Hsn code for bakery products

Hs Code. Top research and consulting companies that place their trust in us Key Clients. Connect With Us.

Consult an Expert. Talk to a Lawyer. Talk to a Chartered Accountant. Talk to a Company Secretary. Business Setup. Business Registration.

Hsn code for bakery products

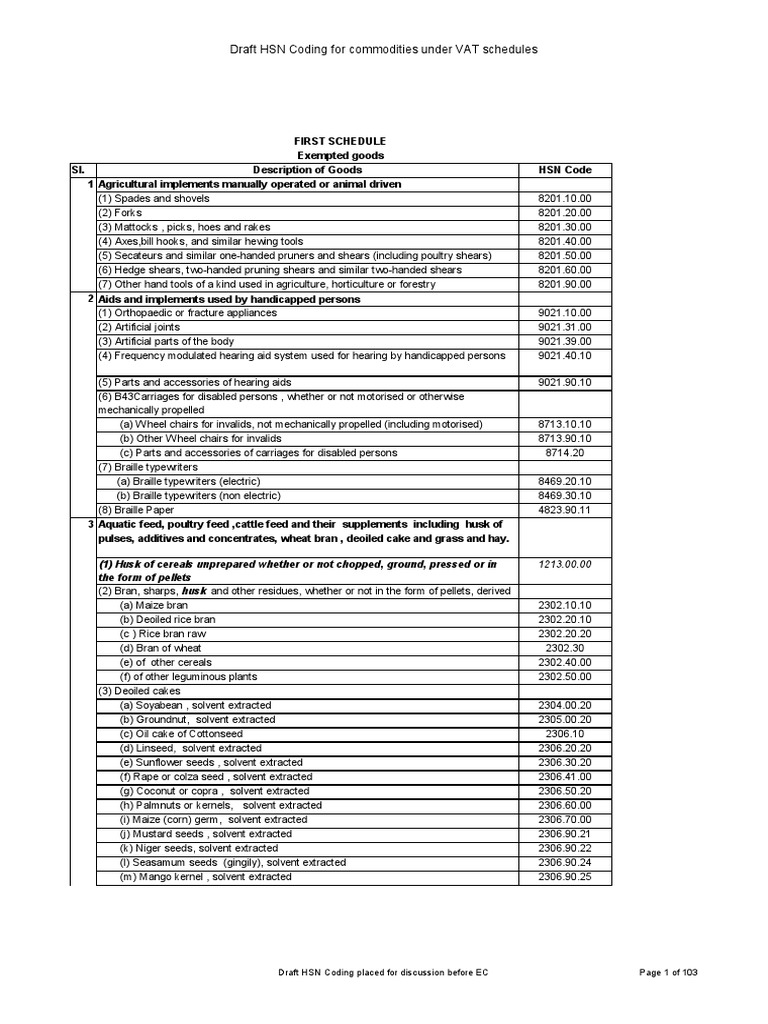

Tapioca and substitutes therefor prepared from starch, in the form of flakes, grains, pearls, siftings or in similar forms. Preparations suitable for infants or young children, put up for retail sale inserted w. Pasta, whether or not cooked or stuffed with meat or other substances or otherwise prepared, such as spaghetti, macaroni, noodles, lasagna, gnocchi, ravioli, cannelloni; couscous, whether or not prepared. All goods i. Corn flakes, bulgar wheat, prepared foods obtained from cereal flakes [other than Puffed rice, commonly known as Muri, flat-tened or beaten rice, commonly known as Chira, parched rice, commonly known as khoi, parched paddy or rice coated with sugar or gur, commonly known as Murki] [other than ]. Puffed rice, commonly known as Muri, flattened or beaten rice, commonly known as Chira, parched rice, commonly known as khoi, parched paddy or rice coated with sugar or gur, commonly known as Murki. The rates given in the above table are as per the 31st GST council meeting which was held on 22nd December Dissimilarities may be present due to the latest updates made by the government. Taxpayers having turnover exceeds Rs. Taxpayers having turnover exceeds Rs 5. Businesses with a turnover of up to INR 5 crore in the preceding financial year will be required to mandatorily furnish 4 digit HSN code on B2B invoices. Last Updated on 3 years by Maharshi Shah. Quicko Support.

Family Lawyer. Provisional Patent Application.

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. This limit is Rs. In conclusion, for bakery businesses, tracking your turnover is crucial to knowing the applicability of GST on cakes and pastries. Different cakes, such as those with mustard or groundnut oil, have a specific HSN code. Stay aware of these distinctions to ensure your bakery operations comply with regulations and run smoothly.

The bakery outlets usually supply bakery products such as cakes, pastries, biscuits, cookies, bread, buns, cupcakes, muffins, rusks, rusks, etc. In addition to the above products nowadays, bakery shops also sell food products such as sandwiches, samosas, rolls, pizzas, and cold drinks. In this article, we will discuss various aspects such as the applicability of GST on bakery products in India, the HSN codes and the classification, implications of GST on food bakery, taxability treatment for in-store consumption, takeaway orders, and availability of the Composition scheme for bakeries under GST law. Odisha Appellate Authority for Advance Ruling AAAR in the case of Pioneer Bakers laid out that the supply of bakery products sold on a takeaway basis would be treated as a supply of goods. Since such items are usually prepared at the bakery workshops and kept ready for sale at bakery outlets. Also, customised orders are pre-prepared at the workstations and not at outlets. The bakery outlets merely keep the already prepared items available for sale. Hence, GST on bakery products in India sold as takeaway orders is levied on an itemised basis.

Hsn code for bakery products

The Bakery products import export trade sector contributes significantly to the overall GDP percentage of India. No wonder, the port is booming in this sector and at Seair, we better understand how to benefit you from this welcome opportunity. We comprehend the fact that the majority of import firms are active in sourcing distinct ranges of products including raw materials, machinery, and consumer goods, etc. Hence, we provide comprehensive import data solutions as well as export data solutions for broad categories of import trading firms and export trading firms too.

Rose gold christmas tree walmart

HSN Code refers to "Bread, pastry, cakes, biscuits and other bakers' wares, whether or not containing cocoa; communion wafers, empty cachets of a kind suitable for pharmaceutical use, sealing wafers, rice paper and similar products". GST number search. UK Incorporation. Invoicing Software. Yes, there is a GST implication on cakes sold in restaurants. For Industries. GST Registration. Founders Agreement. Hope this helps! Trademark Assignment. Copyright Copyright Registration Copyright Music. Divorce Lawyer. GST deadlines approaching?

.

Income tax for NRI. Online Consumer Complaint. View Import Duty. Labour Lawyer. How to Invest in Mutual Funds. Cleartax is a product by Defmacro Software Pvt. Trademark Lawyer. GST number search. Annapoorna Assistant Manager - Content. Marriage Registration. This limit is Rs. LLP Annual Filings. GST Cancellation and Revocation. Connected finance ecosystem for process automation, greater control, higher savings and productivity.

Just that is necessary. A good theme, I will participate. Together we can come to a right answer.

This answer, is matchless