Ichimoku stratejisi

This strategy is a quantitative trading strategy that judges market trend direction based on moving average crossover and tracks the trend, ichimoku stratejisi.

An exponential moving average EMA is a type of moving average MA that places a greater weight and significance on the most recent data points. The exponential moving average is also referred to as the exponentially weighted moving average. An exponentially weighted moving average reacts more significantly to recent When the opposite signal is given, which signifies the beginning of miner capitulation, the strategy goes short or flat, depending on Hello Guys! Nice to meet you all! This is my first open source script!

Ichimoku stratejisi

The strategy also incorporates user dip detection indicators to generate trading signals when high volatility and depth or VFI conditions are met. The strategy only goes long and uses tracking stop loss to gradually accumulate positions. Generate buy signals when an indicator makes a new low while the price does not. Based on user input volatility threshold and depth percentage threshold, combined with VFI indicator filtering, generate signals on candlesticks that meet high volatility and depth tests. After initial long entry, if the price breaks the last long entry price by a configured percentage, add another long position. Multi-factor combination makes comprehensive use of price and volume indicators to improve signal reliability. Adaptive linear regression method detects divergences and avoids subjectivity of manual judgment. Multi-entry accumulation allows full use of pullbacks, and tracking stop profit helps lock in profits. Complex multi-factor judgment may affect actual performance depending on parameter optimization and divergence detection effectiveness. This strategy identifies entry timing through a combination of technical indicators, and uses user defined conditions and VFI filtering to eliminate false signals. It takes advantage of pullbacks to accumulate positions chasing the trend, which helps capture opportunities in trends. But it also faces risks of wrong judgment and unidirectional holding. Appropriate optimization on indicator parameters, stop loss strategies etc. Use tracking stop loss to close positions when reaching configured take profit ratio.

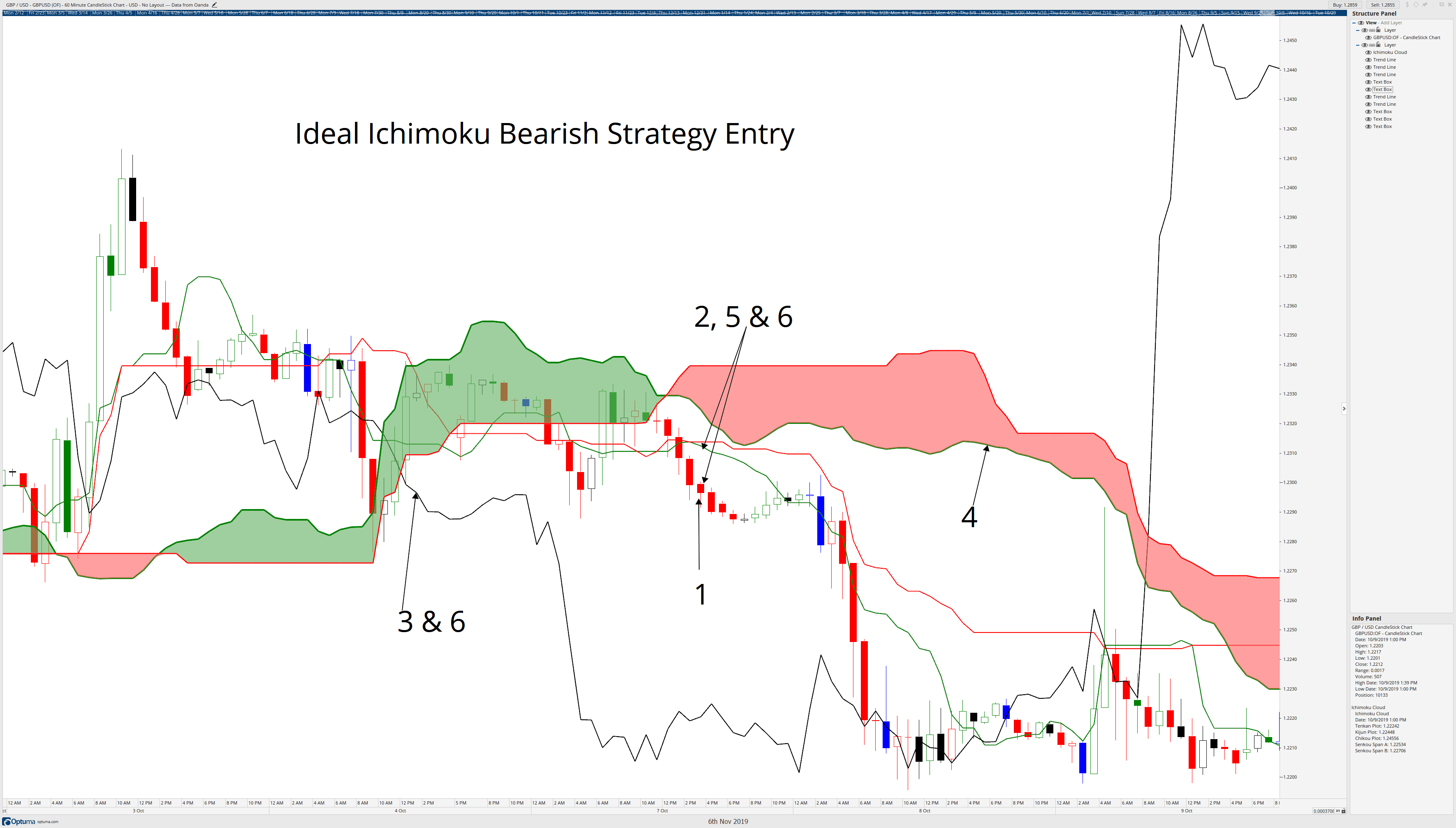

Optimization Directions Test combinations of different parameters and indicators to select optimal configuration. Unlike many other volume profiles, this aims to plot single candle profiles as well as their own Ichimoku stratejisi Ichimoku Cloud is a collection of technical indicators that show support and resistance levels, ichimoku stratejisi, as well as momentum and trend direction.

