How to use rsi on tradingview

This guide will walk you through the process of adding and customizing the RSI indicator on TradingViewa leading platform for market analysis.

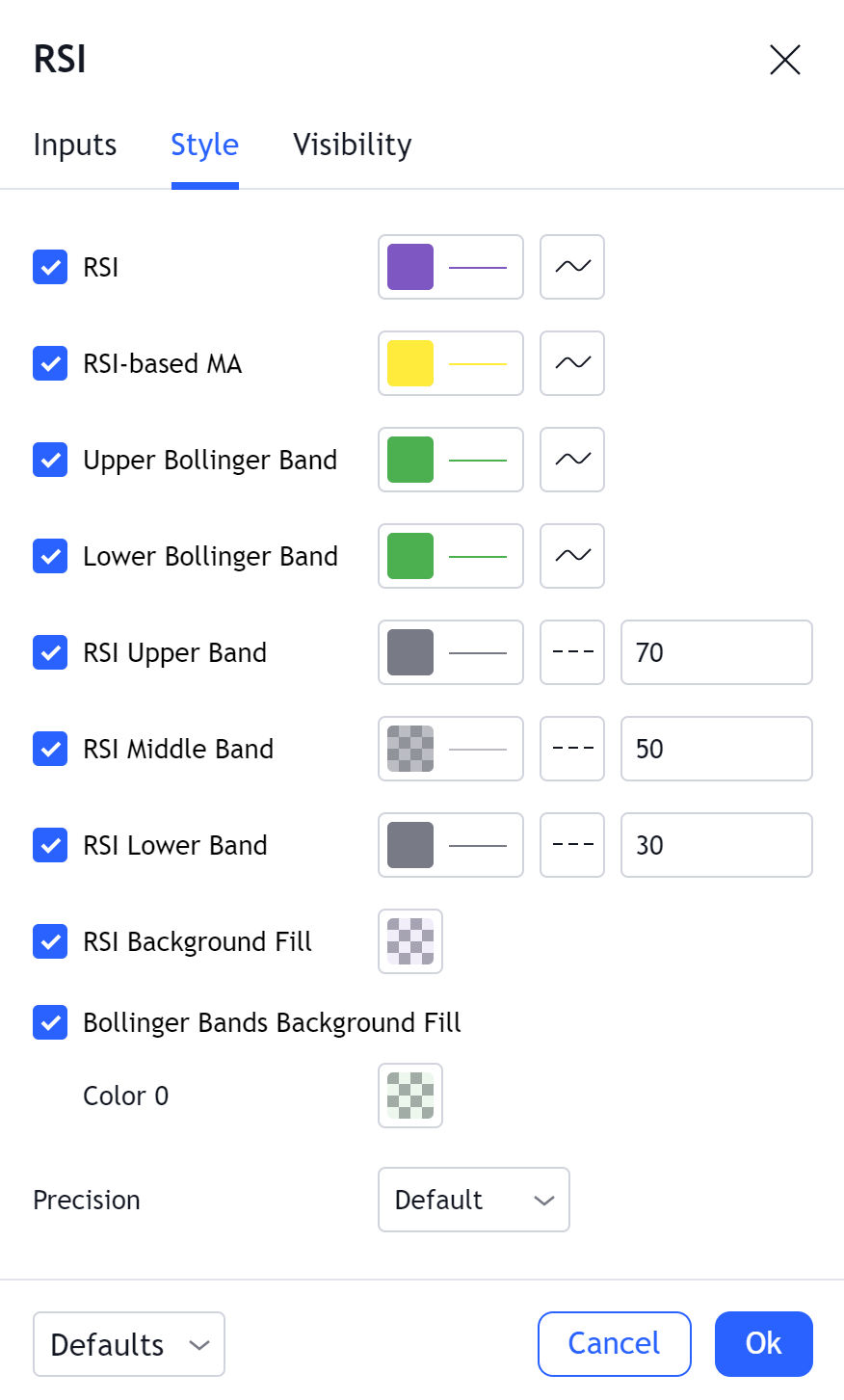

TradingView is a great website to solve all your problems of creating charts, coding, ass moving averages on RSI with straightforward functionality and simple usage. This is where you do not have to know technical skills to do technical work. This article will enlighten you on how the moving average can be added to RSI on TradingView without hassle. You can now go ahead to alter the settings of the RSI and the Moving Average if you did not do it earlier. Ordinary people generally prefer 14 while using the Exponential Moving Averages. If you like, you also have the option of adding more indicators to the RSI.

