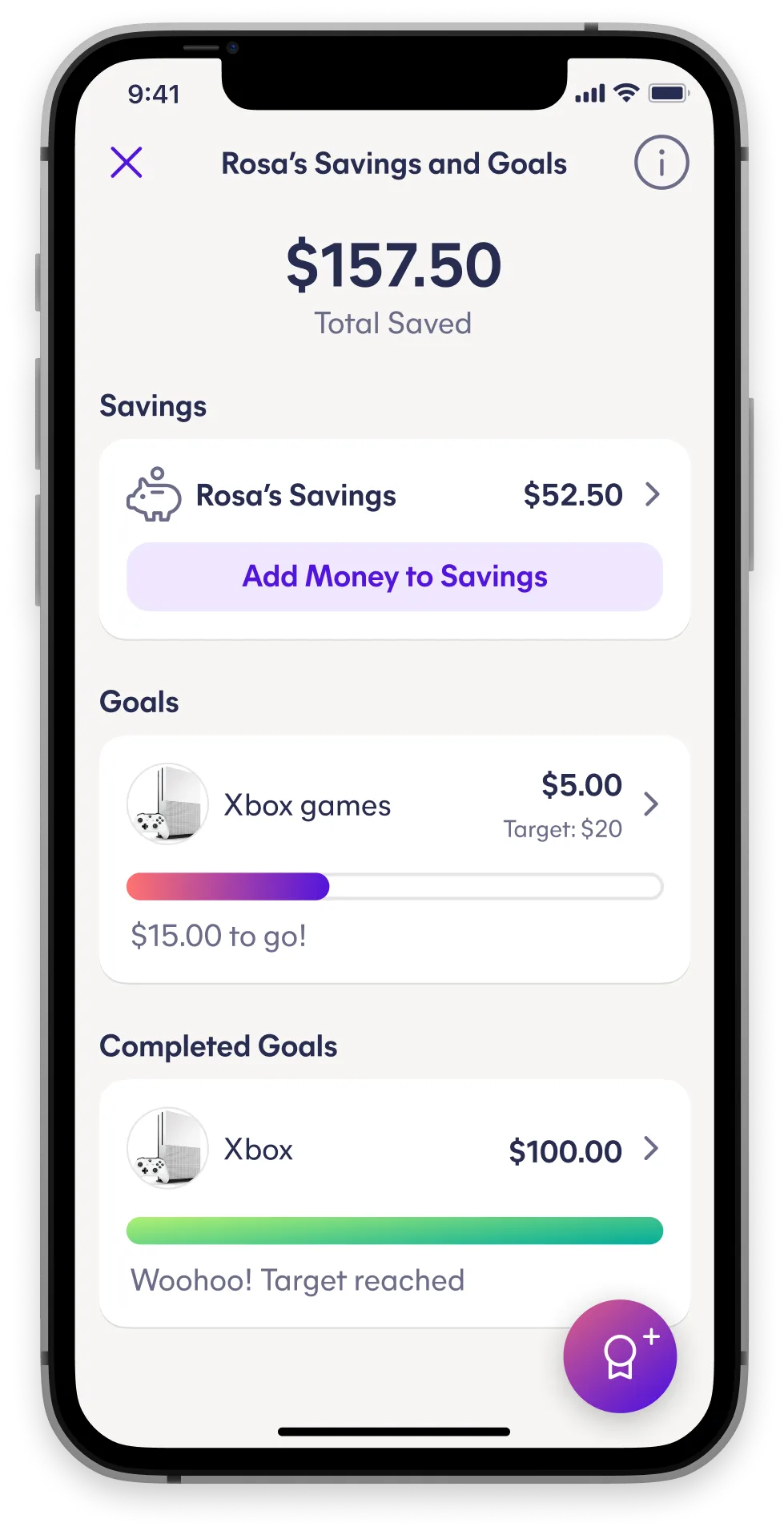

Spriggy is a small business on a big mission - helping Aussie families raise money-smart kids by making learning about money fun. Your kids can safely use their Spriggy cards online and in-store. Their Spriggy cards will work anywhere that Visa is accepted. Spriggy helps kids learn by giving them real-life experience with money. Kids get the independence to manage their own money and learn smart money habits such as earning, saving and spending wisely.

Teaching kids money management has come a long way from a toy cash register and coins in the piggy bank. Spriggy app and card can help teach kids the fundamentals of financial management in a cashless society that turns cold hard cash into an abstract concept, and where money never physically changes hands and relies on fund transfers and tap-and-go purchases. Read on for the full Spriggy review. The Good. The Bad. Verdict: Financial literacy from a young age is vital. Fees are a bit high but the 30 day free trial is a no brainer. Decide from there. CaptainFI is not a financial advisor and this article is not financial advice.

How to transfer money out of spriggy

Spriggy is a small business on a big mission - helping Aussie families raise money-smart kids by making learning about money fun. Your kids can safely use their Spriggy cards online and in-store. Their Spriggy cards will work anywhere that Visa is accepted. Spriggy helps kids learn by giving them real-life experience with money. Kids get the independence to manage their own money and learn smart money habits such as earning, saving and spending wisely. Parents stay in control with complete visibility of how and what their kids are doing.

Stardew valley wine

Sign up in minutes. They use encryption to protect user data and employ industry-standard security practices to safeguard financial information. How it works. Set paid or unpaid jobs for your kids so they know what chores they have to do. Locate the Card Activation Section: Within the app, navigate to the section specifically designated for card activation. Instead, it has established a 'third-party' partnership with a banking institution. If you spend this remaining balance before cancelling, no cancellation fee will be charged. Select 'Cancelling' from the options. What bank is Spriggy with? Who owns the investments? As digital natives, children are growing up with technology at their fingertips. Get Spriggy How it works. This gamified approach makes budgeting fun and interactive, encouraging kids to develop healthy financial habits. Can you withdraw cash from a Spriggy card?

With Australians using cash less and less, Spriggy helps children understand how to manage their money digitally. Spriggy is a mobile app with a linked prepaid card which helps Australian parents and their kids to manage their money together and track their progress in a fun, interactive app. The app is designed for 6—17 year olds, to teach them how to manage their money before setting up a regular bank account.

It allows young users to gain experience with digital transactions and responsible spending in the online world while being under the supervision and guidance of their parents or guardians. Get Spriggy Get Spriggy. Complete Activation: Once you've entered all the required information and successfully completed any necessary steps, your Spriggy card should be activated. Everything you need to know about Spaceship: a review. Transfer money instantly from your Parent Wallet to their cards in emergencies. Need help? You just need to log out of your parent login on the Spriggy app and let your kids log in with their details. See our pricing fees for details of other fees and charges that may apply. All you then need to do is sit back and watch your portfolio perform. Kids get the independence to manage their own money and learn smart money habits such as earning, saving and spending wisely. How do I activate my Spriggy card? Pricing Why does Spriggy have a membership fee? Remember, you need to make sure Spriggy Invest is right for you, please read the PDS and seek your own financial advice. Safety Is Spriggy safe? Follow Spriggy.

Certainly. It was and with me. Let's discuss this question. Here or in PM.