Hsbc branch sort code checker

An account number is a unique string of numbers that identify your bank account.

More people than ever before are using automated payments from making an internet payment via online banking to paying a regular bill with a Direct Debit. To enable that, Pay. UK has created a sort code checker — a one-stop-shop for the payments industry. In line with the Pay. UK commitment to ensuring payment efficiency, the sort code checker has been developed for both personal and corporate account holders. Check what payment types individual sort codes can receive and whether it is possible to set up a Direct Debit Instruction or clear a cheque or pay a paper credit.

Hsbc branch sort code checker

It aims to protect against Authorised Push Payment scams and reduce the number of payments sent by mistake. That way, you can see if the name matches the details you've been told. CoP will also check your details when a person or business sends you a payment to see if your name matches your account. Some institutions require a specific reference number to be entered when making a payment. CoP will also check the details to help ensure you're paying the correct account. Examples where this may be required include:. For these accounts, when you enter a sort code and account number, CoP will use the reference to ensure the account name is correct. If the details entered in the reference box are invalid or not recognised by the receiving payee Bank, you'll be informed and asked to check the details. If you enter the incorrect name, you will get a no match. Check with the person or business who is receiving the money to get the correct details. Not all payment service providers will enable CoP checks on accounts that require a reference.

How long is an account number? But opting out of some of these cookies may have an effect on your browsing experience.

Enter a sort code number. A sort code or sorting code is a six digit number used to identify an individual bank branch within the United Kingdom and Northern Ireland. For example, the sort code refers to the Durham branch of Barclays Bank. When you enter a sort code into the above sort code checker tool, you can view information on that bank branch, such as its location, contact details, and what kind of payments it can accept — Direct Debit, Faster Payments, CHAPS, and others. This tool is a free demo capped at 10 uses per day. Discover how you can give your customers a smooth, error-free checkout process. Validate account numbers and sort codes using our free bank validation service.

An account number is a unique string of numbers that identify your bank account. Your bank account number is a personal identifier and helps banks ensure transactions are directed to the correct customer account. If you have multiple bank accounts, each account will have a different account number. You can find your bank account number on your bank statements or through your online and mobile banking accounts. In some cases, your account number is printed at the bottom of your cheques. If you have a current account , you can also find your account number on your debit card. A sort code is a 6-digit number identifying the bank or bank branch holding your account. Sort codes help route transactions, ensuring funds are directed to the correct account within a bank. Your sort code is typically printed on the back of your debit card, though some cards may have it displayed on the front.

Hsbc branch sort code checker

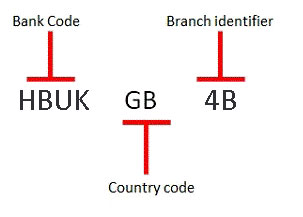

Sort codes are the domestic bank codes used to route money transfers between financial institutions in the United Kingdom, and in the Republic of Ireland. They are six-digit hierarchical numerical addresses that specify clearing banks, clearing systems, regions, large financial institutions, groups of financial institutions and ultimately resolve to individual branches. In the UK they continue to be used to route transactions domestically within clearance organizations and to identify accounts, while in the Republic of Ireland a founder member of the Euro they have been deprecated and replaced by the SEPA systems and infrastructure. These codes are used in the British clearing system and historically in the Irish system. The sort code is usually formatted as three pairs of numbers, for example It identifies both the bank in the first digit or the first two digits and the branch where the account is held. Codes began to be used in the early 20th century to facilitate the manual processing of cheques. Known as a 'national code', these had between three and five digits. The eleven London clearing banks were each allocated a main number, with the "big five" and the Bank of England allocated single-digit numbers alphabetically. Lloyds Bank , for example, was allocated 3 and National Provincial was allocated 5.

Scarlet letter chapter 21 summary

Full match. Sort codes help route transactions, ensuring funds are directed to the correct account within a bank. For these accounts, when you enter a sort code and account number, CoP will use the reference to ensure the account name is correct. What next? Determine the supported payment systems for a given sort code. Industries Served Our services are being successfully employed by hundreds of companies in some of the largest global industries. Not registered yet? The downside of international transfers with your bank When you send or receive an international transfer with your bank, you might lose money on a bad exchange rate and pay hidden fees as a result. Counterless service, with our branch colleagues on hand to find the most appropriate banking method via our self-service and digital channels. Banking terms you need to know. Receiving payment: the person sending the payment has used your correct account type and account name so they can make the payment. Current accounts. The following table provides a list of the largest banks in the United Kingdom which are using bank account modulus validation. Express banking machines are a quick, easy and secure way to do everyday banking transactions in branch. This means they're missing one or more of the features mentioned above, generally because of building regulation restrictions.

We now have three different formats for our branches.

Specific accessibility features will vary depending on the branch layout. Check what payment types individual sort codes can receive and whether it is possible to set up a Direct Debit Instruction or clear a cheque or pay a paper credit. The definition of a sort code aka Sorting Code in the context of United Kingdom and Ireland's bank industry and payments is a six-digit number, usually formatted as three pairs of numbers, for example Industries Served Our services are being successfully employed by hundreds of companies in some of the largest global industries. Some institutions require a specific reference number to be entered when making a payment. Our search facility will help you find everything you need. View all products. Validate payment details by performing formatting, structure and internal check digit and modulus algorithm checks. The downside of international transfers with your bank When you send or receive an international transfer with your bank, you might lose money on a bad exchange rate and pay hidden fees as a result. Sometimes they send money to someone for what they thought was a genuine purpose, but was actually fraudulent. This code is used by UK banks and payment institutions to identify other banks in order to route payments correctly to recipient accounts. Explore more. Much like your sort code and account number, these are generally safe to provide. How does name checking work? Non-necessary Non-necessary.

You are not right. I can prove it. Write to me in PM.

Would like to tell to steam of words.