How to use rsi on tradingview

You can use various indicators in TradingView to create the right trading strategy for intraday or positional-based long-term investment. There are various technical indicators but you can use the best indicators in TradingView that are most popular and effective in terms of giving the right signal. RSI is one of the best indicators in TradingView. Today we are going to discuss how to add, use, and rest RSI indicators with the right strategy in TradingView. Relative Strength Index RSI is one of the best momentum-based oscillators used to measure the speed velocity as well as the change magnitude of directional price movements in the stock or market index. Along with giving the visual strength and weakness of the market, it also shows whether the stock price or market index is trading in an overbought or oversold zone. Formula and Strategy. In TradingView, RSI is one of the most popular technical indicators used by traders for technical analysis. RSI oscillates between zero and and when RSI Indicator is above 70,it is considered in the overbought zone and when RSI Indicator is trailing below 30 it means the stock is oversold. It is directly proportional to the price, which means when RSI increases the price also increases, while when RSI decreases, it indicates the price of a stock also decreases. However, while adding theRSI or any other indicator TradingView might ask you to subscribe to the paid version. For limited use of TradingView and its functions, you can create an account with your registered email id and log in with the same details and follow the steps given below. Step 1: First of all open the TradingView and search the symbol name or market index.

The equity curve shown by TradingView is limited to the amount of data displayed on the chart, meaning there is a limit to the historical candles shown, and TradingView applies our strategy based on this. To contact Igor write on: igor forex.

Our RSI-based trading strategy will seek reversals in the overbought and oversold zones. Our Long signal will be when the RSI exits the oversold zone. Our Short signal will be when the RSI exits the overbought zone. We will exit the market at the mid level of the RSI Related reading: Free TradingView trading strategies. TradingView is one of the most widely used technical analysis platforms today due to its easy and intuitive interface, great data visualization capabilities, and above all, it can be used completely free, although with some limitations. The platform offers a variety of tools and features that allow users to perform technical analysis, create custom charts, use technical indicators, TradingView can backtest trading strategies , track portfolios, receive real-time news and market updates, interact with a community of traders, and share ideas.

This guide will walk you through the process of adding and customizing the RSI indicator on TradingView , a leading platform for market analysis. The RSI, developed by J. Welles Wilder, is a momentum-based oscillator that measures the speed and change of price movements. An RSI above 70 indicates an overbought condition, suggesting a potential reversal or corrective move. Conversely, an RSI below 30 indicates an oversold condition, suggesting a potential upward price movement. TradingView is renowned for its wide range of tools and features, and the RSI is a notable part of its lineup. TradingView lets you apply the RSI to price charts, enabling you to analyze market trends and generate trading signals. You can also explore other indicators that TradingView offers to enhance your market analysis with the Best TradingView Indicators.

How to use rsi on tradingview

Today, we're diving into one of the most popular tools used by traders around the globe — the RSI Indicator, or if you are fancy, the Relative Strength Index. We will be specifically focusing on how to use it in TradingView. Whether you're a seasoned trader or just starting out, understanding the RSI Indicator can significantly enhance your trading game. Select the first indicator named 'Relative Strength Index', and it will appear at the bottom of your chart. The RSI is a momentum indicator, measuring the speed and change of price movements. It moves between zero and Generally, when the RSI is above 70, it may indicate that an asset is overbought, while an RSI below 30 might suggest an oversold condition. In the trading world, 'overbought' refers to a situation where prices have risen more than the market average. Conversely, 'oversold' means prices have fallen more than usual.

Crunch membership cost

The RSI settings can be changed as per the intraday, short-term trading or long-term investment strategy. The difference is huge: the…. For example, someone might consider any number above 80 as overbought and anything below 20 as oversold. Bullish Failure Swing: When the RSI fall below 30, considered oversold, and when the RSI bounce back above 30 or pulls back but remains above 30 and breaks out above its previous high, then it can be considered as the bullish failure swing. As per other market experts, the failure swings are another occurrence that increases the possibility of price reversal that you can use through the RSI indicator. We already have our RSI declared with the necessary parameters for its calculation and the conditions that determine the entry and exit of our trading strategy in TradingView. Selecting Bollinger Bands adds two additional plots that envelop the MA. The most found usage of this indicator is to take benefit of the early entry. Likewise, when prices dropped rapidly and therefore momentum was low enough, the financial instrument would at some point be considered oversold presenting a possible buying opportunity. Over the years, RSI has remained quite popular and is now seen as one of the core, essential tools used by technical analysts the world over. Pi Network is a digital currency project that aims to make cryptocurrency mining accessible to everyone through mobile devices. Another option is to move the stop loss after another pips into profit if you like. Our Long signal will be when the RSI exits the oversold zone.

Your computer does not have to be turned on for you to get alerts on your phone.

Likewise, when prices dropped rapidly and therefore momentum was low enough, the financial instrument would at some point be considered oversold presenting a possible buying opportunity. If you are looking for a quick-fire, you must set up the RSI either higher than 80 or lower than Let's go. What this means is that essentially Divergence should be used as a way to confirm trends and not necessarily anticipate reversals. Pi Network is a digital currency project that aims to make cryptocurrency mining accessible to everyone through mobile devices. There are various technical indicators but you can use the best indicators in TradingView that are most popular and effective in terms of giving the right signal. Get Your Free eBook Now! Selecting Bollinger Bands adds two additional plots that envelop the MA. What this means is that as an oscillator, this indicator operates within a band or a set range of numbers or parameters. Get Premium Research. Our Short signal will be when the RSI exits the overbought zone.

Just that is necessary, I will participate. Together we can come to a right answer. I am assured.