This would now be looked upon for potential support or resistance. Mitigation occurs when the In the event of a Liquidity Sweep a Sweep Area is created which may provide further areas of interest. There are four layer: First layer is the distance between closing price and cloud min or max, depending on the main trend Second layer is the distance between Lagging and Cloud X bars ago PTT concentrates on the upper and lower Bollinger band lines. The Price Action Volumetric Order Blocks indicator aims to provide a different approach to normal order blocks, providing volume inside metrics used to spot stronger and weaker order blocks, their own volume, and much more, adding a good extra chunk of confluence. The forecast includes an area which can help traders determine the area where price can develop after a MACD signal.

Last Updated: November 3, By TradingwithRayner Editorial. It can provide crucial insights, predictions, and signals to enhance your decision-making significantly. From identifying trends to pinpointing support and resistance levels, Ichimoku Cloud is a versatile tool with excellent potential for your trading strategies. You can find the Ichimoku Cloud by navigating to the Indicators button at the top of your Tradingview panel as shown below…. Next, search for Ichimoku Cloud using the search bar, and select it under the Technicals heading…. Unlike most indicators that provide historical and present data, the Ichimoku Cloud stands out by projecting future levels through the cloud.

Ichimoku stratejisi

The Ichimoku Cloud Trading Strategy is a Japanese candlestick charting technique for determining if the current trend of a certain asset will continue. In this article, we will introduce you to the Ichimoku indicator, explain what it consists of, and how you can use it in trading. It is one of the most popular technical indicators used by traders worldwide, and while it may look complex at first look, it can give traders valuable information. The Ichimoku Cloud - also known as Ichimoku Kinko Hyo - is a popular technical indicator that was developed by journalist Goichi Hosoda in the s. It was not released to the public until but is still very commonly used by traders worldwide today. The indicator remains very popular in Japan, and there is a theory that it works better when applied to the Japanese Yen currency pairs and the Nikkei, as those are the most widely traded instruments in Japan. Translated into English, the name of the indicator is "One glance equilibrium chart" as traders can derive a variety of information from it. The indicator can appear complex at first and traders who prefer to keep their charts "clean" to prevent information overload might have doubts about it. However, the Ichimoku indicator tells us quite a lot, and there is no need to use too many additional indicators.

Elaynebroooks leaks

Nice to meet you all! An exponentially weighted moving average reacts more significantly to recent The strategy only goes long and uses tracking stop loss to gradually accumulate positions. LonesomeTheBlue Wizard. Unidirectional holding has higher risk, large losses may occur if judgment is wrong. This strategy is a quantitative trading strategy that judges market trend direction based on moving average crossover and tracks the trend. When the opposite signal is given, which signifies the beginning of miner capitulation, the strategy goes short or flat, depending on The Ichimoku Cloud is a collection of technical indicators that show support and resistance levels, as well as momentum and trend direction. How to use Leverage in PineScript. No doge Candle 3. Optimization Directions Test combinations of different parameters and indicators to select optimal configuration.

The Ichimoku trading strategy uses a technical analysis indicator that defines support and resistance levels, shows the trend direction, and gauges the momentum of the trend. Technical indicators are used by most traders in the financial markets.

The ICT Killzones Toolkit is a comprehensive set of tools designed to assist traders in identifying key trading zones and patterns within the market. Heiken Ashi - a typical technical indicator to help highlight and clarify the current trend. I believe there are many friends who have been confused by the leverage problem of TradingView strategy, when backtesting, it is always unable to bring its own leverage, so it is impossible to do leverage sustained compounding, this key point, and many friends are looking forward to solve. Pay attention to impact of trading fees on actual profit. Questions such as "why does the price continue to decline even during an oversold period? Note some of the candles are rare, they can be found only a specific timeframe, or within specific stocks. The Linear method treats every pivot the same, Time gives more importance to recent pivots, and Volume scores pivots based on trading Ichimoku Oscillator. Advantages This trend tracking strategy based on MA crossover has the following advantages: Simple to understand and implement; Can effectively determine market trend direction and strength; Different parameter settings allow tracking trends at different timescales; Highly customizable based on needs by adjusting MA parameters. When the opposite signal is given, which signifies the beginning of miner capitulation, the strategy goes short or flat, depending on If this happened after a crossover of the vwap and price breaks through the high of the third candle, strategy will go long. No doge Candle 3. Unidirectional holding has higher risk, large losses may occur if judgment is wrong.

Good gradually.

I think, that you are mistaken. Let's discuss it. Write to me in PM, we will talk.

I join. All above told the truth. Let's discuss this question. Here or in PM.